Early groundwork for new crypto investment products

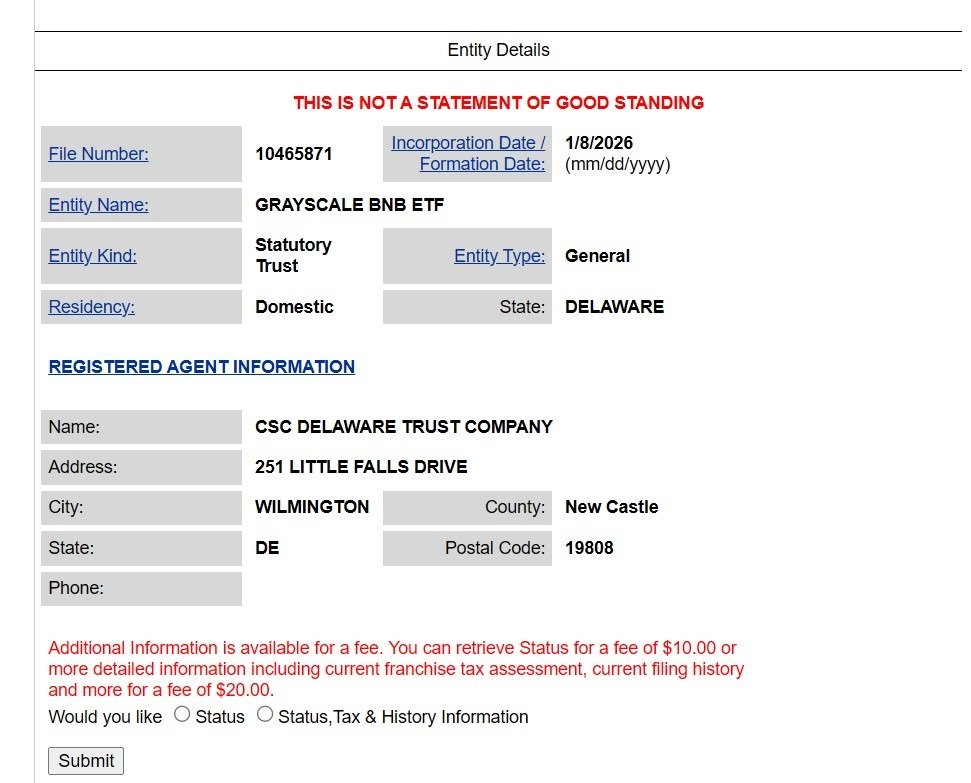

Grayscale has taken a preliminary step that could eventually lead to new crypto exchange traded products tied to BNB and Hyperliquid’s HYPE token. According to public records in Delaware, the asset manager has registered new statutory trusts linked to the two digital assets, a move that often comes before formal filings with US regulators.

The trusts were registered on Thursday and list CSC Delaware Trust Company as the registered agent. While such registrations are common among issuers preparing future products, they do not signal regulatory approval or confirm that any exchange traded fund applications have been submitted to the US Securities and Exchange Commission.

Grayscale has not made any public announcement about the trusts, and the firm did not respond to requests for comment by the time of publication.

What Delaware trust registrations usually mean

In the US ETF market, Delaware trust formation is widely seen as an administrative step rather than a regulatory milestone. Asset managers often create these legal entities early so they are ready to move quickly if market conditions and regulatory clarity improve.

This approach allows issuers to streamline future filings and operational setup, even if a product never ultimately reaches the market. In several past cases, trusts were formed months before an ETF application appeared, and in some instances, no application followed at all.

As a result, the presence of BNB and HYPE trusts should be viewed as early groundwork rather than confirmation of incoming ETFs.

Focus on BNB and HYPE stands out

The inclusion of BNB and HYPE is notable given the current landscape of US listed crypto ETFs. Most products approved or under serious consideration in the US market remain concentrated on Bitcoin and Ether, which are seen as the most established and liquid digital assets.

Only a limited number of altcoin related products have gained traction so far, and regulators have historically taken a cautious stance toward tokens beyond the largest cryptocurrencies.

BNB is the native token of the Binance ecosystem and remains one of the largest crypto assets by market capitalization. HYPE, meanwhile, is tied to Hyperliquid, a decentralized perpetuals trading platform that emerged as a major player in derivatives markets during 2025.

Hyperliquid dominated decentralized perpetuals trading volumes for much of last year, although competition intensified toward the end of the year as rival platforms gained ground. Including HYPE suggests interest in exposure to newer market narratives rather than just established layer one assets.

Grayscale’s broader outlook on the ETF market

The trust registrations come at a time when crypto ETF flows have been under pressure. Spot Bitcoin and Ether ETFs have seen sustained redemptions since late 2025, with more than $1 billion flowing out in early January alone.

Grayscale has argued that much of this activity is driven by tax related selling rather than a fundamental shift in investor sentiment. In a research report published earlier this week, the firm said ETF outflows were largely linked to year end tax strategies.

Despite recent redemptions, Grayscale expressed a constructive outlook for 2026. The firm cited expectations of clearer regulatory frameworks in the US and renewed institutional demand as key factors that could support future growth in crypto investment products.

That view helps explain why the asset manager may be preparing new ETF structures even as near term inflows remain weak.

Gradual expansion beyond Bitcoin and Ether

If Grayscale eventually moves forward with filings tied to the newly registered trusts, it would signal a continued effort to broaden institutional crypto exposure beyond Bitcoin and Ether.

Altcoin ETFs launched so far have attracted smaller inflows compared to their Bitcoin and Ether counterparts, but they have tended to show more stable demand. This steadier performance may encourage issuers to explore additional assets as the market matures.

For now, the BNB and HYPE trusts remain a signal of intent rather than a confirmed product roadmap. Whether they translate into actual ETF filings will depend on regulatory developments, investor appetite, and broader market conditions in the months ahead.