The UK-based Smarter Web Company has raised £15.8 million ($21 million) through a Bitcoin-denominated convertible bond offering, marking a rare and innovative move in British capital markets. The publicly listed firm, which already holds Bitcoin on its corporate balance sheet, launched the bond under the name “Smarter Convert” in collaboration with French asset management firm Tobam.

A Landmark Bond Offering in the UK

Announced on the London Stock Exchange, the bond issue has been fully subscribed, with Tobam investing through three of its managed funds. Tobam, which had more than $2 billion in assets under management by the end of 2024, is no stranger to cryptocurrency. In 2017, it introduced the first Bitcoin mutual fund for institutional investors.

Smarter Web Company’s CEO Andrew Webley described the bond structure as a first for the UK capital markets. “We believe this new structure will open up a new segment of capital for the company and complement our existing funding strategies as we pursue our ambition to become one of the largest publicly listed companies in the UK,” Webley said.

Premium-Priced Convertible Bond

The 12-month bond is denominated in Bitcoin and is convertible into Smarter Web Company shares at a 5 percent premium to the firm’s share price of $2.60 on the day before the announcement. This sets the conversion price at approximately $2.73.

If all bondholders choose to convert, over 7.7 million new shares will be issued. However, the company has built in an option for forced conversion. If the share price rises 50 percent above the conversion price and maintains that level for 10 consecutive trading days, the company may initiate a diversion, compelling bondholders to convert.

Should the bondholders choose not to convert, the company will repay 98 percent of the bond’s principal in Bitcoin at maturity, adjusted to the market rate at that time.

A Crypto-Aligned Fundraising Model

The unique Bitcoin-denominated structure allows the company to raise capital without immediate dilution of existing shares. Since the bond is priced in Bitcoin, the actual repayment amount is subject to fluctuation based on BTC market value.

According to the official statement, “The Smarter Web Company achieves a capital raise at a premium based on the Conversion Share Price being higher than the Reference Share Price, resulting in approximately 5 percent less dilution compared to a traditional equity raise, at the issue date of the bond.”

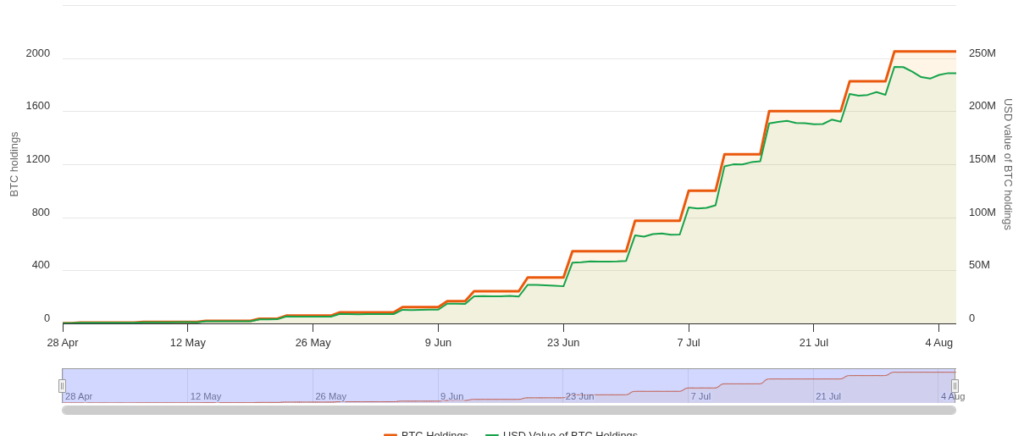

Expanding Bitcoin Holdings

The bond issuance aligns with Smarter Web Company’s ongoing strategy to increase its Bitcoin reserves. According to BitcoinTreasuries.NET, the firm currently holds 2,050 BTC, valued at around $234 million. In July alone, the company added 225 BTC to its holdings.

With the introduction of Smarter Convert, the company has not only strengthened its crypto-aligned fundraising approach but also positioned itself as a pioneer in integrating Bitcoin into traditional capital-raising mechanisms.