Bitcoin experienced a sharp decline on Friday, dipping to a three-week low and filling a closely-watched gap in the CME futures chart. This move has triggered mixed reactions among traders, with some expecting a rebound and others warning of a deeper correction ahead.

Bitcoin Fills July CME Gap at $114,000

Bitcoin’s price dropped to $114,322 on the Bitstamp exchange, completing the “gap fill” traders had been anticipating since early July. This CME gap, a pricing difference in futures contracts that appears when markets are closed, typically over weekends was located just above the $114,000 mark. Historically, Bitcoin has a tendency to “fill” these gaps, returning to the missing price range soon after markets reopen.

This move was seen as technically significant, with some traders pointing out that such gap fills often lead to trend reversals. Investor and crypto entrepreneur Ted Pillows shared optimism following the gap closure, suggesting that an upward move could follow. However, others urged caution, highlighting key resistance levels that Bitcoin needs to reclaim to confirm a bullish outlook.

Traders Split Over BTC’s Next Move

Market sentiment remains divided following Friday’s price action. Popular trader Cipher X noted that BTC must reclaim the $116,000 level quickly to avoid further losses, warning that failure to do so could push the price down to $104,000.

Another well-followed analyst, Crypto Candy, echoed this caution, suggesting that a close below the $115,000–$116,700 zone might open the door to a retest of $111,800 before any meaningful recovery.

This cautious stance is supported by overall market behaviour, with traders now watching support levels closely. The consensus is clear: if Bitcoin cannot hold above recent lows, the road to new all-time highs could be delayed.

Global Markets React to New US Trade Tariffs

Adding to the pressure on Bitcoin was renewed geopolitical and economic tension. On Friday, the Trump administration introduced fresh trade tariffs aimed at China, reigniting fears of a broader trade conflict. This triggered mild reactions in traditional markets, with S&P 500 futures slipping just 0.4%.

Interestingly, Bitcoin showed more volatility than equities. The Kobeissi Letter, a financial commentary outlet, observed that traditional markets had already priced in the possibility of trade tensions, suggesting that investors are becoming desensitised to tariff news. Four months ago, similar announcements might have caused a 3% drop in US stocks, but that impact appears to have faded.

Despite the downward move, US equities remained relatively stable, buoyed by strong earnings from tech firms and investor optimism. The S&P 500 had recently touched all-time highs, highlighting the divergence between crypto and stock market performance in recent sessions.

Fed Policy Still a Key Headwind for Bitcoin

Another factor weighing on Bitcoin and other risk assets is the Federal Reserve’s monetary policy. Earlier this week, Fed Chair Jerome Powell maintained a hawkish tone, keeping interest rates steady and cooling expectations for rate cuts in 2025.

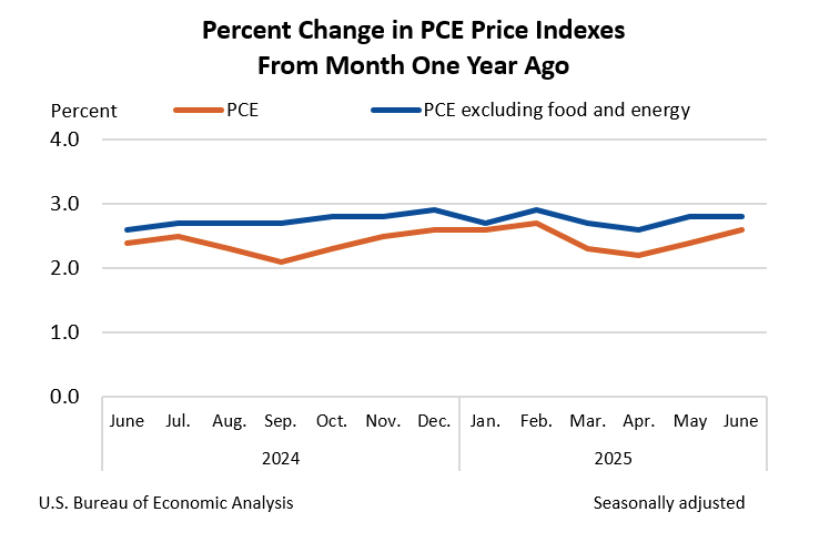

This stance, combined with the latest inflation data, the Personal Consumption Expenditures (PCE) index coming in hotter than expected, suggests that the Fed is in no rush to ease monetary conditions. For Bitcoin, which often benefits from looser financial policy, this continues to be a bearish overhang.

Until inflation data begins to cool more clearly or the Fed changes course, BTC’s upside may remain limited, especially as traders become more sensitive to macroeconomic triggers.

Bitcoin at a Crucial Crossroads

Bitcoin’s recent dip to $114,000 and the CME gap fill have drawn strong reactions from traders. While some expect this technical milestone to mark a bottom, others are warning of further downside if key resistance levels are not regained. With US trade tensions, hawkish Fed signals, and cautious market sentiment, BTC faces a complex mix of challenges in the short term.

For now, all eyes remain on whether Bitcoin can reclaim the $116,000 level and build momentum, or if a slide toward $104,000 is next in line.