Bitcoin hovered around the $100,000 level over the weekend, holding a narrow trading range as broader market sentiment stayed cautious. While the flagship cryptocurrency struggled to find momentum, a select group of altcoins defied expectations with sharp, sustained rallies.

Data from Santiment highlighted that several mid-cap tokens, including Filecoin (FIL), Dash (DASH), Internet Computer Protocol (ICP), and Zcash (ZEC), significantly outperformed the broader market. Traders increasingly pivoted toward assets supported by strong, narrative-driven fundamentals, a clear shift away from speculative momentum.

The rotation reflects a broader trend within crypto markets, where investors are funnelling liquidity into sectors such as decentralised infrastructure (DePIN) and privacy-based assets, both of which offer tangible utility and differentiation from Bitcoin’s store-of-value narrative.

Filecoin Leads the Charge With 60% Surge

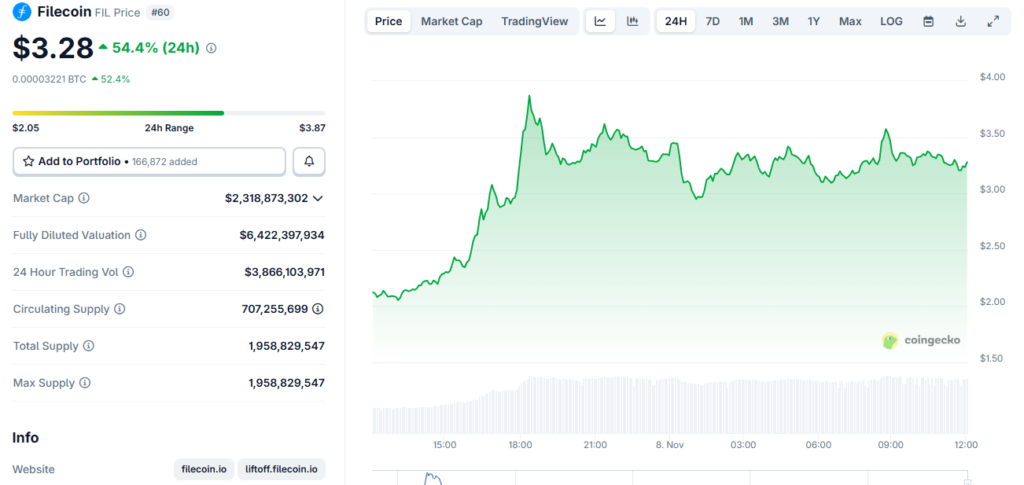

Among the outperformers, Filecoin (FIL) stole the spotlight. The decentralised storage token surged over 60% in the past 24 hours, climbing to around $3.47, its highest price since February.

The rally was fuelled by growing attention on the DePIN sector, where Filecoin has positioned itself as a modular data layer for Web3 and AI workloads. Investors increasingly view the token as a cornerstone in decentralised data infrastructure, capable of bridging traditional cloud storage and blockchain ecosystems.

Momentum accelerated after a multi-hour outage at Amazon Web Services (AWS) in early October disrupted platforms including Coinbase and Robinhood, reigniting debate around centralised cloud vulnerabilities. The incident strengthened the case for decentralised or hybrid data infrastructures, where Filecoin’s value proposition shines.

Additionally, Messari data revealed that Filecoin recently celebrated its fifth anniversary, coinciding with a rise in developer activity and network milestones.

“Originally focused on incentivised cold storage, the network has expanded to support smart contract programmability through the Filecoin Virtual Machine (FVM), enabling applications in DeFi, data management, and DAOs,” Messari noted.

For many traders, Filecoin’s evolution from a storage solution to a fully programmable ecosystem presented a compelling reason to rotate capital into the token amid Bitcoin’s sideways movement.

Privacy Tokens Re-Emerge as Traders Seek Alternatives

While infrastructure tokens gained from decentralisation narratives, privacy-focused assets also saw renewed investor interest. Zcash (ZEC), a leading privacy coin, soared to a multi-year high near $712 on 7 November before retracing to the mid-$500 range, still marking a substantial year-to-date gain.

The surge was partly driven by Arthur Hayes, co-founder of BitMEX, who revealed that ZEC had become the second-largest liquid position in his family office, Maelstrom. His endorsement reignited interest in privacy-enabled settlement and trading, particularly as global financial systems trend toward heightened surveillance and compliance measures.

Similarly, Dash (DASH) followed suit, breaching $100 for the first time in years amid growing privacy-transaction volumes and renewed developer engagement. Analysts suggest these moves represent early-stage capital rotation into the privacy narrative, which may regain importance as regulatory scrutiny tightens over centralised exchanges and transaction tracking.

Market Signals a Shift in Trader Sentiment

Analysts monitoring sector-wide inflows argue that the current rally among infrastructure and privacy tokens reflects a strategic repositioning rather than speculative enthusiasm. As Bitcoin’s dominance consolidates, traders are increasingly allocating capital ahead of potential catalysts instead of reacting to them.

The inflows into Filecoin and Zcash indicate a preference for projects with clear technological relevance, robust developer ecosystems, and compelling macro narratives, decentralisation for Filecoin and financial privacy for Zcash.

Still, questions linger over whether this marks the early stages of an altseason or a short-term rotation. Historically, Bitcoin’s periods of consolidation often precede altcoin rallies, but sustained momentum requires consistent capital inflow and retail participation.

For now, the divergence is clear: while Bitcoin remains stable at six figures, altcoins with strong fundamentals and distinct narratives are leading the charge, signalling a possible new phase in the crypto cycle where utility and narrative cohesion matter as much as liquidity.

Conclusion

The recent moves by Filecoin and Zcash underscore a maturing market dynamic, where narrative clarity and practical use cases drive performance over mere speculation. Whether this trend evolves into a broader altcoin season will depend on sustained network growth and investor conviction.

For now, these two tokens stand out as clear examples of how decentralisation and privacy, the original tenets of cryptocurrency, continue to shape market sentiment, even as Bitcoin consolidates near historic highs.