Itaú Asset Management Advocates Bitcoin Exposure

Brazil’s largest private bank, Itaú Unibanco, has advised investors to allocate between 1% and 3% of their portfolios to Bitcoin in 2026. The recommendation comes despite a volatile year for the cryptocurrency, which has experienced sharp price swings.

Renato Eid, of Itaú Asset Management, highlighted that global factors such as geopolitical tensions, changing monetary policies and ongoing currency risks make Bitcoin an attractive complementary asset. He described the cryptocurrency as “an asset distinct from fixed income, traditional stocks or domestic markets with its own dynamics, return potential and a currency hedging function due to its global and decentralised nature.”

Bitcoin Volatility in 2025

Bitcoin began 2025 near $95,000, dropped to around $80,000 during the tariff crisis, surged to an all-time high of $125,000 and later settled near $95,000. Brazilian investors experienced this volatility more acutely due to the strengthening of the Brazilian real by approximately 15% over the year, which amplified local losses.

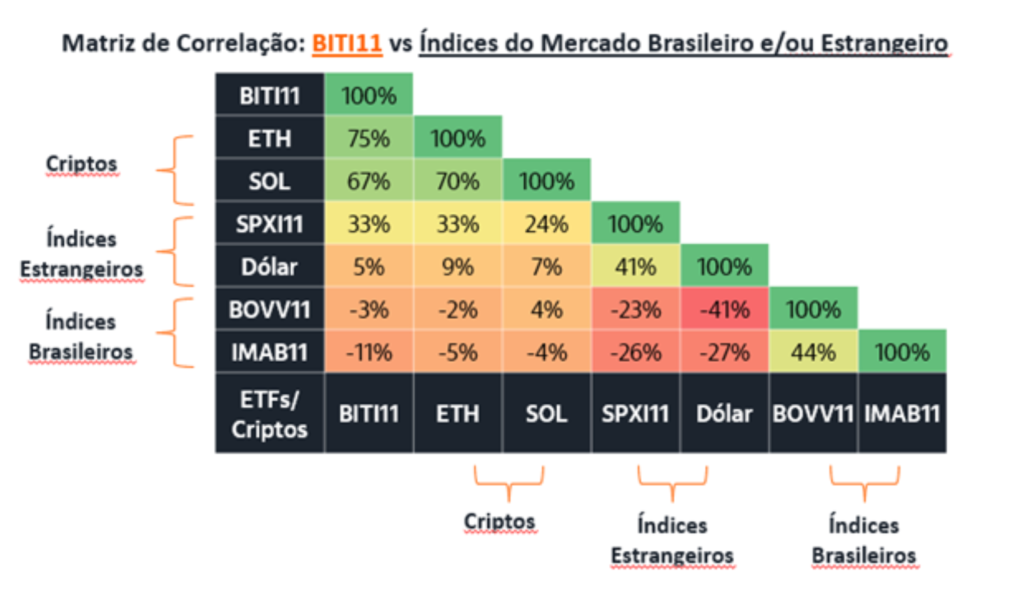

Despite these fluctuations, Itaú Asset suggests that even a small allocation to Bitcoin can provide portfolio stability. The bank’s internal data shows low correlation between BITI11, its locally listed Bitcoin ETF, and other major asset classes, supporting the argument for modest exposure to improve diversification.

Portfolio Diversification and Currency Hedging

Eid emphasised that allocating 1% to 3% of a portfolio to Bitcoin allows investors to benefit from an asset that smooths risks not covered by traditional investments. He noted that Bitcoin’s global and decentralised nature provides a unique hedge against currency swings and market instability.

By integrating Bitcoin into a portfolio, investors may reduce dependence on domestic market movements and conventional financial instruments. Itaú believes that the modest allocation supports long-term portfolio resilience while maintaining exposure to high-potential returns.

Expansion of Crypto Services at Itaú

In September 2025, Itaú Asset launched a dedicated crypto division led by former Hashdex executive João Marco Braga da Cunha. The unit builds on Itaú’s existing digital-asset offerings including its Bitcoin ETF and a retirement fund with crypto exposure.

The bank plans to expand its crypto products further, including fixed-income-style instruments alongside higher-volatility strategies such as derivatives and staking. The move reflects Itaú’s commitment to providing investors with broader options to access the digital-asset market safely and strategically.

Outlook for Bitcoin in Brazil

While Bitcoin remains a volatile asset, Itaú Asset Management’s recommendation signals growing acceptance of cryptocurrencies within mainstream finance. A small, strategic allocation is seen as a way to enhance portfolio diversification, hedge currency risk and gain exposure to potential high returns without overexposing investors to volatility.