Decentralised lending giant Aave has notched another milestone in its DeFi dominance, with net deposits climbing 55% in July to surpass the $60 billion mark in early August, according to data from Token Terminal. The figure represents total assets deposited to the protocol minus outstanding loans, setting a new all-time high for the platform.

The surge was propelled by Ethereum’s strong price rally and heightened activity on Coinbase’s Base network, with increased adoption of liquid staking tokens (LSTs) such as cbETH, wstETH, and wETH.

Ethereum and Base Lead the Charge

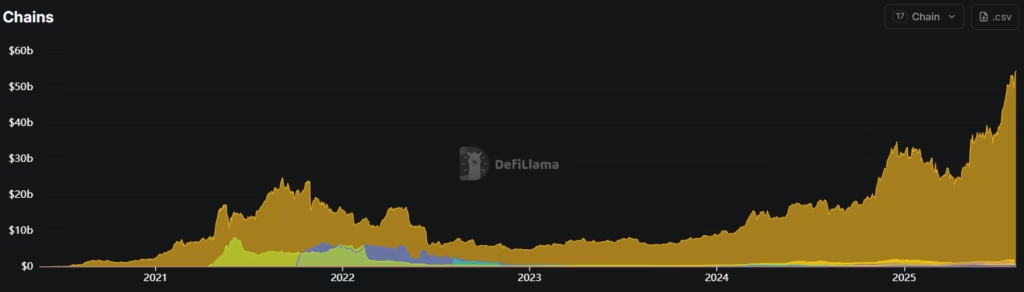

Data from DefiLlama shows Aave’s total value locked (TVL) rose over 40% in July, with the lion’s share on Ethereum, which saw a 47% increase. Activity on Base also impressed, with TVL growing more than 40% to cross the $1 billion threshold, significantly outpacing the roughly 10% growth seen on other chains, including Avalanche and Polygon.

The integration of LSTs into Aave’s offerings has been a key growth driver, enabling users to deploy staked assets as collateral for borrowing. This trend has accelerated as more DeFi participants look to maximise yield opportunities without sacrificing staking rewards.

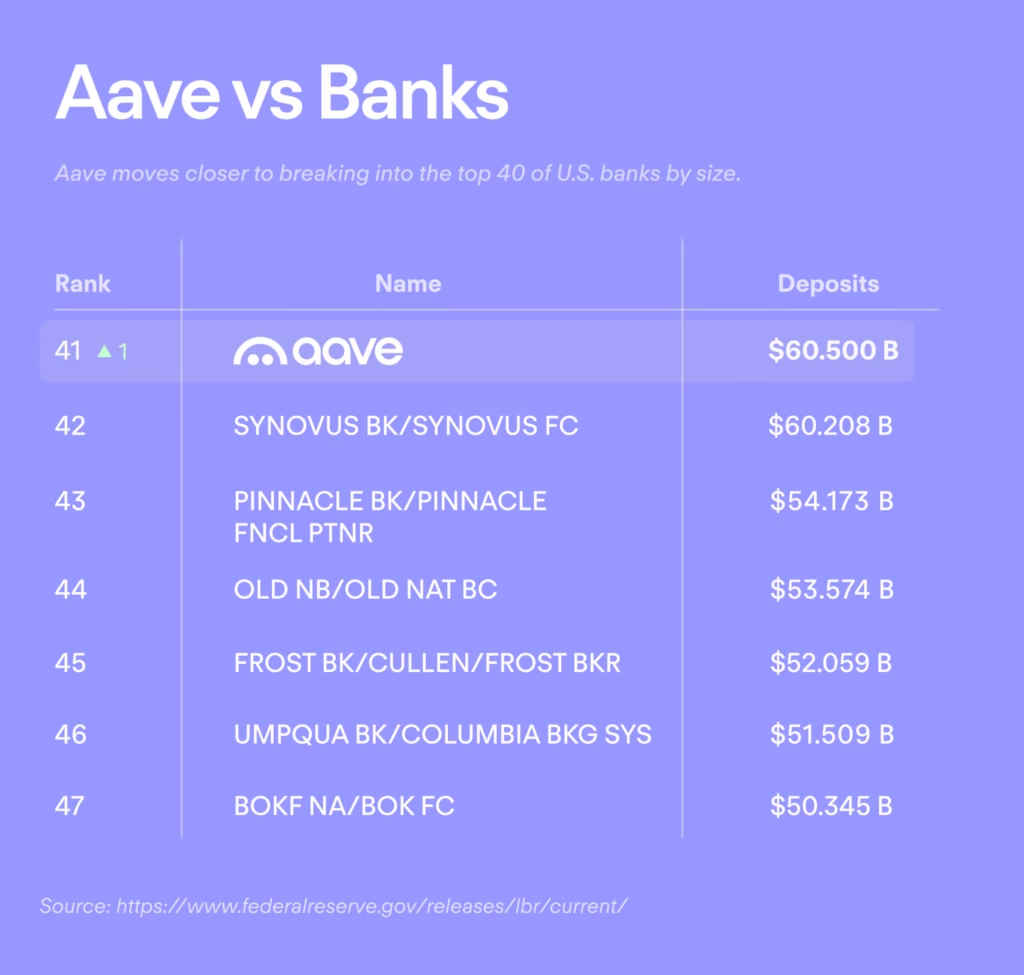

The protocol’s expanding footprint has now brought it close to the scale of the top 40 US banks in terms of deposits, according to DeFi marketer 0xKolten, who works with Aave developer Avara.

ETH Price Gains Lift DeFi

Aave’s July performance coincided with a nearly 50% surge in ETH’s price, climbing from around $2,400 to $3,700. The rally was buoyed by record inflows into spot Ethereum ETFs and an influx of public companies adding ETH to their corporate treasuries.

Ethereum’s bullish momentum spurred broader DeFi activity, benefiting protocols like Aave that are deeply embedded in the Ethereum ecosystem. While ETH’s rise was undoubtedly a major factor, Aave’s growth outpaced several peers, suggesting platform-specific drivers also played a role.

Competitors Show Mixed Results

Other lending protocols on Ethereum saw varied performance over the month. SparkLend’s TVL jumped 38% to $7.28 billion by late July before sliding back to $6.72 billion, trimming gains to 27% by early August.

Compound Finance posted a modest 11% rise in TVL, from $3.59 billion to about $4 billion. Meanwhile, Morpho mirrored Aave’s growth trajectory more closely, recording a 39% increase from $6.57 billion to $9.14 billion.

These figures point to shifting liquidity flows across Ethereum-based lending platforms, with Aave emerging as the clear leader in both growth rate and absolute scale.

Revenue Spikes, Token Price Rises, But Scams Increase

July marked Aave’s second-highest revenue month since January, generating over $3.7 million, according to DefiLlama. The protocol’s native token, AAVE, responded positively, climbing 5% in the past 24 hours to trade at $286.

However, the surge in usage and deposits has also attracted malicious actors. Phishing attacks have been on the rise, with one Aave Ethereum USDT holder reportedly losing more than $3 million in a scam this week.

Aave’s Outlook

With deposits at record highs, revenue surging, and cross-chain activity expanding, Aave is positioned to remain a dominant force in decentralised finance. Its strategic integration of liquid staking assets and growing presence on networks beyond Ethereum could help sustain momentum, particularly if ETH prices remain elevated.

Yet, the rise in phishing incidents underscores the ongoing security risks in DeFi, even for the most established protocols. Users are urged to exercise caution, verify transaction sources, and avoid interacting with suspicious links or wallet prompts.

If market conditions hold and Aave continues innovating, the protocol may soon close the gap with traditional financial institutions in terms of deposit scale, a sign of how far DeFi has come in challenging the incumbents.