The global cryptocurrency market showed signs of renewed strength last week, with overall capitalisation rising by about 3%. This recovery in sentiment, fuelled by stronger ecosystem updates and positive institutional news, has placed a spotlight on crypto stocks. Among the stocks drawing particular investor interest this week are HIVE Digital Technologies Ltd. (HIVE), Digi Power X Inc. (DGXX), and Galaxy Digital Inc. (GLXY). Each company has unveiled key developments that could influence short-term performance and shape investor expectations.

HIVE Digital Technologies: Strong Production Metrics Keep it in Focus

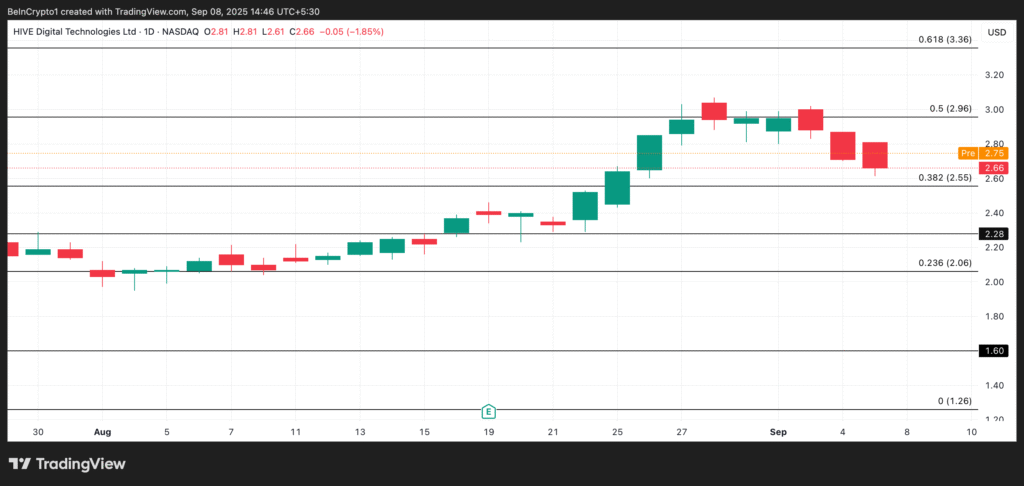

Shares of Bitcoin miner HIVE Digital Technologies Ltd. closed at $2.66 on Friday, marking a 7.33% decline despite a strong operational update. The company’s September 8th report on August 2025 production revealed a notable 22% month-on-month increase in Bitcoin output.

- HIVE mined 247 BTC in August, compared to 203 BTC in July, maintaining an average daily production of 8 BTC.

- The miner reported an average hashrate of 16.3 EH/s, with peak levels reaching 18.1 EH/s, reflecting steady infrastructure efficiency.

Pre-market trading today showed a modest recovery, with shares priced at $2.75. Market watchers suggest that if buying momentum continues, HIVE could test resistance near $2.96. However, weak sentiment could see it retreat below $2.55.

For investors, the company’s consistent operational improvement against a volatile backdrop reinforces its relevance as one of the more closely tracked crypto mining stocks this week.

Digi Power X: Tier 3 Certification Adds Major Tailwind

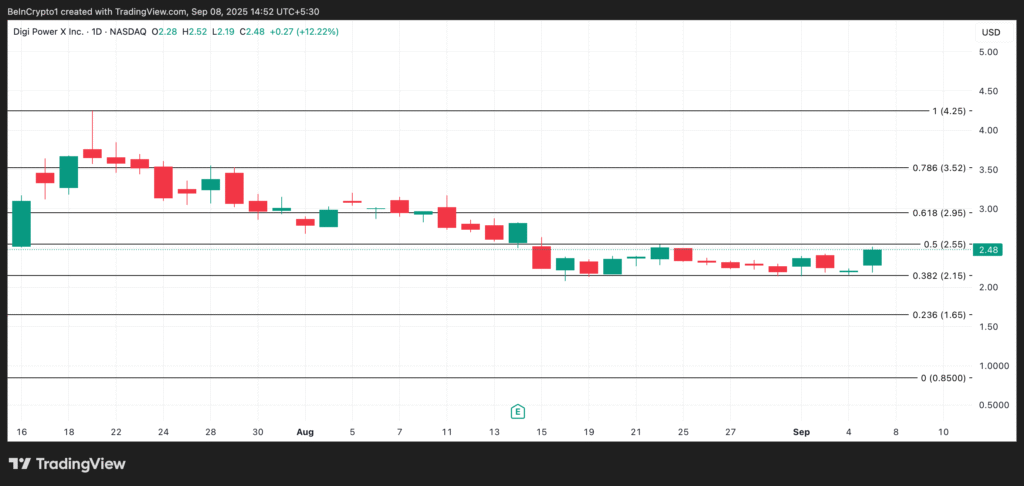

Digi Power X Inc. (DGXX) attracted attention after its stock surged 10.22% on Friday, closing at $2.48. The sharp uptick followed a significant corporate milestone that positions the company more prominently within the AI and digital infrastructure space.

On 4 September 2025, Digi Power X announced that its subsidiary, US Data Centers, Inc., had been awarded Tier 3 certification under the ANSI/TIA-942-C-2024 “TIA-942 Ready” standard for its ARMS 200 modular AI-ready data centre platform.

The certification, confirmed by EPI Certification Pte Ltd. after an audit on 26 August 2025, places Digi Power X among a select group of providers delivering globally recognised resilience, reliability, and compliance standards.

Pre-market indicators suggest the stock could break past $2.55, with a potential upside toward $2.95 if buying interest sustains. Conversely, weakness could push it below $2.15, highlighting short-term volatility risks.

This development not only strengthens Digi Power X’s standing within crypto-linked equities but also broadens its appeal to investors looking at AI-driven infrastructure growth.

Galaxy Digital: Tokenising Public Equity on Blockchain

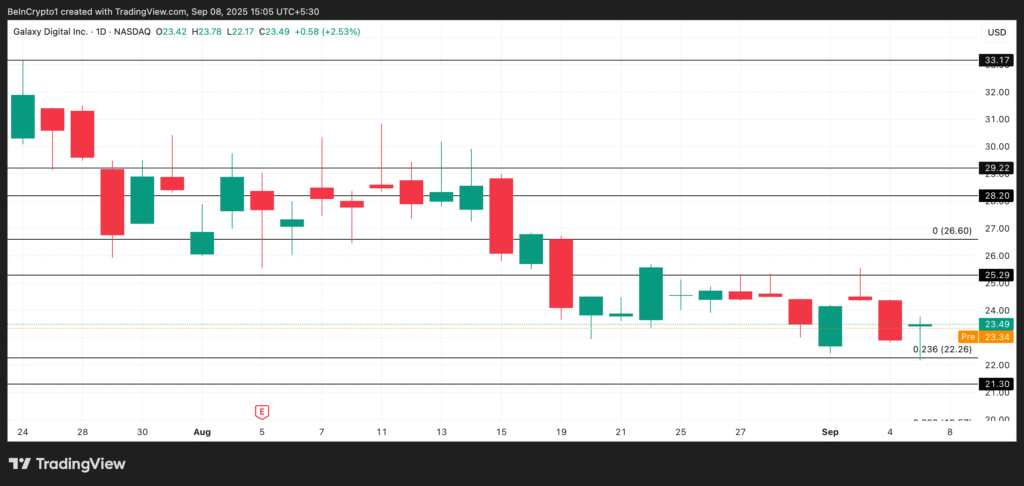

Galaxy Digital Inc. (GLXY) closed Friday’s session at $23.49, posting a 3% rise as it revealed one of the most notable innovations in recent weeks. The firm confirmed plans to execute the first-ever tokenisation of SEC-registered public equity on a major blockchain.

In partnership with Superstate, Galaxy Digital will enable shareholders to tokenise and hold GLXY shares on-chain, creating a blockchain-native model of public equity ownership. This move represents a major leap for traditional finance integration with digital assets, offering investors new levels of accessibility and flexibility.

Pre-market trading placed the stock slightly lower at $23.34, but analysts note the potential for a rally toward $25.59 if demand strengthens. On the downside, weak momentum could see shares drift below $22.26.

For investors, this development signals Galaxy’s push beyond traditional asset management and into pioneering blockchain-native equity models, strengthening its positioning within the rapidly evolving digital economy.

Crypto Stocks Ride on Momentum

As the broader crypto market stabilises and capitalisation ticks upward, these three stocks are positioned as key beneficiaries of renewed investor interest.

- HIVE continues to prove operational resilience in mining despite market swings.

- Digi Power X is carving out a niche in AI-ready data infrastructure with globally recognised certification.

- Galaxy Digital is bridging traditional finance and blockchain through equity tokenisation.

The week ahead will reveal whether momentum can sustain these gains or whether profit-taking trims valuations. For now, however, these names remain front and centre for crypto-focused equity investors.