Avalanche is set to significantly enhance its presence in the real-world asset (RWA) sector through a new $250 million initiative. This expansion comes via a partnership between Grove, a DeFi-focused credit protocol backed by Steakhouse Financial, and Janus Henderson Anemoy, a global asset manager with $373 billion in assets under management.

Grove and Janus Henderson Bring Credit and Treasury Funds Onchain

The collaboration will see Grove deploying two Janus Henderson Anemoy products on the Avalanche blockchain: the Janus Henderson Anemoy AAA CLO Fund (JAAA) and the Janus Henderson Anemoy Treasury Fund (JTRSY). These funds are among the first institutional-grade offerings to be launched on Avalanche and mark a significant step in the blockchain’s tokenisation efforts.

JAAA offers investors access to the collateralised loan obligation (CLO) market, an important segment of the credit and fixed-income landscape. Meanwhile, JTRSY is an actively managed fund providing onchain access to short-term US Treasury bills. Both products are issued using Centrifuge, a tokenisation platform known for enabling onchain versions of traditional financial assets such as the S&P 500 Index fund.

Avalanche’s RWA Market Share Set to Grow

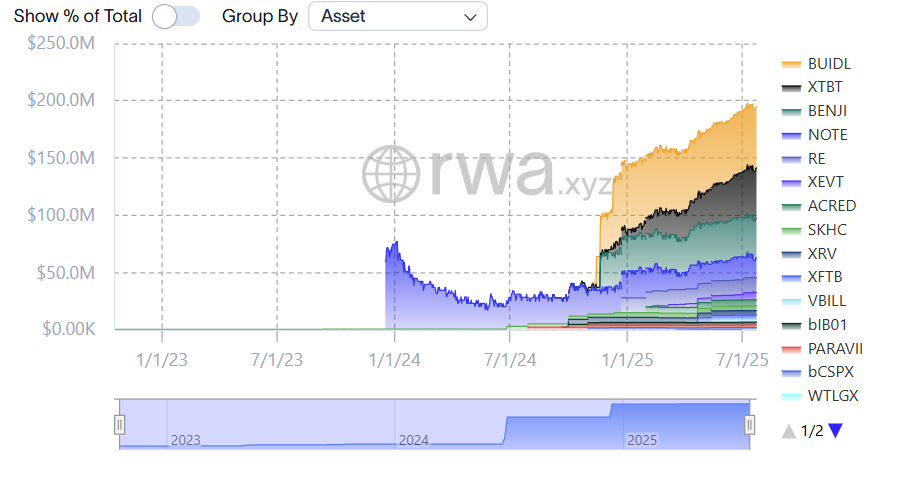

Avalanche currently hosts 29 RWAs with a total value of approximately $195 million. With the deployment of Grove’s $250 million RWA initiative, the network’s total onchain RWA value is set to more than double. This expansion reflects Avalanche’s growing role in the broader tokenisation ecosystem, which has been historically dominated by Ethereum.

Ethereum continues to lead the RWA market with roughly 59 percent of all tokenised assets. However, other blockchain platforms are quickly gaining ground as institutional interest in tokenised financial instruments grows.

Rise of RWA Adoption Across Blockchains

Besides Avalanche, blockchains such as Aptos, Solana, Stellar and Algorand are witnessing increased RWA activity. Aptos in particular has experienced rapid growth in this area, driven by issuers like BlackRock, Franklin Templeton and Berkeley Square.

Aptos’ chief business officer, Solomon Tesfaye, recently highlighted the impact of the newly passed US GENIUS Act, stating that it is likely to accelerate RWA adoption. The Act has bolstered confidence in the use of stablecoins as gateways to tokenised assets, a trend that continues to attract both private and institutional capital.

New Frontiers in Tokenisation

Private credit and US Treasury bonds remain the cornerstone of the RWA market. However, industry analysts suggest the next wave of growth will involve equities and commodities. According to a report by RedStone, tokenisation is bringing features to private credit markets that were previously lacking, such as improved liquidity, transparency and accessibility.

The firm also anticipates that the next phase of tokenised finance will go beyond debt instruments and venture into traditional equity and commodity markets, reflecting the growing maturity and appeal of blockchain-based asset infrastructures.

Grove and Steakhouse Financial Strengthen DeFi Integration

Grove’s development under Sky, formerly known as MakerDAO, and its incubation by Grove Labs highlight the deep DeFi roots of the initiative. Grove Labs operates as a subsidiary of Steakhouse Financial, a firm specialising in stablecoins and DeFi advisory. With strong ties to the Morpho ecosystem, Steakhouse’s expertise positions Grove to navigate and capitalise on the evolving tokenised asset landscape.

The Grove and Janus Henderson partnership on Avalanche signals a broader institutional shift toward leveraging blockchain technology for traditional financial markets, bringing the long-promised vision of tokenised finance closer to reality.