The PENGU token has entered a turbulent phase, with market indicators suggesting that its recent gains may be under threat. Trading around $0.030 at press time, PENGU has already shed more than 8% over the past 24 hours, erasing most of its monthly progress. Despite still boasting a 113% return over the last three months, the latest signals point to mounting selling pressure and the potential for a steep decline toward $0.014.

Exchange Inflows Signal Bearish Intent

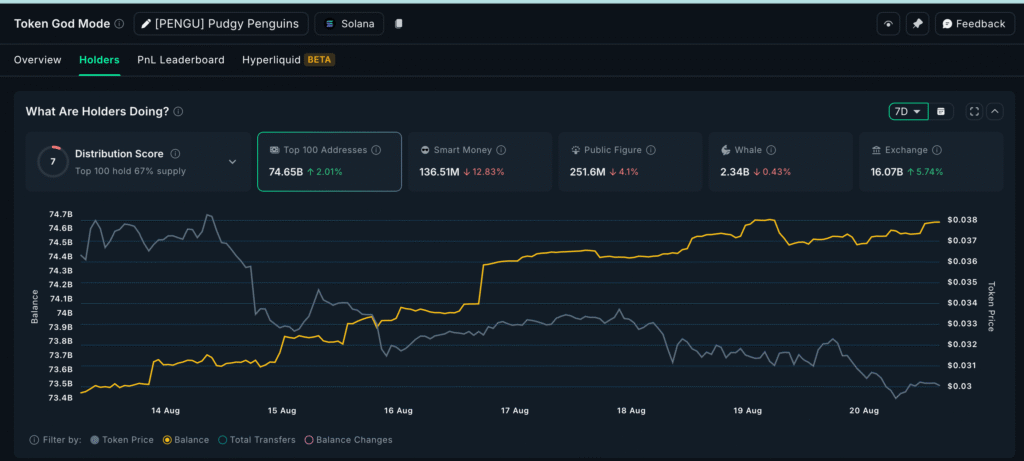

Fresh data highlights a concerning shift in token distribution. According to analytics provider Nansen, exchange reserves for PENGU climbed by 5.74% this week, now holding 16.07 billion tokens. This represents an additional 873 million tokens moving into centralised exchanges, typically a bearish development that precedes heightened sell activity.

At the same time, whale wallets trimmed their holdings by 0.43%, while smart money participants reduced exposure by a sharper 12.83%. Smart money wallets now hold just 136.51 million tokens, signalling that experienced traders are unwilling to absorb the growing supply. Even public-figure-linked wallets took part in the exodus, offloading 4.1% of their balances.

Interestingly, only the top 100 addresses showed an increase, boosting their holdings by 2.01% to 74.65 billion tokens. However, this rise is likely due to redistribution rather than new accumulation, suggesting large holders may simply be absorbing outflows from smaller players. Overall, the balance of supply and demand points towards heightened caution rather than bullish conviction.

Technical Setup Hints at Death Cross

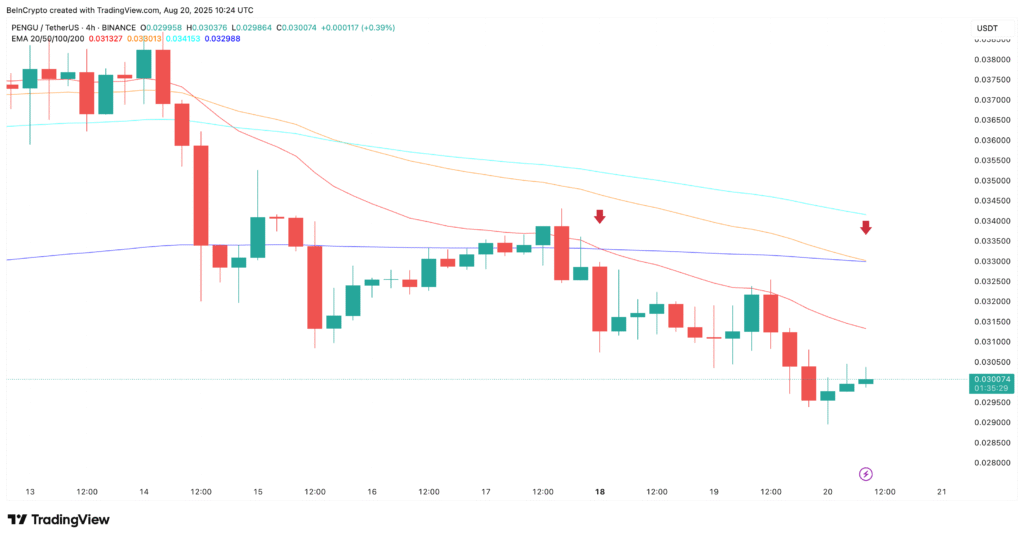

On the technical front, the charts are flashing further warnings. The 4-hour PENGU chart shows that the 50-period Exponential Moving Average (EMA) is on the verge of crossing below the 200 EMA, forming what is commonly known as a “death cross.” This pattern is generally interpreted as a bearish signal, reflecting a shift in momentum in favour of sellers.

The market has already felt the sting of an earlier crossover. Just days ago, the 20 EMA dropped beneath the 200 EMA, sparking a 15% decline in price from $0.033 to $0.028. Should the 50 EMA follow suit, historical precedent suggests another leg down could unfold, potentially accelerating the ongoing correction.

EMA crossovers are widely used to assess medium- to long-term trend reversals. A shorter-term EMA sliding beneath a longer-term one typically indicates sustained downside pressure and reduced confidence from bulls. For now, the market structure appears to be tilting further towards the bears.

Key Support Levels Under Pressure

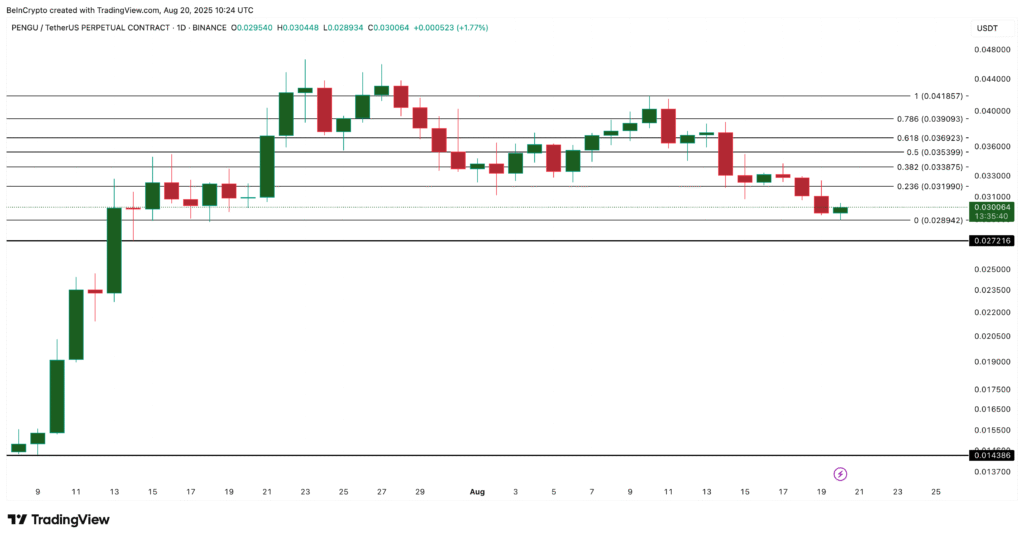

With the token struggling to hold above critical levels, the near-term risk has intensified. PENGU is currently attempting to defend the $0.028–$0.030 range, a support zone highlighted by Fibonacci retracement levels on the daily chart. A confirmed breakdown beneath $0.028 would expose the next immediate support near $0.027.

Should that floor collapse, the next significant safety net lies at $0.014. Such a move would represent a staggering 53% drop from current prices, effectively undoing the token’s three-month rally and sending it back to pre-pump valuations.

Given the combination of surging exchange reserves, reduced whale holdings, and looming technical crossovers, the likelihood of such a correction cannot be dismissed. While bulls are still defending near-term support, the downside risks appear considerable.

Can Bulls Invalidate the Bearish Outlook?

Despite the current gloom, not all hope is lost. If the PENGU price manages to reclaim $0.033, it could invalidate the short-term bearish case. Such a move would require buyers to return with conviction, forcing the death cross to fail and re-establishing bullish control over the trend.

For now, however, sentiment remains cautious. Exchange inflows typically precede sell-offs, and the reduction in exposure from high-conviction wallets only reinforces the risk narrative. Unless accumulation returns meaningfully, any relief rally may prove short-lived.

PENGU’s sharp reversal highlights the fragility of momentum-driven rallies in the cryptocurrency market. With selling pressure intensifying, the token faces the real possibility of a deep retracement. Traders will be closely monitoring the $0.028 support zone in the coming sessions, as a break could open the door to levels not seen in months.

While the long-term narrative for PENGU may not be fully derailed, the immediate picture tilts heavily towards caution. Until the charts and on-chain data show fresh signs of accumulation, the bears appear firmly in control.