Bitcoin (BTC) is facing growing selling pressure as investors withdraw billions from spot Bitcoin ETFs, raising concerns that the leading cryptocurrency may be entering a deeper correction phase. Over the past week, spot Bitcoin ETFs have recorded more than $2 billion in outflows, marking one of the heaviest withdrawal periods since their debut earlier this year.

At the time of writing, Bitcoin is trading just above the $100,000 mark, a critical psychological and technical level for both retail and institutional participants. The mounting ETF outflows, combined with a deteriorating macroeconomic backdrop, have weakened investor conviction and placed BTC’s short-term trajectory on shaky ground.

Institutional Sentiment Turns Cautious

The recent exodus from Bitcoin ETFs underscores shifting institutional sentiment. With rising U.S. Treasury yields and a tighter global liquidity environment, risk assets across the board are experiencing renewed pressure. Bitcoin, once hailed as a hedge against inflation and financial instability, is now seeing its institutional supporters step back in favour of safer assets.

Analysts note that the $2 billion in ETF redemptions could signal a structural change in investor behaviour. Rather than accumulating during dips, large holders appear to be de-risking their portfolios, anticipating further market weakness. The ETF outflows effectively translate into real selling pressure, as fund managers must redeem underlying Bitcoin to meet investor withdrawals, amplifying downward price momentum.

“ETF flows have become a key liquidity driver for Bitcoin,” said one market strategist. “When inflows dry up and redemptions spike, it creates a feedback loop that intensifies price declines.”

On-Chain Metrics Hint at Growing Capitulation Risk

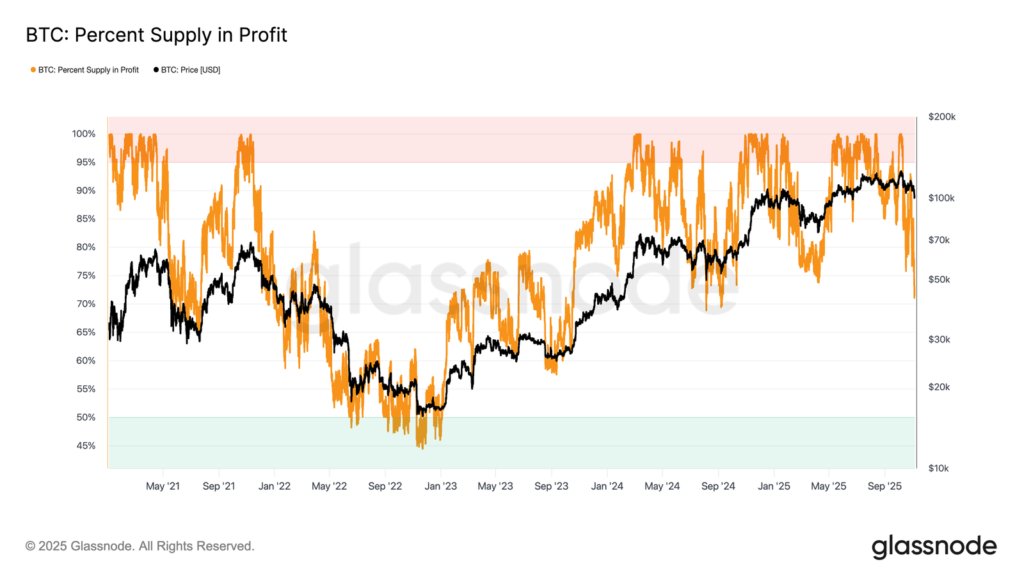

On-chain data adds weight to the bearish narrative. According to Glassnode metrics, Bitcoin’s supply in profit has dropped to around 71%, suggesting that nearly 30% of circulating coins are now held at a loss. Historically, this 70–90% range has represented a mid-cycle equilibrium zone, a phase where market participants consolidate before choosing a new direction.

However, if Bitcoin’s price slips further and pushes a larger share of supply into loss territory, capitulation risk rises sharply. In previous cycles, such conditions have triggered steep sell-offs as investors rush to cut losses. The current setup resembles late-stage consolidations seen in earlier bull markets, where waning demand preceded a deeper pullback before eventual recovery.

The next few weeks are crucial: without fresh inflows or renewed buying enthusiasm, Bitcoin could struggle to stabilise above key support levels, paving the way for an extended bearish phase.

Key Levels to Watch: $100K Support and $98K Pivot

Technically, Bitcoin’s $100,000 level represents a make-or-break point. A sustained break below could lead to panic selling among retail traders and trigger further liquidations across leveraged positions. Analysts are closely watching the $98,000 and $95,000 zones as potential downside targets if bearish momentum continues.

Conversely, if bargain hunters step in and ETF outflows ease, Bitcoin could stage a short-term relief rally. A move above $105,000 would be the first sign of stabilisation, while reclaiming $110,000 would signal that bulls are regaining control. Such a rebound would also help restore investor confidence in ETF demand, mitigating fears of a prolonged correction.

The Road Ahead: Rebuilding Confidence

The next phase for Bitcoin hinges on whether institutional inflows return and if macro headwinds, including high yields and tightening liquidity, begin to ease. A renewed wave of ETF buying could offset recent selling and reinforce Bitcoin’s long-term bullish narrative.

Until then, the market remains in a fragile state. With ETF outflows exceeding $2 billion, profit-taking rising and risk appetite fading, Bitcoin faces the prospect of deeper volatility in the near term. A decisive defence of the $100,000 threshold will be critical to preventing a broader capitulation event.

For now, all eyes remain on ETF flows, the same instrument that once propelled Bitcoin to record highs may now be testing its resilience under mounting market strain.