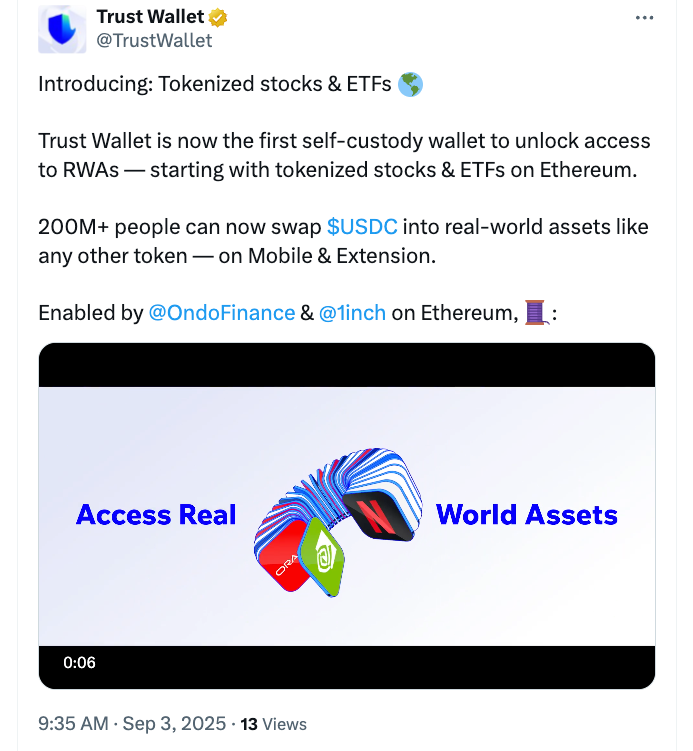

Trust Wallet, the self-custodial crypto wallet owned by Binance co-founder Changpeng “CZ” Zhao, has rolled out support for tokenised stocks and exchange-traded funds (ETFs). The move positions the platform among the first to integrate real-world assets (RWAs) with self-custody, widening access to financial markets through blockchain technology.

Collaboration with Ondo Finance and 1inch

The integration has been launched in collaboration with Ondo Finance, a leading decentralised finance (DeFi) platform specialising in RWAs, and the decentralised exchange aggregator 1inch. Ondo Finance provides the tokenised assets, including stocks, ETFs and bonds, initially issued on Ethereum with future plans for Solana. Meanwhile, 1inch enhances liquidity and pricing through its Fusion system, ensuring smoother swaps for users.

“Integrating RWAs into self-custodial wallets is an important step in making global finance more open and efficient,” said Trust Wallet chief executive Eowyn Chen. “The bigger picture is how blockchain democratises access to financial markets and lays the foundation for a more inclusive future of finance.”

Sami Waittinen, head of marketing at Trust Wallet, described the approach as collaborative. “In short, Ondo brings the assets, 1inch powers the rails, and Trust Wallet makes it accessible in self-custody,” he said, adding that the company aims to expand by integrating more RWA providers and liquidity sources in the future.

Limited availability and trading hours

Despite its global ambitions, access to these tokenised assets remains restricted. According to Trust Wallet’s website, RWA tokens are not available in regions including the United States, the United Kingdom and the European Economic Area. Transactions attempted from these jurisdictions will not be processed.

Trading also follows US market hours, operating Monday to Friday from 1:30 pm to 8:00 pm UTC. Users cannot trade outside these times, although Trust Wallet notes it monitors off-hours activity to explore potential future features such as 24/7 trading or limit orders.

Self-custody meets real-world assets

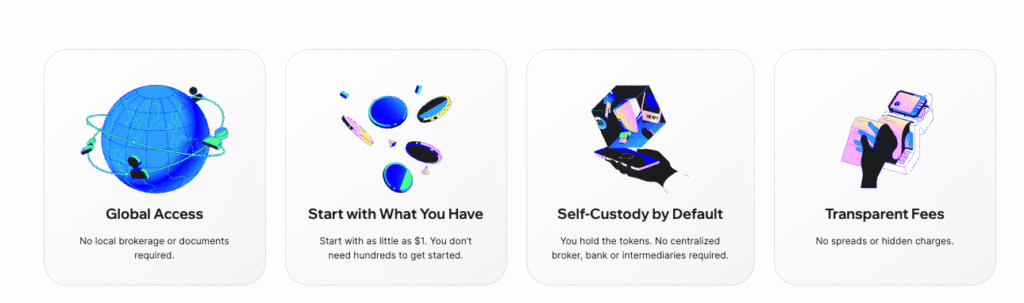

By merging RWAs with self-custody, Trust Wallet extends the meaning of independent asset management. Tokenised RWAs act as digital certificates of ownership, making traditionally restricted investments like stocks or ETFs available directly from a personal wallet.

“Tokenised RWAs are a natural next step as they unlock traditionally gated assets and make them accessible to anyone, anywhere,” said Waittinen. “It is a powerful extension of what self-custody can mean.”

Lucien Bourdon, analyst at hardware wallet maker Trezor, highlighted the technical and ownership aspects of this development. He explained that from a wallet’s perspective, there is no difference between RWA tokens and other digital tokens. Assets such as gold or Treasury-backed tokens are already securely held in self-custodial wallets. However, he stressed that ownership differs from cryptocurrencies.

“With cryptocurrencies, your keys equal direct ownership of the asset. With real-world assets or stablecoins, your keys secure the token, but the underlying asset remains with an issuer or custodian,” Bourdon said. “That means self-custody works technically, but trust in the issuer is still essential.”

Paving the way for broader access

The launch of tokenised RWAs within Trust Wallet signals a growing convergence between decentralised finance and traditional markets. While regulatory limitations remain a challenge, the initiative underscores blockchain’s potential to broaden financial participation and reimagine access to global markets.

For Trust Wallet, the development aligns with its mission of promoting financial freedom through decentralised ownership. As partnerships expand and technology matures, the platform intends to give users wider, more open access to tokenised assets while reinforcing the benefits of managing them independently.