Google has expanded its growing footprint in the high-performance computing (HPC) and Bitcoin mining crossover sector by acquiring a 5.4% equity stake in Cipher Mining. The move is tied to a $3 billion, 10-year hosting deal with AI cloud infrastructure company Fluidstack, positioning Cipher as a major player in both crypto mining and artificial intelligence services.

Deal Structure: Backstopping $1.4 Billion in Obligations

According to Thursday’s announcement, Google will receive warrants to acquire around 24 million shares of Cipher common stock, representing a 5.4% pro forma stake. In return, the tech giant will guarantee $1.4 billion of Fluidstack’s lease obligations under its colocation agreement with Cipher.

The agreement will see Cipher provide 168 megawatts (MW) of critical IT load capacity to Fluidstack at its Barber Lake site in Colorado City, Texas. With 244 MW of gross capacity available and the potential to expand to 500 MW across the 587-acre site, the project is one of the largest of its kind in the United States.

Cipher said the 10-year deal carries an estimated value of $3 billion, with options for two five-year extensions that could raise the total value to approximately $7 billion. Importantly, Cipher retains full ownership of the Barber Lake facility.

A Strategic Pivot Into AI Hosting

Cipher CEO Tyler Page described the deal as a turning point for the company’s high-performance computing ambitions:

“We believe this transaction represents the first of several in the HPC space as we continue to scale our capabilities and strengthen our position in this rapidly growing sector.”

The move reflects a broader industry trend of Bitcoin mining companies pivoting into AI hosting and GPU-driven infrastructure. CleanSpark, for instance, recently raised $100 million in part to support AI data centres, while Hive Digital reported record revenue after expanding into GPU services.

The crossover between mining and AI has been accelerating as investors reward firms diversifying beyond Bitcoin. A September analysis from The Miner Mag found that mining stocks have been outperforming Bitcoin itself, partly due to this shift into high-performance computing.

Google’s Growing Interest in Mining Firms

The Cipher deal follows a similar arrangement between Google and Fluidstack in August, when the search giant became the largest shareholder of Bitcoin miner TeraWulf. In that case, Google acquired a 14% stake in TeraWulf by backstopping Fluidstack’s obligations under a separate AI hosting contract.

By investing in mining firms through its partnerships with Fluidstack, Google is positioning itself to secure large-scale AI infrastructure capacity while diversifying its exposure to emerging computing industries.

This latest deal underscores the internet giant’s strategy of leveraging existing mining infrastructure originally built to support Bitcoin as a foundation for high-demand AI and GPU workloads.

Financing Boost and Market Impact

Alongside the Google-backed agreement, Cipher announced a proposed private offering of $800 million in convertible senior notes, maturing in 2031. The notes, which will not bear interest, can be converted into shares, cash, or a combination under certain conditions. Cipher also granted purchasers the option to buy an additional $120 million in notes within 13 days of issuance.

The company said proceeds will support the build-out of its Barber Lake project, fund its broader 2.4 gigawatt (GW) HPC pipeline and accelerate development across other sites.

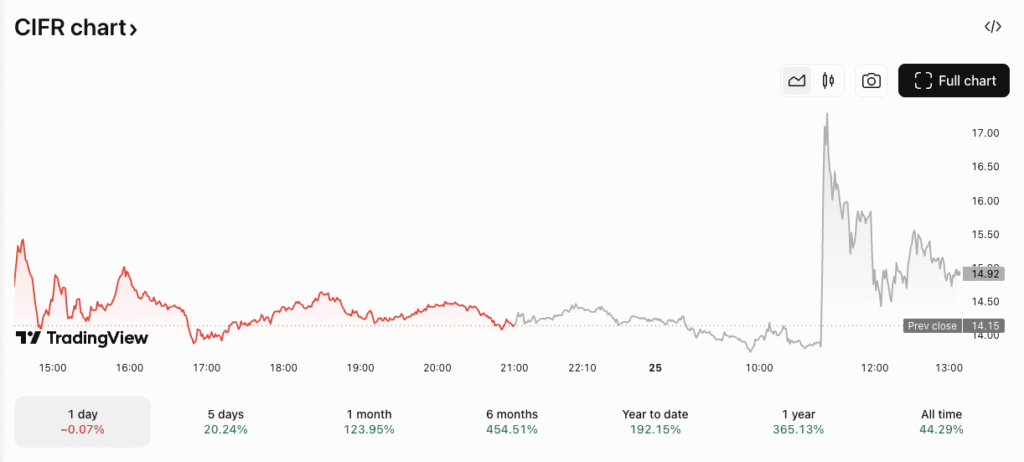

Investor reaction to the announcements was swift. Cipher’s stock (NASDAQ: CIFR) surged more than 22% in pre-market trading before correcting, settling around $14.95 per share. The company now commands a market cap of $5.6 billion, having gained over 190% year-to-date.

Outlook: Crypto Mining Meets AI

Cipher, the fourth-largest public Bitcoin miner by market cap, has now cemented itself at the forefront of the crypto-to-AI shift. The Google-backed deal not only secures a long-term revenue stream but also strengthens the firm’s position in high-performance computing, a sector experiencing explosive demand.

With Google doubling down on partnerships that repurpose mining infrastructure for AI workloads, the boundary between traditional crypto mining and next-generation data centres continues to blur. For Cipher, the agreement could serve as a template for future deals, ensuring both diversification and resilience as the mining industry adapts to new market realities.