Winklevoss twins push for Wall Street debut with ticker GEMI

Gemini, the cryptocurrency exchange and custodian founded by Cameron and Tyler Winklevoss, has officially filed with the US Securities and Exchange Commission (SEC) to list on the Nasdaq Global Select Market under the ticker symbol GEMI. The filing comes after a wave of strong crypto-related IPOs, though Gemini’s own financials highlight widening losses that may temper investor enthusiasm.

Gemini’s Journey from Startup to Nasdaq Aspirant

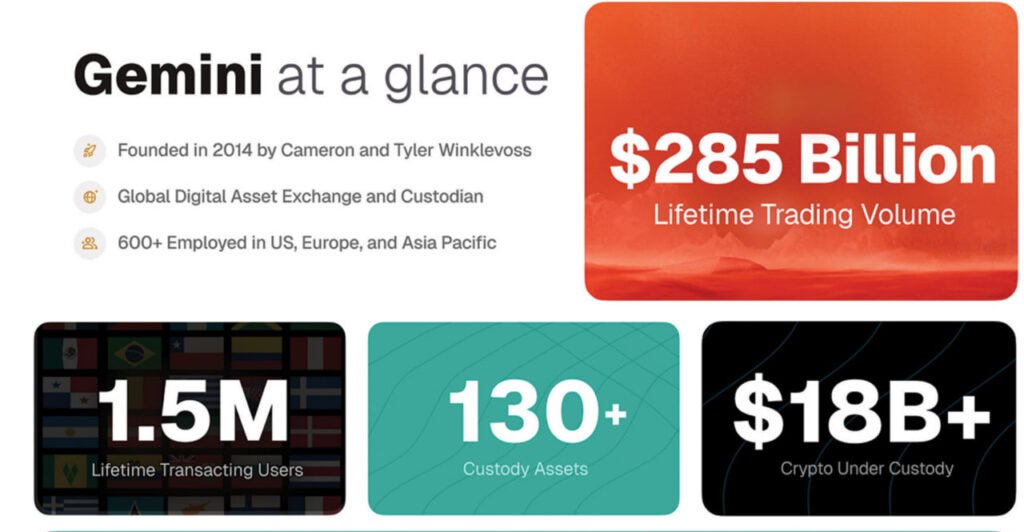

Founded in 2014, Gemini has built its reputation as a regulated digital asset platform offering exchange services, secure custody, and a suite of blockchain-based products. Among its most notable products are the Gemini Dollar (GUSD), a US dollar-backed stablecoin, and a crypto-rewards credit card.

The IPO will mark the first time Gemini’s shares are publicly traded. The company has opted for a dual-class share structure: Class A stock carrying one vote per share, and Class B stock carrying ten votes per share. The Winklevoss twins will retain all Class B shares, giving them majority voting power and qualifying Gemini as a “controlled company” under Nasdaq rules.

Investment banks including Goldman Sachs, Morgan Stanley, and Citigroup are leading the offering, though pricing details remain undisclosed.

Financial Strains: Losses Mount as Revenues Shrink

Despite the bullish framing of its market entry, Gemini’s S-1 filing reveals a challenging financial backdrop.

- 2024 Performance: Revenue reached $142.2 million, but the company posted a net loss of $158.5 million.

- 2025 First Half: The financial strain intensified, with losses ballooning to $282.5 million on revenues of just $67.9 million.

The company’s cash reserves have also thinned. From $341.5 million at the end of 2024, Gemini’s cash and equivalents dropped to $161.9 million by mid-2025, reflecting both operational costs and sustained deficits.

Such figures highlight the uphill battle Gemini faces in balancing growth ambitions with financial sustainability.

A Political and Regulatory Tailwind

Gemini’s Nasdaq filing coincides with a renewed wave of optimism in the crypto industry, fuelled by shifting US politics. With Donald Trump’s re-election and his administration signalling a pro-crypto stance, digital asset companies are enjoying more favourable regulatory conditions and stronger capital market interest.

The Winklevoss twins themselves have been vocal backers of Trump and crypto-focused political action committees, a factor aligning Gemini with the current policy direction in Washington.

Riding the Momentum of Peer Success

The timing of Gemini’s IPO bid follows high-profile successes from other crypto firms:

- Circle Internet Group, issuer of the USDC stablecoin, raised $1.1 billion in June through a blockbuster IPO that closed its debut trading day at 167% above issue price.

- Bullish Exchange, another digital asset platform, also staged a stellar debut, with shares closing up 83.8% on day one at $68. The stock opened at $90, briefly surged to $118, a staggering 215% above its $37 IPO price, before retracing.

These performances suggest that despite volatile markets, investor appetite for crypto companies remains robust. Gemini is hoping to ride this wave of optimism, though its steep losses may make investor scrutiny more intense compared to its peers.

Outlook: Risk and Reward on Wall Street

Gemini’s bid to go public underscores both the opportunities and challenges facing crypto-native companies. While regulatory clarity and strong precedents from Circle and Bullish signal investor demand, Gemini’s mounting losses and declining liquidity present clear red flags.

For now, the Winklevoss twins are betting that their brand recognition, regulatory positioning, and political timing will outweigh financial headwinds. Whether Wall Street agrees will become clear once GEMI makes its long-awaited Nasdaq debut.