SOL Strategies, the first Solana-focused treasury and validator company, has secured approval to list its shares on the Nasdaq Global Select Market under the ticker STKE. Trading will begin on Tuesday, September 9, 2025, marking a milestone not just for the company but for the broader Solana ecosystem.

The move brings SOL Strategies into the spotlight as one of the few crypto-native firms to establish a foothold on Nasdaq, signalling heightened institutional interest in Solana’s network and staking opportunities.

From Cypherpunk Holdings to Solana Pioneer

Originally founded as Cypherpunk Holdings, the firm underwent a major transformation in September 2024 under the leadership of former Valkyrie CEO Leah Wald, who took over as chief executive in mid-2024. Rebranded as SOL Strategies, the company pivoted to focus exclusively on Solana’s staking economy months before Wall Street enthusiasm for digital asset treasuries (DATs) accelerated.

As part of its new direction, SOL Strategies acquired Solana validators from Orangefin Ventures, Cogent Crypto and Laine, while also making ecosystem-driven moves such as powering the Solana Mobile validator and launching a white-label validator for Pudgy Penguins. This strategy allowed the firm to position itself as a central player in Solana’s rapidly expanding staking environment.

Stock Performance and Market Position

SOL Strategies’ share price has surged nearly 900% over the past year, yet the firm remains smaller in scale compared to its US-based rivals. With around $90 million in SOL holdings, the company trails behind three of the largest Solana DATs, each holding between $380 million and $420 million.

One key reason has been limited market exposure. Until now, its stock traded only on the Canadian Securities Exchange (CSE) under the symbol HODL. It also maintained OTCQB shares under CYFRF, which will automatically transfer once Nasdaq trading opens.

The upcoming Nasdaq debut, however, is expected to level the playing field. By gaining access to the US market, SOL Strategies can broaden its shareholder base and enhance liquidity.

Institutional Signal for Solana

Wald described the Nasdaq approval as a validation of both the company’s strategy and the wider Solana ecosystem:

“Our approval to list on Nasdaq signals to both institutional and retail investors that a Solana-focused validator and treasury company can meet the same standards of transparency, resilience and growth expected of any public company.”

The listing means every Solana DAT tracked by Blockworks Research, with the exception of BIT Mining, will now trade on Nasdaq. It also cements Solana’s reputation as a blockchain network capable of drawing significant institutional attention, particularly in staking markets.

Solana Price and Technical Outlook

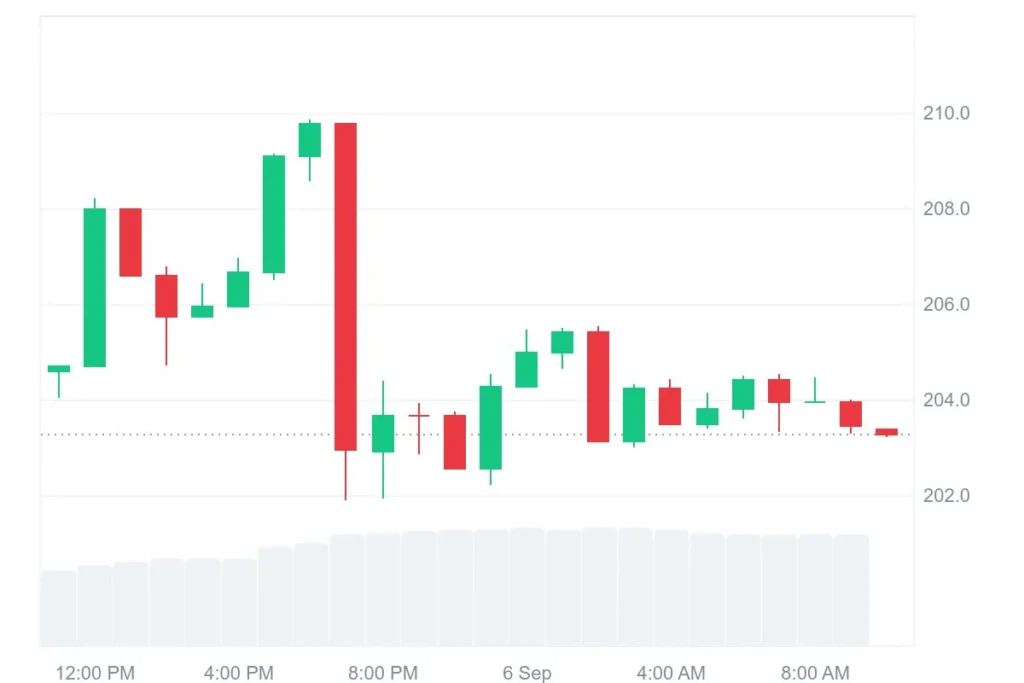

The Nasdaq development coincides with steady activity in Solana’s token (SOL). At the time of writing, SOL trades at $203.53 with a market capitalisation of $110.14 billion and daily trading volume of $16.24 billion. Prices dipped slightly by 0.33% in the past 24 hours but analysts remain optimistic.

Technical strategist DreamBoat highlighted bullish signals, noting SOL recently tested support around $202–$204, bounced back after reaching $206.5 and is now eyeing a move toward $208. The rebound is largely attributed to institutional buying ahead of SOL Strategies’ Nasdaq debut, suggesting growing investor confidence in Solana’s trajectory.

A New Chapter for Solana and SOL Strategies

The Nasdaq listing represents a turning point for SOL Strategies, bridging traditional capital markets with Solana’s decentralised economy. With enhanced institutional access, the company is poised to expand its validator operations, deepen ecosystem collaborations and attract long-term capital into the network.

For Solana, the event underscores its momentum as one of the leading blockchains gaining traction beyond retail adoption. As institutional players gain more ways to engage with Solana’s staking and validator economy, the ecosystem could see an acceleration in both network growth and investor participation.

In short, SOL Strategies’ Nasdaq debut not only reshapes its own prospects but also signals Solana’s growing role in mainstream finance.