After 15 straight weeks of gains, the crypto investment market witnessed a reversal last week, triggered by hawkish signals from the US Federal Reserve. Meanwhile, regulatory developments in the United States are gathering pace as the Commodity Futures Trading Commission (CFTC) teams up with the Securities and Exchange Commission (SEC) for a joint push in line with recent White House recommendations. In a separate event, a symbol of the Bitcoin community, the statue of Satoshi Nakamoto, was recovered after being vandalised in Switzerland.

Here’s a look at the top developments in the crypto space today.

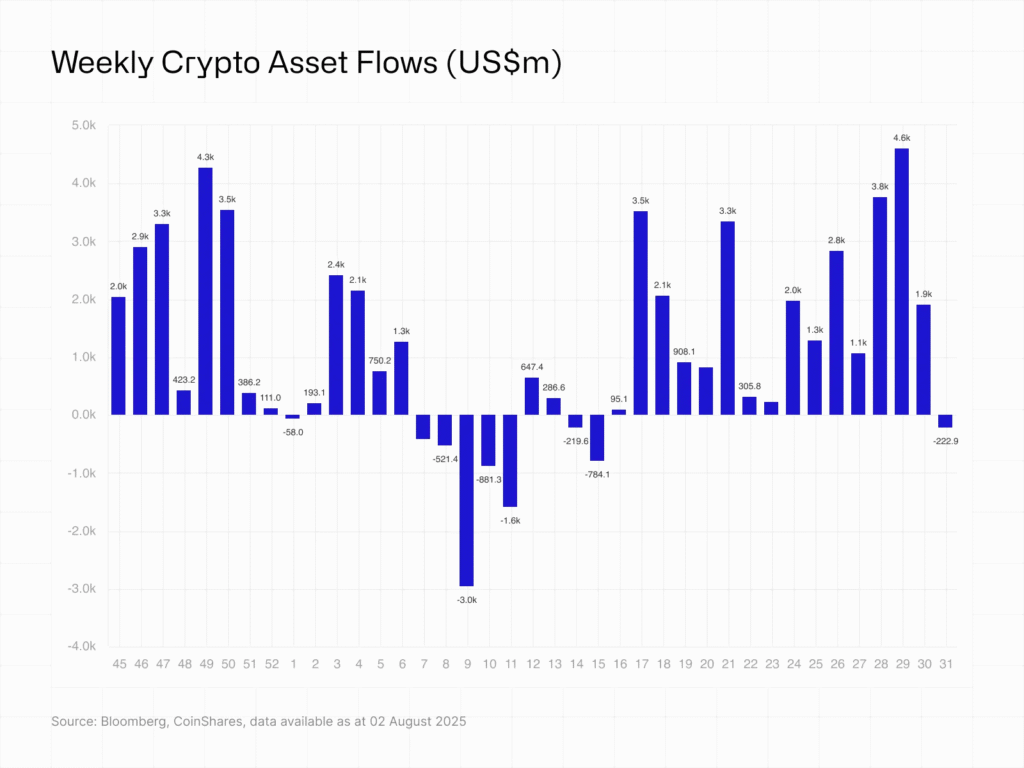

Crypto funds see $223 million in outflows

Cryptocurrency investment products ended last week in negative territory, marking the first week of outflows after 15 consecutive weeks of inflows. According to digital asset management firm CoinShares, crypto funds saw a total outflow of $223 million, despite beginning the week on a strong note with $883 million in inflows.

The reversal is attributed to renewed investor caution following the Federal Open Market Committee (FOMC) meeting, which dampened hopes for an imminent interest rate cut. The committee’s hawkish tone and a series of better-than-expected US economic indicators appear to have prompted profit-taking by investors.

CoinShares noted that while the sell-off broke the streak of inflows, it may be a sign of short-term caution rather than a long-term trend. Over the past 30 days, the market has seen net inflows of $12.2 billion, accounting for half of the year’s total so far.

Fed remarks shake investor confidence

The recent FOMC meeting significantly altered market expectations regarding interest rate cuts. Remarks by Federal Reserve Chair Jerome Powell caused the perceived probability of a September rate cut to drop to 40 percent, down from 63 percent prior to the meeting.

Analysts believe this shift in expectations is likely behind the sudden withdrawal of funds from crypto investment products. The market’s earlier optimism gave way to concerns about tighter monetary policy persisting longer than previously anticipated.

CFTC and SEC join forces in crypto oversight

In a notable regulatory move, the US Commodity Futures Trading Commission has initiated a “crypto sprint” aimed at implementing key recommendations from the White House’s recent report on digital assets. The project, dubbed “Project Crypto”, will see the CFTC work closely with the SEC in shaping crypto policy and oversight.

CFTC Acting Chair Caroline Pham announced the new initiative on Friday, emphasising that the agency is acting swiftly to align with the President’s vision of establishing the United States as a global leader in cryptocurrency.

Pham said the CFTC will collaborate with SEC Chair Paul Atkins and Commissioner Hester Peirce to ensure coordinated regulatory action. The plan originates from the recommendations made by former President Donald Trump’s Working Group on Digital Asset Markets, which called for greater clarity and coherence in the regulatory framework for digital assets.

Satoshi Nakamoto statue recovered in Lugano

In an incident that drew widespread attention in the crypto community, the iconic statue of Bitcoin creator Satoshi Nakamoto was recovered in Lugano, Switzerland, days after it was reported stolen and vandalised.

The statue, a prominent symbol of the Bitcoin movement, was originally installed in Parco Ciani, a popular municipal park in Lugano. Over the weekend, municipal workers discovered the broken statue both submerged in Lake Lugano and scattered along the lakeshore.

Despite the damage, the art collective behind the statue, Satoshigallery, expressed resilience in an emotional statement on X (formerly Twitter): “You can steal our symbol, but you will never be able to steal our souls.”

Created by Italian artist and Bitcoin advocate Valentina Picozzi, the statue is widely seen as a tribute to the decentralised and independent ethos of the Bitcoin ecosystem. Its recovery was welcomed by Bitcoin supporters worldwide, many of whom consider the artwork a rallying point for the global push towards financial sovereignty.

Final thoughts

Today’s developments highlight both the volatility and growing maturity of the cryptocurrency landscape. While investor sentiment appears shaken by macroeconomic signals, regulatory clarity is on the horizon as US agencies begin coordinated efforts to supervise the evolving digital asset market. Meanwhile, the emotional response to the vandalism of the Satoshi statue reveals the deep symbolic meaning these projects hold for the crypto community.

From financial flows to policy shifts and cultural symbolism, the world of crypto continues to evolve rapidly.