Crypto venture capitalists are taking a far more measured approach to investments in 2025, stepping away from hype-driven narratives and focusing on projects with proven utility and sustainable growth, according to industry executives.

Bullish Capital: No More “Ethereum Killer” Bets

Sylvia To, director at Bullish Capital Management, said that venture capital firms are “a lot more careful now” compared to previous years when money flowed freely into emerging blockchain projects.

Speaking at Token2049 in Singapore, To explained that the earlier investment rush toward new layer-1 blockchains, each claiming to be an “Ethereum killer” had left the market fragmented. Many of these networks failed to attract real users, exposing the limits of narrative-based investing.

“Before, you could throw a cheque and say, ‘Oh, there’s another L1, it’s going to be an Ethereum killer.’ Then subsequently, you saw all these new chains forming,” she said. “Now, that’s not viable anymore.”

The Key Question: Who Is Actually Using It?

To emphasised that investors are demanding stronger fundamentals and real-world adoption before deploying capital.

“We’re at a phase where you don’t have the luxury to just bet on new narratives,” she said. “You really have to start thinking, there’s all this infrastructure being built, but who has been using it? Are there enough transactions? Is there enough volume coming through these chains to justify all the money being raised?”

According to To, 2025 has been a “slow year” for crypto startups, many of which continue to raise funds at inflated valuations based on speculative future revenue. “The potential revenue and the pipeline they’ve got aren’t solidified,” she added.

A Cooling Funding Climate

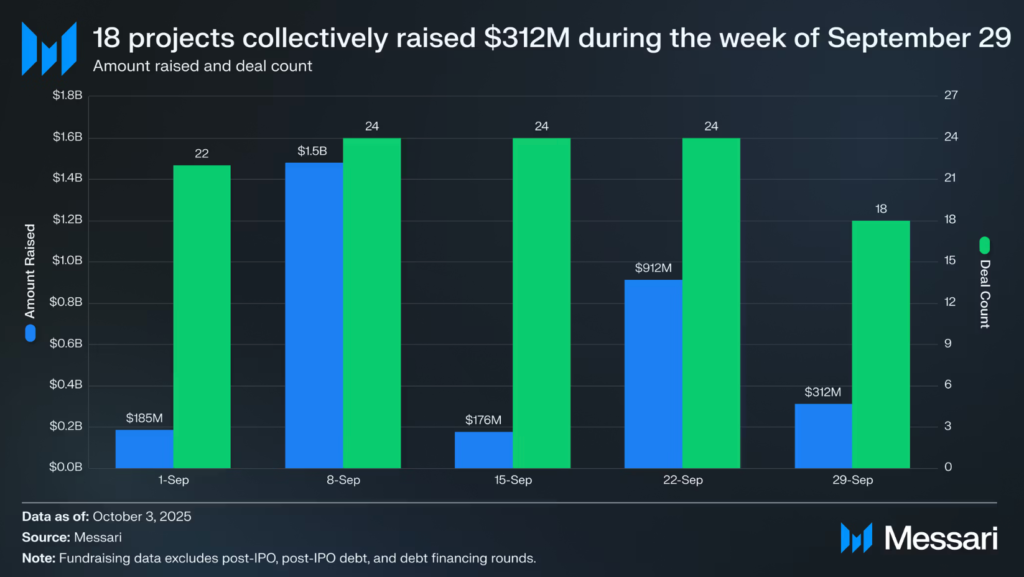

The slowdown in optimism has been reflected in recent funding data. Galaxy Research reported that crypto and blockchain startups raised a total of $1.97 billion across 378 deals in the second quarter of 2025. This represents a 59% drop in total funding and a 15% fall in deal count compared to the previous quarter.

Despite the decline, total venture capital investment in the crypto sector still reached $10.03 billion during the three months ending in June. Analysts say this shows that while funding is slowing, there remains a strong interest in projects with long-term potential and institutional backing.

Ajna Capital: Selectivity Over Speculation

Eva Oberholzer, chief investment officer at Ajna Capital, echoed To’s observations, describing 2025 as a turning point for crypto venture investment.

“VC firms have become much more selective with the crypto projects they invest in,” Oberholzer said on 1 September. “It’s more about predictable revenue models, institutional dependency, and irreversible adoption.”

This marks a significant shift from the previous bull cycle, when investors poured funds into experimental projects that prioritised rapid growth over sustainable business models. Oberholzer believes that this maturing approach signals a healthier long-term outlook for the industry, even if short-term enthusiasm appears subdued.

Institutional Interest Still Driving Big Moves

Despite the broader slowdown, some major players continue to secure large funding rounds. In May, Strive Funds, an asset management firm founded by American entrepreneur and politician Vivek Ramaswamy, raised $750 million to pursue “alpha-generating” strategies through Bitcoin-related investments.

Industry observers see such deals as evidence that while the speculative frenzy has cooled, serious institutional investors still recognise the long-term potential of blockchain technology, particularly in areas such as digital assets, tokenised finance, and decentralised infrastructure.

A Shift Toward Sustainability

Analysts suggest the current investment climate could ultimately benefit the crypto industry by filtering out weak projects and concentrating capital on ventures with genuine user bases and measurable progress.

“The easy money phase is over,” said one Singapore-based venture partner. “Now, founders need to show traction, not just talk about it.”

For entrepreneurs, this means greater scrutiny from investors who expect clear product-market fit, transparent revenue models, and evidence of adoption. For investors, it means navigating a maturing ecosystem where short-term hype gives way to long-term fundamentals.

Outlook for the Rest of 2025

With funding volumes shrinking and investors demanding accountability, crypto startups are facing tougher questions about sustainability and scalability.

Industry insiders predict that while the rest of 2025 may remain slow, this consolidation phase could pave the way for a stronger, more grounded market in 2026.

As To summed up, “The industry isn’t dying, it’s growing up.”