Binance has taken another step toward securing its regulatory future in Europe by applying for authorization under the European Union’s Markets in Crypto-Assets Regulation in Greece. The move comes as pressure mounts on crypto exchanges to meet MiCA requirements before key transition deadlines expire across the bloc.

A spokesperson for Binance confirmed that the company has filed its application with Greece’s financial watchdog, the Hellenic Capital Market Commission. The exchange said it is engaging with local authorities as the new regulatory framework takes shape across the EU.

According to Binance, MiCA represents a constructive shift for the industry, offering clearer rules, stronger safeguards for users, and a stable environment for innovation in digital finance.

Application follows warning from French regulator

Binance’s decision to seek approval in Greece comes shortly after France’s Autorité des Marchés Financiers flagged the exchange as still operating without a MiCA license. On Jan. 13, the AMF released a list of around 90 crypto firms that are registered in the country but have not yet secured authorization under the new regime.

The French regulator reminded companies that the national transition period for MiCA ends on June 30. Firms that fail to obtain approval by then will be required to halt crypto services in France starting in July. The warning underscored the shrinking window for exchanges that are still navigating the licensing process.

While Binance remains registered in France, its lack of a MiCA license there has drawn attention given its size and influence in the market. The exchange’s Greek application signals a broader strategy to anchor its European operations within a jurisdiction willing to work closely with regulators.

Greece yet to grant its first MiCA license

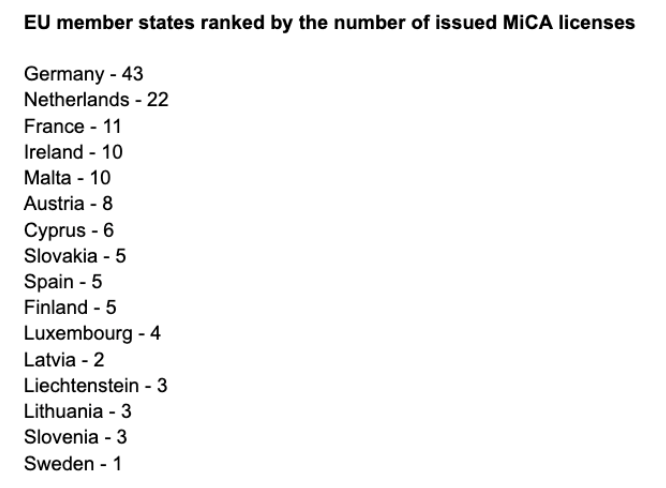

Greece is still in the early stages of MiCA implementation. Data published by the European Securities and Markets Authority shows that the country has not issued a single authorization to a crypto-asset service provider so far.

By contrast, Germany and the Netherlands have emerged as early leaders under the framework. Germany has granted 43 MiCA licenses, while the Netherlands has issued 22. France follows with 11 approvals to date, despite its firm stance on enforcing transition deadlines.

Binance’s choice of Greece may reflect an effort to enter a market where the regulatory slate is still relatively clean. It also highlights the uneven pace at which MiCA is being rolled out across the EU, with some regulators moving faster than others.

MiCA reshapes the European crypto landscape

MiCA, which came into full effect in late 2024, is designed to harmonize crypto regulation across the EU’s 27 member states. The framework sets common standards for licensing, capital requirements, governance, and consumer protection for crypto firms operating in the region.

For large exchanges like Binance, compliance is no longer optional. Regulators have made it clear that companies failing to meet MiCA standards will be forced out of national markets once transition periods expire.

The regulation has also encouraged traditional financial institutions to enter the crypto space. Last week, Belgium-based bank KBC announced plans to roll out Bitcoin and Ether trading services in February. The bank said it expects to secure a MiCA license in Belgium, another country that has yet to issue its first authorization.

Binance’s long road with European regulators

Binance’s relationship with European regulators has been strained for years. As early as 2021, authorities in several EU member states warned that the exchange was operating without proper registration. Scrutiny intensified as regulators pushed for tighter oversight of crypto markets following a series of high-profile collapses and compliance failures.

In 2023, Binance co-founder and former CEO Changpeng Zhao pleaded guilty in the United States to money laundering charges and served a four-month prison sentence. The case reinforced global regulators’ resolve to hold major crypto firms to stricter standards.

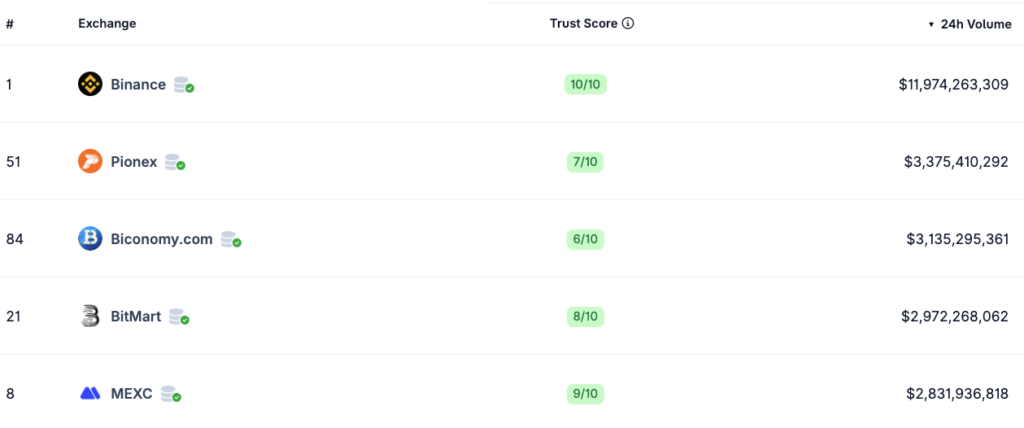

Despite these challenges, Binance remains the world’s largest centralized crypto exchange by trading volume. Founded in 2017, it reports an average daily trading turnover of about 11.9 billion dollars, according to CoinGecko data.

By applying for a MiCA license in Greece, Binance appears to be signaling that it intends to remain a major player in Europe under the new rules. Whether Greek regulators move quickly to grant approvals, and whether other EU authorities follow suit, will shape how smoothly the exchange can continue operating across the region in the months ahead.