Russia has taken another decisive step towards tightening control over its rapidly expanding cryptocurrency mining sector, proposing new criminal penalties for miners who operate without registering with tax authorities. The move follows growing concern within the government that the majority of mining activity remains outside the formal system, depriving the state of tax revenue and placing pressure on the country’s energy infrastructure.

A new draft bill published by the Ministry of Justice seeks to amend the Criminal Code to introduce fines, forced labour and prison sentences for illegal crypto mining. The proposal reflects Moscow’s broader effort to bring digital asset activities under strict regulatory oversight while allowing limited forms of mining to continue within clearly defined legal boundaries.

Proposed criminal penalties for illegal mining

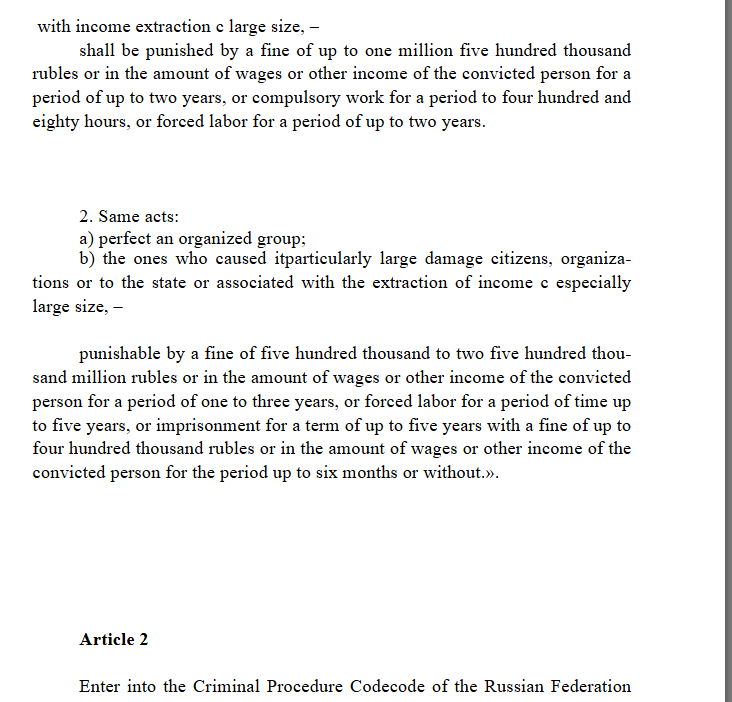

Under the draft amendments, individuals or entities found guilty of unregistered cryptocurrency mining could face fines of up to 1.5 million rubles, equivalent to around nineteen thousand US dollars, alongside sentences of up to two years of forced labour. Officials argue that these penalties are necessary to deter widespread non compliance and to ensure that mining operations contribute to the national budget.

The bill proposes even harsher punishment in cases where mining activity generates what authorities define as outsized profits. In such situations, offenders could receive prison sentences of up to five years, fines reaching 2.5 million rubles and up to four hundred and eighty hours of forced labour. The proposed thresholds for outsized profits have not yet been fully detailed, but lawmakers indicate that they will be linked to both financial gains and energy consumption levels.

If illegal mining is conducted by an organised group and results in significant profits, penalties would be equally severe. Members of such groups could face fines of up to 2.5 million rubles or sentences of up to five years, either in prison or in forced labour programmes. The inclusion of organised groups in the legislation highlights the government’s concern that industrial scale mining operations are deliberately avoiding registration to reduce tax liabilities.

Efforts to bring mining out of the shadows

Russian officials have repeatedly stated that the primary goal of mining regulation is to formalise an industry that has grown quickly due to low electricity costs and cold climates in certain regions. According to the Ministry of Finance, the new draft bill represents the next phase in a longer process aimed at reducing illegal activity and increasing transparency.

Deputy Minister of Finance Ivan Chebeskov revealed in June that only around thirty percent of cryptocurrency miners in Russia had registered with the authorities. Speaking to the state news agency Tass, he explained that the government’s intention was never to ban mining outright but to ensure it operates within a legal framework. He acknowledged that progress had been slower than expected, adding that the process of bringing miners out of the shadows was still incomplete.

The low registration rate has alarmed policymakers, particularly as the global cryptocurrency market continues to expand. Without accurate reporting, the government struggles to assess the scale of mining activity or to forecast its impact on electricity grids and regional development.

Tax obligations and registration requirements

Current regulations require registered miners to submit a special monthly tax declaration detailing the amount of digital currency they have produced. These declarations form the basis for calculating tax obligations, which vary depending on the legal status of the miner and the scale of operations.

Under rules that came into force on November one twenty twenty four, miners consuming less than six thousand kilowatt hours of electricity per month are classified as physical persons. These small scale miners are allowed to operate without formal registration with the Federal Tax Register, provided they declare their income and pay personal income tax on the cryptocurrency they mine.

Larger operations, however, are required to register as legal entities or individual entrepreneurs. They must disclose detailed information about their activities, including energy usage and infrastructure arrangements. Failure to comply with these requirements is what the new criminal penalties aim to address.

The government argues that the distinction between small and large miners strikes a balance between encouraging innovation and preventing abuse of cheap electricity resources. Critics, however, say that enforcement has been inconsistent, allowing many large operations to disguise themselves as smaller ones.

Scale of the registered mining sector

Despite Russia’s reputation as one of the world’s major cryptocurrency mining hubs, official figures show that the number of registered miners remains relatively low. Finance Minister Anton Siluanov told lawmakers at a plenary session of the State Duma that only one thousand three hundred and sixty four cryptocurrency miners were officially registered by the end of October.

This figure contrasts sharply with estimates from industry analysts, who suggest that tens of thousands of mining rigs may be operating across the country. Many are believed to be located in regions with surplus electricity, such as Siberia, where low temperatures reduce cooling costs.

The gap between official data and industry estimates has reinforced the government’s view that tougher measures are needed. By introducing criminal liability, officials hope to push unregistered miners into compliance or drive them out of the market altogether.

Legal framework signed by President Putin

The proposed criminal amendments build on a broader legal framework for cryptocurrency mining that was approved earlier in the year. In August twenty twenty four, President Vladimir Putin signed a package of laws regulating mining activities, which came into effect on November one.

These laws introduced compulsory registration and taxation requirements for all entities involved in mining, including companies that provide infrastructure such as data centres and power supply services. The legislation marked the first comprehensive attempt to regulate mining at a national level.

The framework also included controversial provisions. Foreign entities were prohibited from engaging in cryptocurrency mining within Russia, reflecting concerns about capital flight and national security. In addition, the government was granted authority to restrict or ban mining in specific regions if it threatened energy stability or conflicted with regional development plans.

Criticism and industry reaction

While the government presents the new measures as necessary for economic and regulatory reasons, they have not been universally welcomed. Some industry representatives argue that criminal penalties are excessive and risk driving innovation underground or pushing miners to relocate to other jurisdictions.

Critics also point out that the regulatory environment remains complex and subject to frequent change, making compliance difficult for smaller operators. They warn that uncertainty could discourage investment in legitimate mining infrastructure and related technologies.

Supporters of stricter regulation counter that clear rules and enforcement are essential if Russia is to benefit from the mining industry. They argue that formalisation could lead to increased tax revenues, better energy planning and reduced strain on local electricity networks.

Outlook for cryptocurrency mining in Russia

The draft bill has not yet been passed into law and may still be amended following public consultation and parliamentary debate. However, its publication signals the government’s determination to tighten oversight of cryptocurrency mining.

If adopted, the new penalties would significantly raise the stakes for miners who remain outside the tax system. For many operators, the choice may soon be between registering and paying taxes or facing serious legal consequences.

As Russia continues to navigate its relationship with digital assets, the balance between control and innovation will remain a central challenge. The coming months are likely to determine whether the government’s tougher stance succeeds in bringing the majority of miners into the legal economy or whether it triggers further resistance from an industry accustomed to operating on the margins.