World Liberty Financial, the DeFi venture linked to former US President Donald Trump, is preparing to bring its USD1 stablecoin to the Solana blockchain. The move is expected soon and could reshape liquidity in Solana’s fast-growing decentralised finance (DeFi) ecosystem.

Early Signals of Expansion

On 29 August, Charles, who leads Solana ecosystem strategy at World Liberty Financial, confirmed that the stablecoin’s rollout on Solana would happen “sooner than you think.” His message was later echoed by co-founder Zach Witkoff, who posted “Solana here we come” on X.

The company’s official account also revealed its logo redesigned in Solana’s signature purple and green colours, underlining its intention to integrate more closely with the blockchain.

Interestingly, independent blockchain researchers had already spotted technical groundwork before these announcements. On 28 August, research group Dumpster Dao identified that a wallet linked to World Liberty Financial had deployed Chainlink’s CCIP bridge on Solana to connect its WLFI token. The following day, they reported new activity hinting at integrations with established Solana protocols.

Technical Implementation Underway

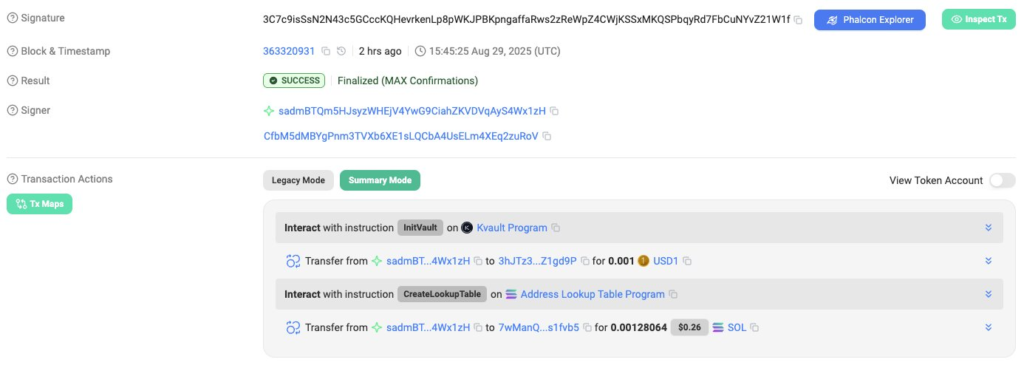

Among the most notable developments, Dumpster Dao highlighted that Kamino Finance, the largest lending platform on Solana had set up a dedicated USD1 vault. Analysis showed that the vault’s deployer address aligned with Kamino’s official documentation, while on-chain flows confirmed that stablecoin transactions were already moving between Kamino’s multisig wallet and the WLFI deployer address on Solana.

These steps indicate that the project is already progressing beyond marketing statements and into real-world implementation. If successful, USD1 will become part of Solana’s DeFi infrastructure, supporting lending, borrowing, and liquidity across protocols.

Solana’s Growing Stablecoin Market

The expansion comes at a time when Solana’s stablecoin market has reached fresh highs. According to DeFiLlama data, Solana’s stablecoin market capitalisation has climbed above $12 billion, its highest level in nearly four months.

The chain is currently dominated by Circle’s USDC, with around $8.7 billion in supply, followed by Tether’s USDT at $2.17 billion. Market analysts believe that the arrival of USD1 could introduce fresh liquidity, making Solana’s DeFi markets more robust. With additional liquidity, lending platforms, settlement layers, and trading activity could all benefit.

USD1’s Position in the Stablecoin Sector

USD1 is pegged to the US dollar and backed by a reserve of US Treasuries and cash equivalents. The stablecoin is already active on Ethereum, BNB Chain, and TRON. Over recent months, it has seen increased adoption, with exchanges such as Binance and Bullish integrating the token in investment deals.

This momentum has pushed USD1 into the ranks of the top six stablecoins globally, with a circulating supply approaching $2.5 billion. Most of this supply is concentrated on BNB Chain, but the Solana expansion could diversify its presence and strengthen its market share further.

The decision to extend USD1 to Solana marks a critical step for World Liberty Financial. If integrations with protocols like Kamino succeed, USD1 could establish itself as a key stablecoin on one of the fastest-growing blockchains in crypto.

For Solana, the addition of another dollar-pegged asset with real backing could help improve liquidity, attract institutional adoption, and further cement its position as a major player in the DeFi sector.

As technical developments continue, the market will be watching closely for the official launch and the impact of USD1 on Solana’s $12 billion stablecoin economy.