Fresh Addition to Record Holdings

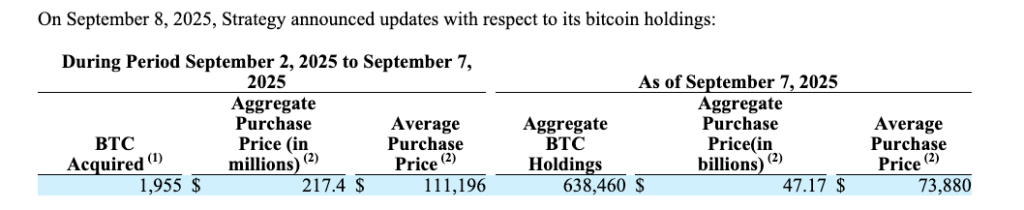

Michael Saylor’s company Strategy has strengthened its position as the largest corporate holder of Bitcoin. The firm bought 1,955 BTC worth about $217.4 million between 2 and 7 September, according to a filing with the United States Securities and Exchange Commission. The purchase was made at an average price of $111,196 per coin.

The acquisition came as Bitcoin briefly climbed above $113,000 before settling near $110,000, based on CoinGecko data.

Growing Bitcoin Portfolio

Following this latest purchase, Strategy’s total Bitcoin holdings reached 638,460 BTC. The company has spent approximately $47.2 billion on its accumulation, with an average purchase price of $73,880 per coin.

This milestone underscores Strategy’s continuing belief in Bitcoin as a core reserve asset, even amid short-term market fluctuations.

Recent Buying Trends

September’s purchase follows a series of steady acquisitions earlier in the year. In August, the company added 7,714 BTC to its balance sheet. This was a smaller figure compared with July, when Strategy acquired 31,466 BTC, and June, when it bought 17,075 BTC.

Although the pace of buying has varied, Strategy has consistently added to its Bitcoin reserves each month, reinforcing its long-term strategy.

Financing the Purchase

The September acquisition was funded through proceeds from three of Strategy’s at-the-market equity offerings. These included the Series A Perpetual Strife Preferred Stock (STRF), the Series A Perpetual Strike Preferred Stock (STRK), and the company’s Common A stock MSTR.

By using equity sales rather than debt, Strategy has maintained financial flexibility while continuing to expand its Bitcoin holdings.

Market Context

The purchase took place during a period of renewed strength in Bitcoin’s price. The cryptocurrency has shown resilience, rising from earlier summer lows and moving into six-figure territory. Analysts suggest institutional activity and continued interest from major corporate buyers like Strategy are helping to underpin confidence in the market.