In a crypto market dominated by hype, memecoins, and leveraged gambles, one trader quietly achieved something remarkable: turning just $6,800 into $1.5 million in two weeks. No price predictions, no risky bets, just a precise, disciplined execution of a sophisticated high-frequency trading (HFT) strategy.

The $1.5 Million Breakthrough: Not Your Usual Crypto Story

Unlike typical success stories where traders ride bullish trends or altcoin pumps, this one was all about infrastructure, automation, and market structure.

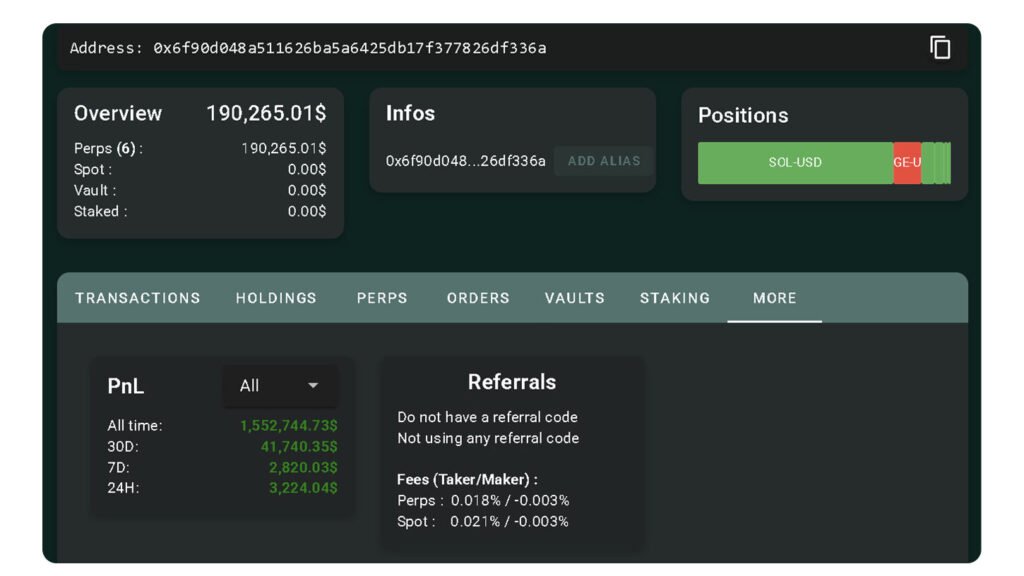

The trader identified only by wallet address 0x6f90…336a operated on Hyperliquid, a decentralised perpetuals exchange that rose to prominence in 2025. Starting in early 2024 with just under $200,000, the wallet had processed over $20.6 billion in trading volume by mid-2025, with most of the growth taking off over a concentrated two-week period.

This was no lucky streak. The trader ran a delta-neutral, high-frequency strategy focused on maker rebates, a trading model that earns small amounts per trade but scales massively with volume. While most traders try to guess where prices will go, this trader focused on being the market, not beating it.

Strategy Breakdown: How It Actually Worked

The key to the strategy’s success was combining multiple advanced elements into one tight system. Let’s break them down.

1. One-Sided Market-Making

In traditional market-making, bots post both buy (bid) and sell (ask) orders to capture spread. But this trader used one-sided quoting, meaning they posted either a bid or an ask.

This approach reduced inventory risk, made the trading bot faster and more efficient, and allowed better control over exposure. However, it also introduced directional risk during volatility spikes. To manage this, the trader closely monitored exposure, never letting net delta exceed $100,000, even when billions were in play.

2. Maker Rebates: Tiny Profits, Massive Scale

On Hyperliquid, makers (those who add liquidity) earn rebates of around 0.0030% per trade fill, that’s roughly $0.03 for every $1,000 traded. It doesn’t sound like much until you realise the trader pushed $1.4 billion in volume in 14 days.

By compounding those profits (redeploying them into more trades), the gains grew exponentially, taking a $6.8K starting balance to $1.5 million.

3. Ultra-Fast Execution with Colocation

This strategy wasn’t possible with regular trading tools. It required colocated bots (servers physically close to the exchange infrastructure) to maintain millisecond-level latency.

These bots executed hundreds of trading cycles per day, constantly adjusting to market conditions and flipping between sides with near-instant decision-making. Without this speed, the trader would’ve been picked off by faster participants.

4. Delta-Neutral, Futures-Only Focus

The strategy avoided risky mismatches between spot and futures markets by trading only perpetual futures contracts. This removed reliance on staking, farming, or tokenomics and ensured the trader profited purely from market volatility and structural inefficiencies, not price movement.

What Made This Strategy So Powerful and Rare

This wasn’t a retail-friendly, easy-to-copy setup. It demanded a unique blend of skills, tools, and access.

- High capital turnover: Billions of dollars had to be cycled through to extract significant profit from tiny rebates.

- Infrastructure mastery: Colocation, automation, and latency optimisation were non-negotiable.

- Technical coding and risk control: The strategy required precise bot logic, exposure limits, and fail-safes to avoid liquidation or drawdowns.

Importantly, the trader kept drawdowns capped at just 6.48%, an impressive level of risk control considering the sheer volume involved.

Why It Matters: A Glimpse into the Future of Trading

This story isn’t just about a trader who struck gold. It reflects a deeper shift happening in crypto:

Liquidity provision is becoming an elite profession.

Instead of speculative punting, the edge is now with traders who can build systems, bots that operate non-stop, exploit microstructure inefficiencies, and scale intelligently.

Hyperliquid’s open access and on-chain data tools (like Hypurrscan.io) helped make such strategies possible for coders and quants, not just big institutions.

This style of trading delta-neutral, rebate-driven, and automated is still in its early phase. But it’s growing fast. And as crypto infrastructure evolves, we can expect more such traders to emerge, quietly powering the system while earning handsomely behind the scenes.

Don’t Try This Without Preparation

While it’s tempting to chase similar results, this strategy is not easily replicable. Retail traders can’t simply plug into this system, it requires advanced infrastructure, coding, capital, and execution speed.

There are also real risks:

- Infrastructure failure (bot crash, exchange downtime)

- Adverse selection (getting picked off during volatility)

- Regulatory clampdowns on high-frequency activity or DEX features

- Platform changes (smart contract upgrades or fee model shifts)

But for those who can manage these risks, the payoff can be extraordinary as this $1.5M story proves.