Pump.fun is rewriting the playbook for livestreaming and creator monetisation, combining tokenisation, attention economics and viral stunts to capture crypto’s fast-moving retail crowd. With revenues soaring and new projects turning into cult movements overnight, the platform is positioning itself at the intersection of Web3 speculation and mainstream creator culture.

Dynamic Fee Model Restores Market Momentum

Project Ascend’s introduction of a floating creator fee has been central to Pump.fun’s resurgence. Instead of a flat 0.05% charge, the system now applies a 0.95% fee on tokens below $300,000 market capitalisation allowing small creators to capture nearly 1% of each trade, while scaling down to 0.05% for tokens above $20 million.

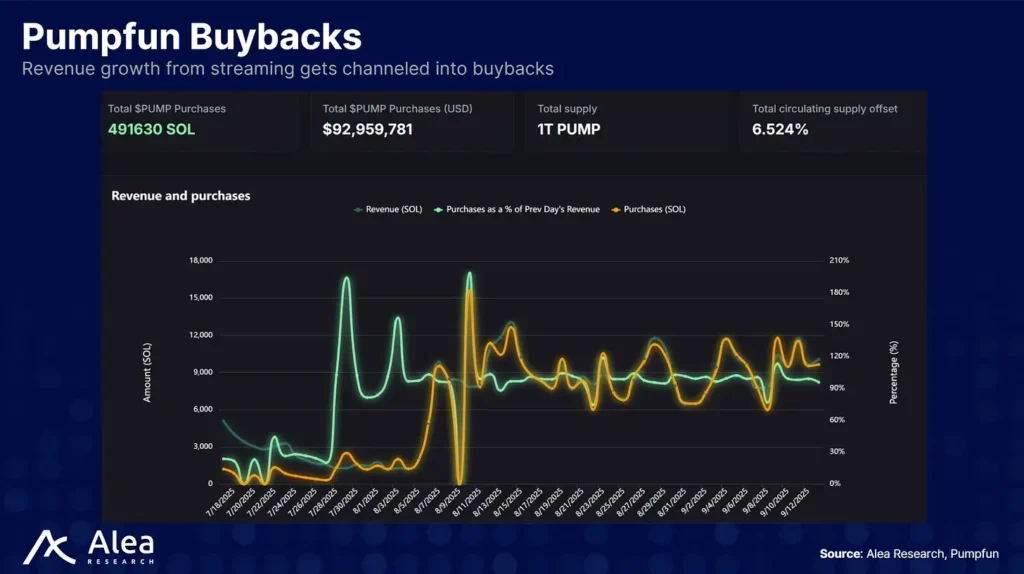

According to Blockworks, this shift helped Pump.fun claw back market share, with platform revenue surpassing $834 million, annualised revenue hitting $492 million and daily buybacks averaging $68 million. This liquidity injection has reinforced Pump.fun’s sustainability while drawing both creators and speculators back into its ecosystem.

Livestreaming Relaunch: Stricter Rules, Bigger Stakes

Pump.fun’s livestreaming feature, previously suspended after dangerous stunts, is now live again, albeit cautiously. Access has been restored to 5% of users, alongside tighter community standards prohibiting violence, animal cruelty and hate speech.

The platform’s innovation lies in making streamer tokens directly tradable, with viewers able to buy or short tokens tied to creators. No single entity controls liquidity, meaning token prices reflect community sentiment in real time. This turns viewer engagement into a live market, where a creator’s consistency and popularity directly impact their token value.

Such a system transforms tipping into equity-style investment: fans not only support their favourite streamer but also stand to profit if their popularity surges. This deeply aligns creator incentives with community growth.

Attention Economics and the Pareto Effect

Despite fears of oversaturation, livestreaming is not a zero-sum market. Attention tends to follow a Pareto distribution, where a handful of breakout creators dominate viewership. Platforms such as Kick have proven that onboarding top-tier streamers like Kai Cenat or IShowSpeed can expand overall audiences rather than dilute smaller ones.

Pump.fun leverages this principle by converting fans’ existing tipping budgets into tokenised bets. Streamer tokens function like “attention derivatives”, rewarding early believers when a creator gains traction. The migration of traditional Twitch streamers, such as League of Legends player BunnyFuFuu, signals growing crossover interest.

Why $Runner Pumped

One of Pump.fun’s breakout success stories is $Runner, a token that surged from under $500,000 to $3 million market cap within hours of launch. Its success was fuelled by:

- A viral stunt: the developer committed to livestreaming on a treadmill until $100 million market cap, creating a meme-narrative hybrid too compelling to ignore.

- KOL amplification: major crypto influencers including Mariuscrypt0, EzMoneyGems and Deg_Ape promoted the token in quick succession, sparking a snowball effect.

- Community momentum: over 1,000 members rallied behind the challenge within days, ensuring organic hype spread beyond paid promotion.

- On-chain action: solid liquidity ($196K) and high-volume trading created early FOMO followed by accumulation, attracting both speculative and “smart money” players.

The formula, unique narrative, coordinated KOL push, community-driven hype and on-chain confirmation have since been echoed by other tokens on the platform.

Other Rising Narratives: $CLIP, $STREAMER and $BAGWORK

Beyond $Runner, several tokens have demonstrated how storytelling and real-life stunts drive price action:

- $CLIP: Built around a clipping economy, it surged past $6.3M market cap with locked liquidity, major influencer support and over 3,000 wallet holders.

- $STREAMER: Pitched as utility-driven, it donates 100% of transaction fees to streamers, with viral marketing strategies forcing mentions in mainstream broadcasts. Now at $10M market cap, it has transcended crypto-native hype.

- $BAGWORK: Based on a “crazy stunts” narrative, it hit $34M market cap, powered by explosive volume and influencer amplification.

Each of these tokens demonstrates the power of narrative-driven investing: when story, speculation and community converge, meme assets can quickly turn into cultural movements.

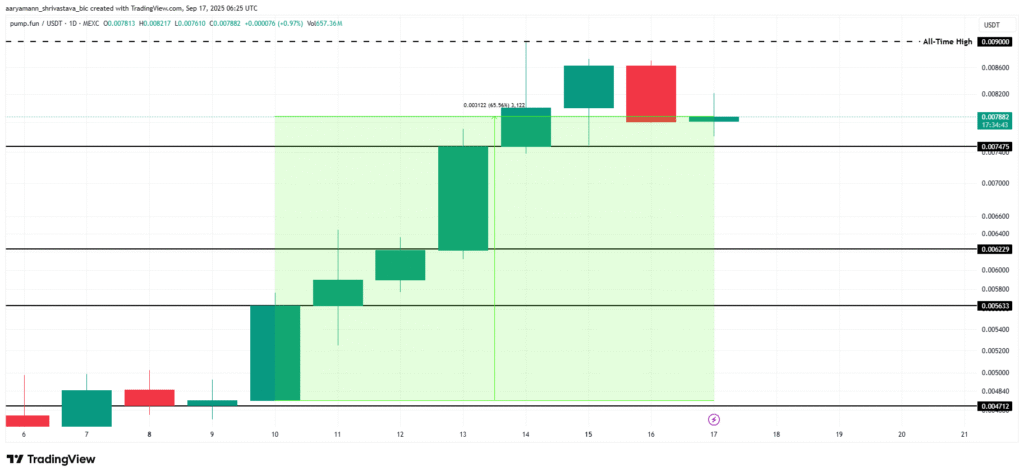

PUMP Token Price Action: Rally With Caution

Pump.fun’s native token, PUMP, recently rallied 65%, setting a new all-time high at $0.0090 before consolidating at $0.0078. Active addresses surged to 58,467, reflecting strong investor participation.

However, network growth has slowed, signalling fewer new entrants. This divergence between rising activity from existing holders and declining adoption, raises questions about sustainability. Should selling pressure mount, PUMP risks falling below the $0.0074 support, with $0.0062 as the next downside target.

The Bigger Picture

Pump.fun has managed to turn livestreaming into a financialised attention market where narratives matter as much as fundamentals. The platform’s new fee model, paired with viral creator-driven stunts, has pushed revenues into the hundreds of millions and birthed token movements that blur the line between speculation and entertainment.