In 2025, AI tools have become integral to navigating fast-moving crypto markets. Among them, Google Gemini, especially its Pro version, is gaining traction as a research assistant for crypto traders. While it doesn’t execute trades or generate live signals, Gemini offers real-time insights by leveraging Google Search, making it useful for analysing market narratives and verifying signals. But how far can it go in supporting actual trade planning?

Gemini as a Research and Signal Tool

Gemini stands out for its real-time access to web content. Traders are increasingly using it to monitor news catalysts, emerging narratives and sentiment trends. Its strength lies in parsing through crypto news and identifying broader patterns, rather than offering immediate trading signals.

For example, when prompted to scan news on Render Token (RNDR), Gemini highlighted four key narrative signals: its association with trending AI and Web3 tokens, a spillover effect from positive media coverage of similar projects, sustained media visibility over months and recognition as a sector leader in AI crypto.

However, Gemini’s analysis tends to favour long-term narrative consistency over short-term market movements. In one test, it failed to explain a 50 percent spike in RNDR’s trading volume, indicating no clear catalyst but referencing long-term AI alignment instead. This suggests Gemini is valuable for thematic confirmation but not for identifying short-term price triggers.

No Charts, No Execution: Gemini’s Technical Gaps

Gemini falls short when it comes to technical analysis. It can suggest hypothetical setups based on traditional indicators such as the 200-day moving average, RSI or MACD, but these are approximated. There is no integration with live charting platforms, so data like RSI levels or MACD crossovers are not verified in real time.

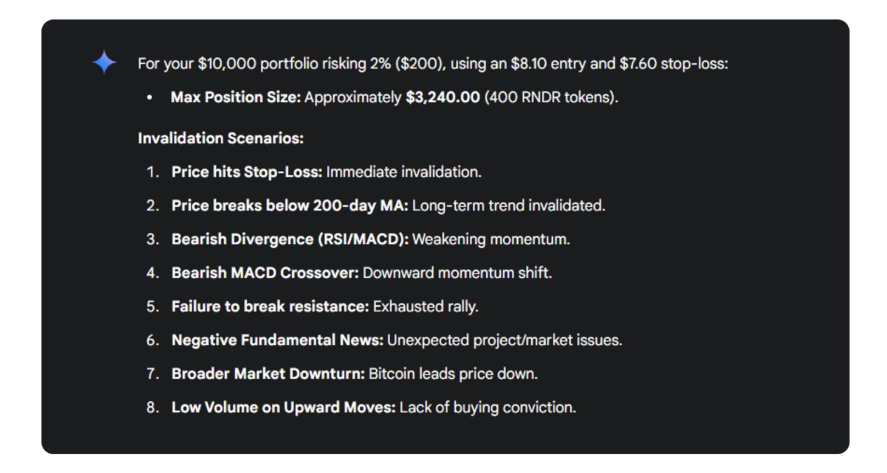

In practice, this means Gemini can outline a basic trading plan including entry, stop-loss and take-profit levels, but traders must validate everything independently using tools like TradingView. For risk management, Gemini can apply common heuristics, such as calculating position size based on portfolio risk. Yet again, the final responsibility lies with the trader to assess volatility and confirm market conditions.

When Gemini Misses the Mark

Despite its capabilities, Gemini is prone to errors and oversights. It lacks direct access to price feeds, onchain data or exchange APIs. As a result, it cannot confirm wallet movements, detect sudden market shifts or adjust to real-time volatility. Traders relying on Gemini alone may miss key signals, especially in rapidly moving markets.

Moreover, Gemini does not forecast prices or suggest buy/sell actions. It is designed to support research, not replace trading platforms or technical tools.

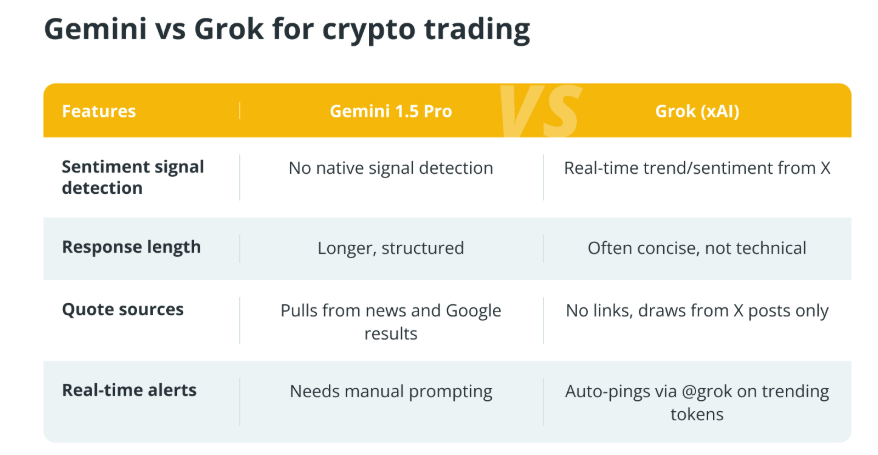

Comparing Gemini with ChatGPT and Grok

Gemini is part of a broader ecosystem of AI models that includes ChatGPT and xAI’s Grok. Each offers different strengths. Gemini excels at pulling real-time news and verifying narratives. ChatGPT is preferred for building trade logic and strategy simulations, while Grok is useful for sentiment tracking and identifying token chatter across platforms.

For instance, a trader could use Grok to detect rising buzz around a token, Gemini to check if the chatter is supported by news, and ChatGPT to build a structured trading plan. Together, these tools can provide a comprehensive research stack.

Responsible Use in Trading Workflows

Using Gemini responsibly means understanding its limitations. It is best suited for narrative validation, prompt planning and early-stage trade ideation. Traders should always cross-check its suggestions using market data tools like CoinMarketCap, TradingView or blockchain explorers.

Here are some tips for integrating Gemini into crypto trading:

- Use it to validate narratives, not execute trades.

- Always verify RSI, volume and token movement manually.

- Combine it with other tools for sentiment and technical analysis.

- Treat Gemini-generated setups as drafts to be tested in simulation first.

As AI continues to influence crypto trading, understanding how to prompt effectively, verify outputs and manage risk remains essential. Gemini may not be a complete trading assistant, but used wisely, it can help separate signal from noise in a crowded market.