The crypto market faced significant turbulence today, marked by heavy outflows from investment products, a sharp pullback in Bitcoin and renewed debate surrounding the rise of Zcash. Market uncertainty, regulatory shifts and investor flight contributed to one of the most volatile weeks in recent months.

Largest Crypto ETP Outflows Since February

Crypto exchange-traded products recorded their steepest weekly outflows since February, with investors pulling nearly $2 billion from the market. The latest CoinShares report shows a 71% rise from the previous week’s $1.17 billion, marking the third consecutive week of withdrawals. The total outflow streak has now reached $3.2 billion.

James Butterfill, head of research at CoinShares, attributed the outflows to monetary policy uncertainty together with increased selling pressure from large crypto holders. Assets under management in crypto ETPs have fallen to $191 billion, a drop of 27% from their October peak of $264 billion.

The United States accounted for the overwhelming majority of outflows with $1.97 billion leaving US-based products. Germany stood out as the only major market with positive flows, logging $13.2 million in new investments. Switzerland and Sweden recorded withdrawals of $39.9 million and $21.3 million respectively. Hong Kong, Canada and Australia saw combined outflows of $23.9 million.

Bitcoin Bears the Brunt of the Withdrawals

Bitcoin and Ether investment products experienced the most severe losses. Bitcoin ETPs alone saw almost $1.4 billion exit the market last week, roughly 2% of their total assets under management.

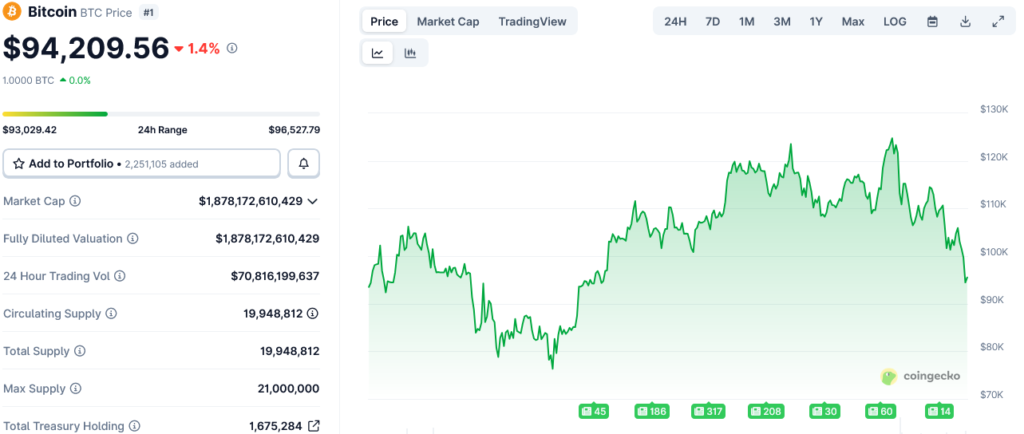

Bitcoin briefly erased all of its 2025 gains as the broader crypto market suffered heavy weekend losses. The leading cryptocurrency dropped to $93,029 on Sunday, falling 25% from its October all-time high. Its price has since recovered slightly to around $94,209 according to CoinGecko.

Strong expectations for the year followed the inauguration of US President Donald Trump in January. His administration has been widely described as the most pro-crypto government to date with increased regulatory support and corporate Bitcoin adoption. Nonetheless, tariff-related economic pressures and a 43-day government shutdown triggered multiple sharp corrections throughout the year.

Market Mood Sours Despite Earlier Optimism

Earlier bullish sentiment driven by spot Bitcoin ETF inflows and rising institutional interest has been overshadowed by renewed market anxiety. Although the government reopened on Thursday, the relief failed to halt the weekend sell-off. Investors remain cautious due to global risk concerns together with unpredictable economic policy signals.

Zcash Rally Reignites Privacy Coin Debate

Zcash provided one of the day’s more dramatic price swings. The privacy-focused cryptocurrency climbed above $700 on Sunday before slipping back to the mid-$600 range. This move followed a historic rally that saw Zcash surge over 1,000% in two months, drawing intense attention from traders and industry commentators.

Bitwise CEO Hunter Horsley commented on social media that Bitcoin-only supporters would struggle to position Zcash within their usual “everything else is a scam” narrative. His remark sparked a wave of reactions from Bitcoin maximalists. Investor Dale Edward argued that although Zcash may offer trading opportunities there is no meaningful comparison with Bitcoin.

Zcash advocates swiftly pushed back. Mert Mumtaz, CEO of node provider Helius, dismissed criticisms as exaggerations and conspiracy-driven objections to the Zcash protocol. The renewed debate has reignited broader conversations around privacy, decentralisation and Bitcoin’s place in a rapidly diversifying market.

A Volatile Week Leaves Markets on Edge

The combination of heavy institutional outflows, policy uncertainty and weekend sell pressure has left the crypto market on unstable ground. While long-term optimism remains supported by ongoing regulatory advancements together with increasing corporate adoption, short-term volatility is likely to persist as global economic risks continue to shape investor sentiment.