A new policy paper from the Coinbase Institute argues that the modern wealth gap is no longer defined simply by how much people earn, but by whether they can access capital markets at all. According to the report, the most important divide in global finance today is between those who are “brokered” into capital markets and the billions who remain “unbrokered,” unable to own productive assets or raise capital efficiently.

Coinbase says this divide has widened over decades as returns from capital have increasingly outpaced income growth. The firm believes tokenization and open blockchain infrastructure could play a central role in narrowing that gap, if regulators allow systems that are open rather than tightly permissioned.

Capital income pulls ahead of wages

The report highlights a long term trend that has reshaped wealth creation, particularly in advanced economies. Over the past 40 years in the United States, capital income rose by 136 percent, while labor income increased by just 57 percent. This imbalance, Coinbase argues, shows that wages alone are no longer enough to build lasting wealth.

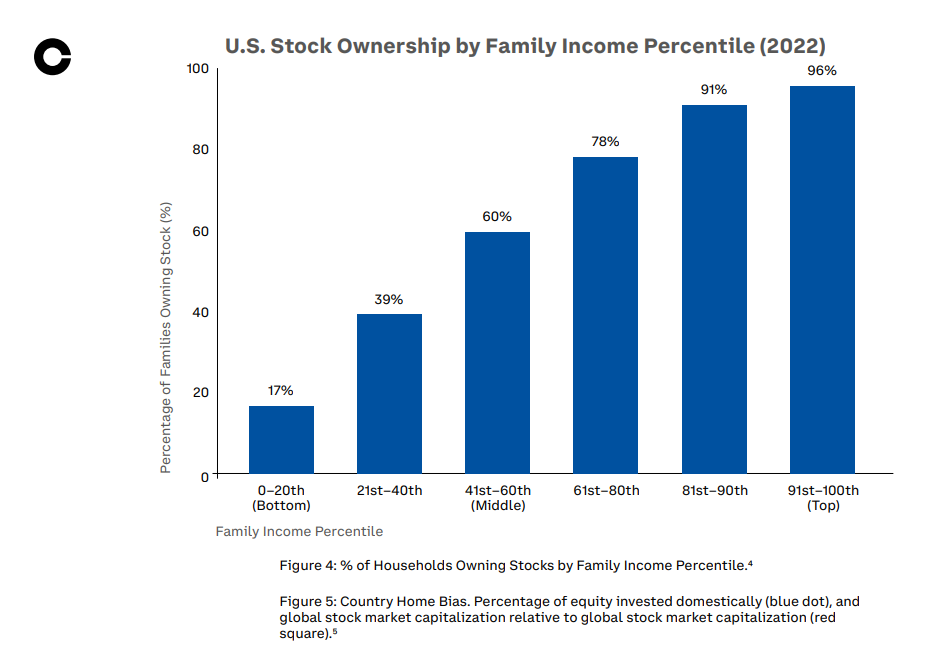

Instead, ownership of assets such as stocks, bonds and funds has become the main engine of financial growth. However, access to those assets remains concentrated among households that already sit inside traditional brokerage and banking systems. For those outside these systems, rising asset prices only widen the gap.

Coinbase describes this as a shift in the real gatekeeper of opportunity. Basic banking access, while important, is no longer sufficient. Direct access to capital markets is now what determines who can participate in economic growth and who is left behind.

The brokered versus the unbrokered

At the core of the report is the idea that global finance is split into two groups. The brokered minority has access to exchanges, custodians, clearing houses and investment products. The unbrokered majority relies on layers of intermediaries or has no access at all.

Coinbase estimates that roughly four billion people fall into this unbrokered category. Traditional financial rails, built around multiple intermediaries, are costly to operate and difficult to scale down. As a result, serving smaller investors or issuers is often uneconomical, leaving vast populations unable to invest or raise capital directly.

This structure, the report argues, creates what it calls a capital chasm. Even as technology lowers costs in other industries, market access remains tightly controlled, reinforcing existing wealth concentration rather than broadening participation.

Why Coinbase is pushing permissionless tokenization

Coinbase makes a clear distinction between tokenization in general and permissionless tokenization in particular. While many financial institutions are experimenting with blockchain, the report warns that closed or permissioned systems often mirror existing power structures.

In permissioned models, a small group of institutions decides who can issue assets, who can list them and who is allowed to participate. Coinbase argues that this risks recreating the same barriers that exist in traditional finance, only on new technology.

By contrast, the report compares permissionless blockchain infrastructure to early internet protocols such as TCP/IP. These open standards allowed anyone to build applications without needing approval from a central authority, leading to widespread innovation and global adoption. Coinbase says a similar approach is needed if tokenization is to benefit the unbrokered rather than entrench current gatekeepers.

Tokenization moves from theory to practice

The report lands at a time when tokenization is no longer just a concept discussed in white papers. Real world deployments are already taking shape across both crypto native firms and traditional financial institutions.

Franklin Templeton, for example, has issued tokenized shares of its US money market fund on public blockchains. Investors hold onchain fund units that settle more quickly while still operating within existing securities regulations.

Large banks are also experimenting at scale. JPMorgan operates a live Tokenized Collateral Network through its Kinexys platform. The system uses blockchain based tokens that represent assets such as money market fund shares, allowing institutional clients to move collateral more efficiently while the underlying assets remain on the bank’s balance sheet.

Stock exchanges are entering the space as well. The New York Stock Exchange recently announced plans for a 24/7 trading venue for tokenized stocks and exchange traded funds, supported by blockchain based post trade infrastructure and stablecoin settlement.

Regulation, Davos and the road ahead

The release of the Coinbase Institute report coincides with the annual World Economic Forum meeting in Davos, where global policymakers and business leaders gather to discuss economic priorities. Coinbase CEO Brian Armstrong said he planned to use the meetings to push for updated market structure legislation and to advocate for tokenization as a path toward broader economic participation.

According to the report, the stakes extend beyond faster settlement or operational efficiency. Coinbase frames tokenization as a chance to rethink who gets access to wealth building tools in the first place. Whether that promise is realized, the firm argues, will depend largely on whether regulators support open, interoperable systems or default to familiar, tightly controlled models.