Bitcoin’s latest downturn has sharpened concerns among traders, with analysts pointing to heavy selling pressure in US markets and growing uncertainty over institutional demand. Despite inflows into spot exchange-traded funds (ETFs) earlier in August, the price has slipped to near two-week lows, reigniting fears of deeper corrections.

A Slide Towards Critical Support

At Tuesday’s Wall Street open, Bitcoin (BTC) dropped below $114,000, marking its weakest level in nearly two weeks. According to data from TradingView, the decline aligned with broader market weakness as the Nasdaq Composite Index fell 1.2%.

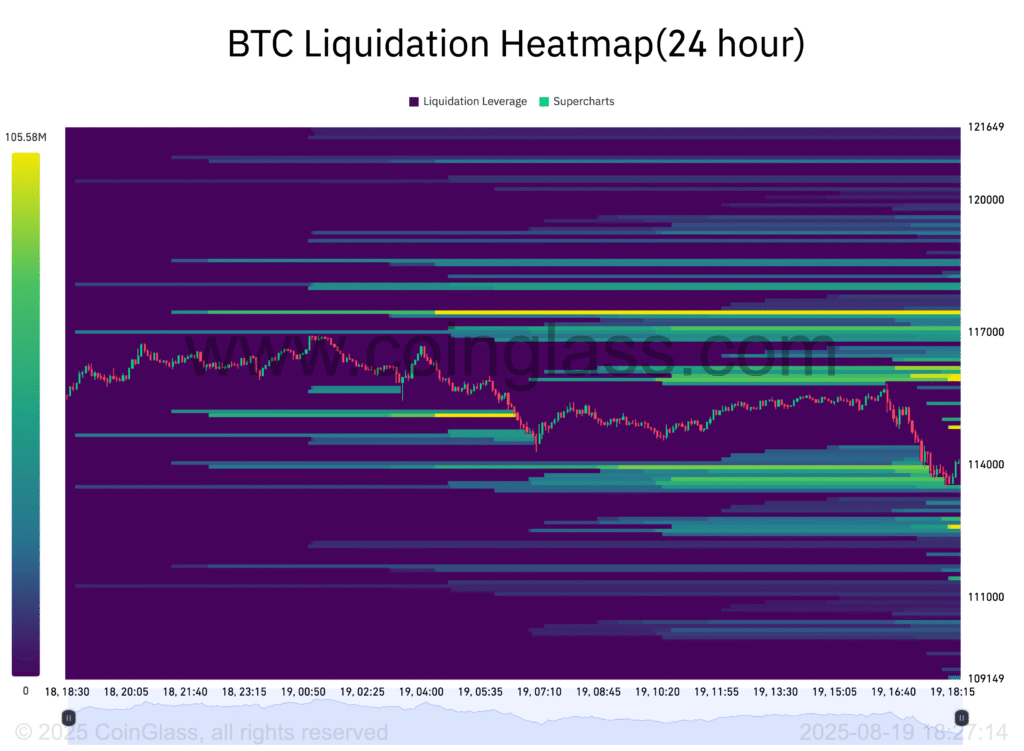

The sharp decline triggered another wave of liquidations. Long BTC positions suffered an additional $116 million in losses in just one hour, continuing the squeeze that has plagued bullish traders since the weekend. Market analytics platform CoinGlass highlighted concentrated bids forming around the $112,000 mark, signalling a key short-term battleground between buyers and sellers.

Analysts Warn of “Palpable” Downward Pressure

Keith Alan, cofounder of Material Indicators, cautioned that the $107,000 to $110,000 range has become the zone to watch. In a post on X, he described the move lower as “not a sign of strength,” underscoring the intensity of selling pressure.

Alan pointed to the 100-day simple moving average (SMA) at $110,950 as a possible support level, while stressing the need for bulls to reclaim the 50-day SMA near $115,875 to restore confidence.

One factor attracting particular attention is the presence of a $25 million bid wall at $105,000. Material Indicators suggested this “plunge protection” liquidity band might not actually be intended to fill orders but rather to nudge market sentiment upward. If the effort fails, Alan warned that such bids could be withdrawn, leaving Bitcoin vulnerable to a swift drop through that threshold.

Institutional Flows Show Divergence

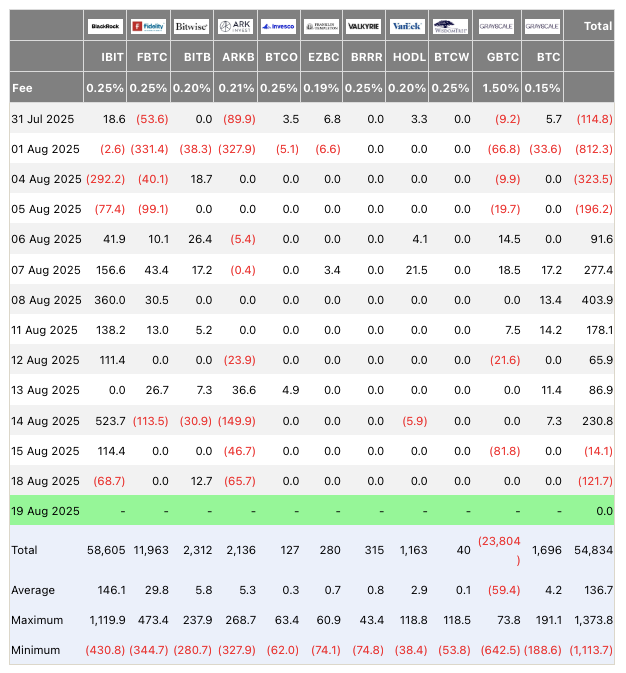

Onchain analytics firm Glassnode highlighted a growing disconnect between institutional investment trends and the weakening onchain picture. While ETFs initially attracted strong inflows earlier this month, network activity, volume, and other metrics have continued to soften.

“Profit-taking is on the rise,” Glassnode noted, adding that the next phase for Bitcoin depends heavily on whether institutional demand can sustain momentum. A contraction, it warned, could either stabilise into a new base for upward momentum or extend into a more protracted consolidation.

The divergence was underscored by ETF data from Farside Investors, which reported $121 million in net outflows on Monday. BlackRock’s flagship iShares Bitcoin Trust (IBIT) registered its first outflows since 5 August, breaking its streak as one of the most reliable demand anchors in recent weeks.

What Lies Ahead for Bitcoin

For now, traders are keeping close watch on whether Bitcoin can defend the $110,000 level. Sustained closes below this line may embolden bears, potentially dragging BTC closer to the heavily bid $105,000 zone. Conversely, a recovery above $115,000 could restore some technical strength, especially if supported by renewed ETF inflows.

The current environment is marked by heightened sensitivity to US market moves, particularly as risk assets continue to wobble under macroeconomic uncertainty. While some institutional investors remain active, the fading strength of retail participation and onchain signals suggests that Bitcoin’s recent rally is under strain.

As Keith Alan concluded, the downward pressure remains “palpable”, and without a decisive return of buyer conviction, the market could be preparing for a deeper test of support.