Bitget Wallet has unveiled a major integration with Base, Coinbase’s Ethereum Layer-2 (L2) network, and Aerodrome, one of its most active decentralised exchanges (DEXs). The move underscores the growing battle among wallet providers to simplify user access to decentralised finance (DeFi), even as market indicators show declining momentum across the sector.

Direct Trading on Base Without Bridges

The latest update enables Bitget Wallet users to trade assets on Aerodrome directly through its mobile app. Traditionally, DeFi users must bridge funds or navigate across multiple platforms to access liquidity pools or execute trades. By embedding Aerodrome’s features into its ecosystem, Bitget aims to remove this friction and make DeFi more accessible to retail users.

Aerodrome has become the central liquidity hub for Base-native assets, including cbETH and cbBTC, Coinbase’s wrapped Ethereum and Bitcoin offerings. According to Aerodrome contributor Alex Cutler, the DEX consistently provides some of the best trade execution on Base’s largest assets. Cutler noted that in-app access via Bitget Wallet is a “logical next step” for deepening liquidity and retail adoption.

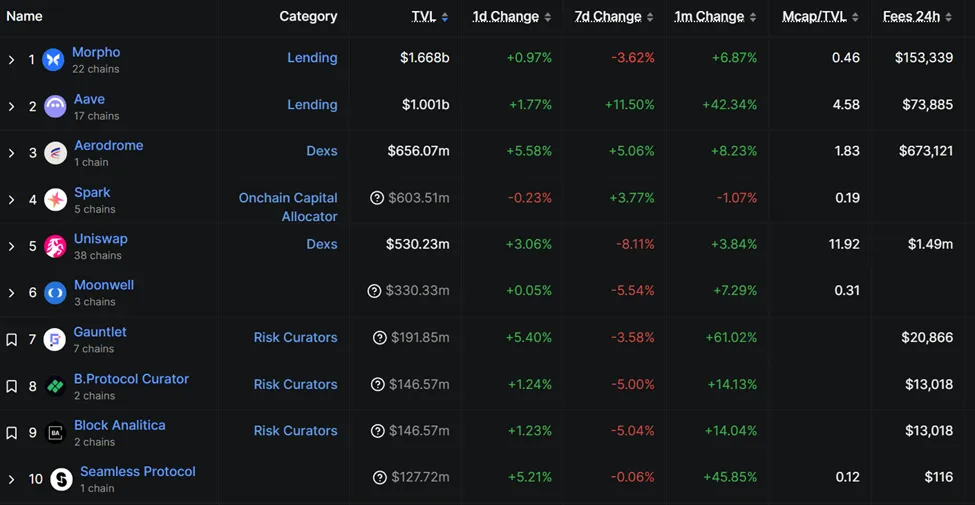

At present, Aerodrome ranks as the third-largest protocol on Base, trailing Morpho and Aave, with a total value locked (TVL) of $656 million.

Expanding Ecosystem Features

Bitget’s integration with Aerodrome goes beyond trading. The wallet will introduce a dedicated Base ecosystem section within its “Discover” tab, featuring curated decentralised apps (dApps), token feeds, and streamlined trading options.

The rollout also extends to Bitget Wallet’s GetGas function, which allows users to pay transaction fees without holding ETH. This addresses one of the biggest pain points for L2 users, who often face unexpected friction when they lack ETH for gas payments despite holding other assets.

In a statement, Jamie Elkaleh, Chief Marketing Officer at Bitget Wallet, emphasised that the partnership reflects a “shared belief in building an on-chain ecosystem that anyone can access.”

Combining AI and DeFi Integrations

The Aerodrome update arrives just one day after Bitget launched GetAgent, an AI assistant designed to help users navigate its platform. The back-to-back releases highlight the company’s dual strategy: combining AI-driven support tools with deeper DeFi integrations.

By aligning user-friendly features with the growing Base ecosystem, Bitget is positioning itself as a competitor to established players such as MetaMask and Trust Wallet. Industry analysts suggest that if successful, the approach could help Base capture a larger slice of the DeFi market.

Weak Market Conviction Clouds Momentum

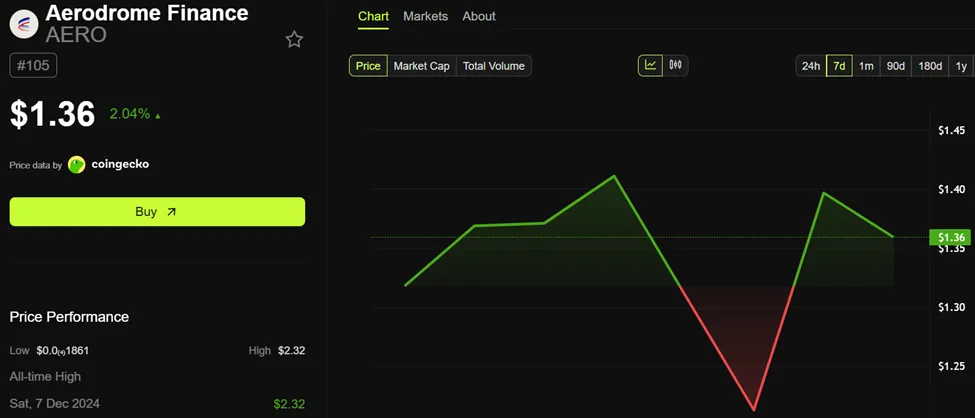

Despite the innovation, Bitget’s expansion comes at a challenging time for DeFi markets. Aerodrome’s native token, AERO, has struggled to sustain upward momentum. At the time of writing, AERO had risen just 2.04% to $1.36, with analysts warning that weak trading volumes and declining futures open interest point to limited near-term upside.

More broadly, activity on the Base chain has softened. According to DeFiLlama data, Base’s TVL slipped from $4.9 billion on 14 August to $4.75 billion this week, representing a decline of more than 3%. Liquidity incentives that drove early growth appear to be losing steam.

The network also recently suffered a 20-minute chain outage that halted block production, raising questions about the robustness and decentralisation of L2 blockchains.

Analysts warn that in the current cycle, speculative flows remain muted, leaving protocols like Aerodrome vulnerable to pullbacks. This raises doubts about whether convenience features alone will be enough to sustain user adoption and capital inflows.

Can Simplicity Outweigh Market Headwinds?

Bitget’s integration with Base and Aerodrome signals strong intent to make DeFi more intuitive for mainstream users. By tackling common pain points such as bridging, gas fees, and platform navigation, the wallet provider is betting that user experience will drive adoption even in weaker markets.

However, structural challenges remain. DeFi conviction is waning, liquidity growth has slowed, and trust in L2 infrastructure has been dented by recent outages. The real test for Bitget will be whether simplified flows and AI-powered support can attract new users at a time when the broader DeFi ecosystem is grappling with declining confidence.