XRP’s recent price surge may be under threat as on-chain data reveals that major investors have been quietly offloading their holdings. In the past month alone, whales have reportedly sold off tokens worth nearly $1.91 billion, raising concerns among analysts who warn of a possible 30 per cent drop if key support levels fail to hold.

Whales Sell 640 Million XRP Tokens

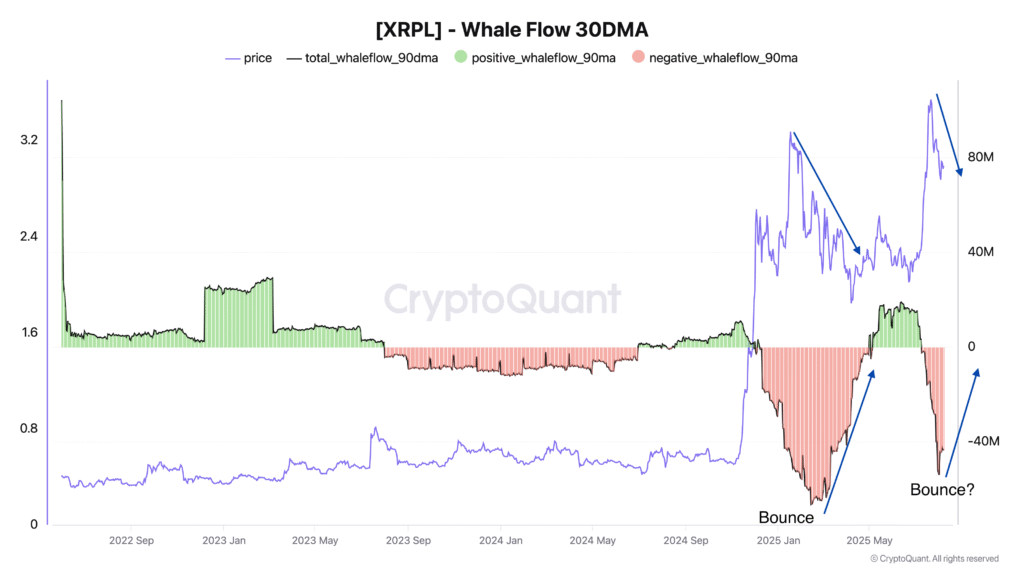

According to data from CryptoQuant, XRP whales have shed approximately 640 million tokens since 9 July. These sales took place while the price of XRP ranged between $2.28 and $3.54, suggesting that whales were offloading during rallies. At current prices, the total value of these outflows exceeds $1.91 billion.

This marks the second instance within a year where large holders have distributed tokens amid price surges. A similar pattern was observed between November and January, when XRP rose from $1.65 to $3.27 while whales simultaneously reduced their exposure, indicating that retail investors may have absorbed much of the sell pressure.

Accumulation Seen Only During Market Weakness

Although not all outflows necessarily signal sales – some could be internal transfers or reshuffling – analysts have identified an inverse trend between whale activity and price movements. For instance, when whales began accumulating again between January and April, XRP saw a correction from $3.27 to $1.87.

More recently, modest recovery signs have emerged in whale flows. However, Enigma Trader, a CryptoQuant-affiliated analyst, cautioned that XRP remains structurally weak unless large holders begin acquiring at least 5 million XRP tokens per day.

“At present, there is no sign of consistent accumulation from large holders, a key component for a constructive trend reversal,” the analyst noted.

Technical Indicators Suggest Momentum Weakening

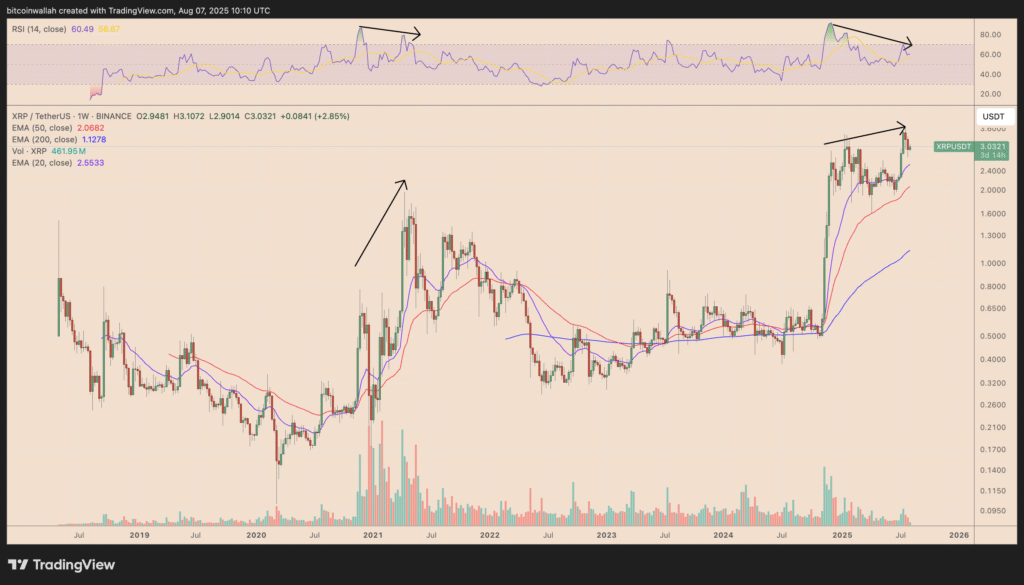

Beyond whale behaviour, technical indicators are also painting a cautious picture. While XRP has been printing higher highs on the price chart in recent weeks, its relative strength index (RSI) has shown a pattern of lower highs since January. This divergence is often seen as a sign of fading bullish momentum.

The situation resembles the lead-up to the market top in April 2021, when prices continued rising despite weakening underlying strength. In addition, volume has declined during the recent rally, further indicating exhaustion in upward momentum.

XRP Must Hold $2.65 Support to Avoid Deeper Decline

Analysts stress the importance of the $2.65 support level for XRP. A drop below this level could trigger a decline toward the 20-week exponential moving average (EMA) near $2.55. If this level also fails, the next potential support lies at the 50-week EMA around $2.06.

Failing to hold these levels may result in a sharp 30 per cent correction, particularly if selling pressure intensifies and whale inflows remain weak.

Outlook Hinges on Whale Activity and Support Levels

XRP’s near-term outlook depends heavily on whether large holders return with meaningful accumulation. Without that, and with technical signals flashing warnings, the current rally may be on shaky ground. Traders and investors will be closely watching both whale wallet activity and key price supports in the days ahead to gauge the strength of XRP’s trend.