SharpLink Gaming, the second-largest corporate holder of Ether, has approved a $1.5 billion share repurchase programme to reinforce its Ethereum-focused treasury strategy. The move highlights the betting platform’s growing commitment to Ether as its primary reserve asset.

Buyback Programme Announced

The company revealed on Friday that its board has authorised the repurchase of $1.5 billion worth of shares as part of a disciplined capital markets strategy. While no shares have yet been repurchased, Co-Chief Executive Officer Joseph Chalom explained that the company would consider buybacks when its stock trades at or below the net asset value of its Ether holdings.

“This programme provides us with the flexibility to act quickly and decisively if those conditions present themselves,” said Chalom. By repurchasing shares below net asset value, the company expects to increase its Ether-per-share ratio and further strengthen its treasury position.

Ethereum-Centric Treasury Approach

SharpLink Gaming has fully embraced an Ethereum-based corporate treasury strategy. In late May, the company nominated Ethereum co-founder Joseph Lubin as chairman, signalling its long-term commitment to Ether. At the time, the firm stated that ETH would serve as its primary treasury reserve asset.

Lubin has argued that corporate Ether treasuries are vital to the broader Ethereum ecosystem. He described such companies as “a great business to run” and stressed their importance in balancing supply-demand dynamics as more decentralised applications are developed.

Current Treasury Position

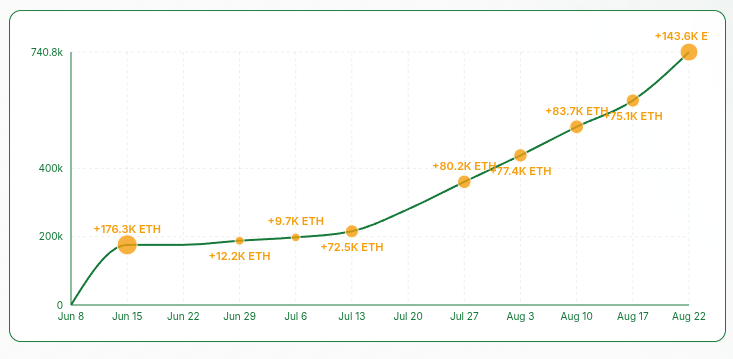

SharpLink currently holds 740,800 Ether, valued at approximately $3.14 billion. The firm is also standing on an unrealised gain of nearly $600 million following Ether’s recent price rally. Despite this impressive position, SharpLink trails BitMine, the industry leader in Ether treasuries.

BitMine, a former Bitcoin mining company, holds around 1.5 million Ether, worth $6.47 billion, giving it the top spot according to Strategic ETH Reserve data. SharpLink, however, remains the second-largest holder and continues to expand its position through accumulation and staking.

Strategic Outlook

SharpLink’s decision to initiate a substantial buyback programme underscores its long-term strategy of boosting shareholder value while reinforcing its Ethereum-centric approach. The company emphasises that buybacks below net asset value are designed not only to improve the ETH-per-share metric but also to showcase confidence in the sustainability of its treasury model.

By aligning its corporate structure closely with Ethereum, SharpLink has positioned itself as a key player in advancing the ecosystem. The approval of the $1.5 billion buyback is likely to further strengthen its role as a leading Ether-focused corporate treasury.