Uniswap, one of the most influential decentralised exchanges (DEXs) in crypto, has hit a major milestone. On July 27, 2025, its latest version, Uniswap v4 crossed $1 billion in Total Value Locked (TVL), just 177 days after launch. Alongside, its native token UNI is gaining momentum, currently trading at $10.82 and eyeing a potential move toward $15.

The rise of v4 highlights increasing user activity across Ethereum and Layer 2 chains, along with new tools that enhance liquidity management in the decentralised finance (DeFi) space.

Uniswap v4 Hits $1B TVL in Record Time

Uniswap v4’s growth has been rapid and impressive. According to on-chain data, it took only 177 days for the protocol to exceed $1 billion in TVL, significantly faster than the 45-day climb of its predecessor, v3.

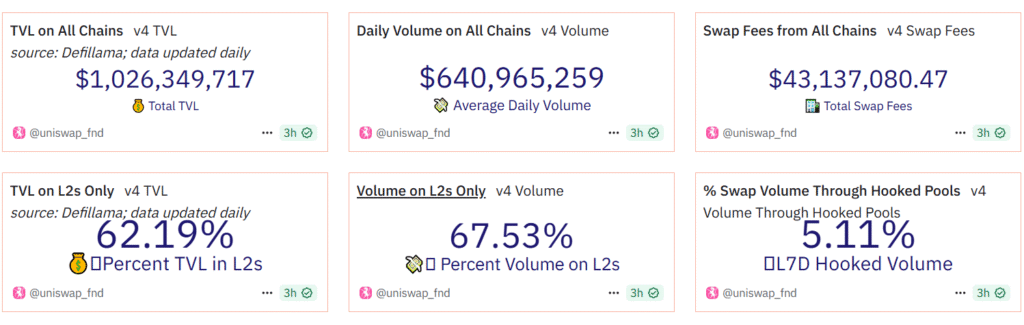

This milestone was driven by increased trading across Ethereum and Unichain, with these two blockchains accounting for the bulk of v4’s volume. The current daily trading volume stands at $640.9 million, with Layer 2 networks contributing 67.53%, a strong signal of rising demand beyond Ethereum’s mainnet.

In total, Uniswap v4 has processed over $110 billion in trading volume. More than 2,500 Hooks, modular smart contract add-ons that customise liquidity pools have been deployed by users to enhance flexibility and control over their trading strategies.

Bunni and EulerSwap Drive Volume Surge

Among the standout performers on Uniswap v4 are two DeFi projects: Bunni and EulerSwap. Both have each surpassed $1 billion in trading volume on the platform, underlining the impact of new liquidity management tools.

Bunni in particular has gained attention for its yield-generating features, such as auto-compounding and rehypothecation, which allow users to maximise returns. It also supports cross-chain liquidity transfers through Ethereum and Polkadot bridges.

EulerSwap, on the other hand, has seen significant trade activity despite modest TVL growth. This suggests that while its pools are actively used, they don’t necessarily hold large amounts of locked capital. The contrast between these two projects reflects the variety of strategies being adopted by different users and developers building on v4.

Importantly, the top pools did not dominate total volume. Instead, activity was distributed across many small to mid-sized liquidity pools, showcasing a shift toward decentralised and specialised DeFi infrastructure.

Uniswap’s Smart Features Redefine DeFi Liquidity

One of the core innovations in Uniswap v4 is the use of Hooks. These allow custom logic to be embedded directly into liquidity pools for example, setting dynamic fees, rebalancing strategies, or time-based liquidity controls.

Hooks accounted for 5.11% of overall v4 volume, indicating early but promising adoption of these advanced features. Analysts suggest that such smart liquidity tools could make capital usage more efficient while reducing risk for liquidity providers.

By allowing more precise control over how liquidity is deployed, Uniswap v4 is offering an alternative to the one-size-fits-all model of earlier protocols. This could be key to retaining users and attracting developers looking for more flexibility and innovation.

UNI Price Eyes $15 As Trading Volume Spikes

As of now, UNI, the native token of the Uniswap protocol is trading at $10.82, up 2.20% over the past 24 hours. Its market cap stands at $6.78 billion, placing it 23rd among all crypto assets. What’s notable is that trading volume for UNI surged over 25%, crossing $405 million within a single day.

The recent spike comes as investor confidence in the future of Uniswap v4 grows. If adoption continues and Uniswap maintains its momentum, analysts believe UNI could climb toward the $15 mark in the near term. However, this is likely to depend on continued user growth, sustained trading volume, and how well the protocol holds its ground against competitors.

A Defining Moment for Uniswap and DeFi

The surge in TVL, combined with high trading activity and the rollout of smart liquidity tools, signals a new era for Uniswap and the wider DeFi ecosystem. By enabling more tailored and efficient liquidity provisioning, Uniswap v4 is attracting both casual users and sophisticated builders.

With top projects like Bunni and EulerSwap pushing volume forward, and strong participation from Layer 2 chains, Uniswap v4 is well-positioned to lead the next phase of decentralised finance. As the UNI token rides this momentum, all eyes are now on whether it can break through to $15 and help mark another historic chapter in the DeFi story.