Ripple co-founder Chris Larsen has reportedly transferred 50 million XRP to exchanges, raising fresh concerns over potential sell-side pressure on the token. On-chain analysts warn that this may just be the beginning, as Larsen-linked wallets still hold billions worth of XRP, threatening to flood the market if offloading continues.

The recent movement follows XRP’s impressive rally, where it reached near all-time highs of $3.60 on July 17. However, the celebration was short-lived as wallet data triggered fears of a possible long-term price correction.

Analysts Warn: ‘Don’t Be Exit Liquidity’

According to J. A. Maartunn, contributor at on-chain analytics platform CryptoQuant, Larsen still holds around 2.58 billion XRP, roughly $8.83 billion at current prices. In a post on X (formerly Twitter), Maartunn stated that the recent 50 million XRP transfer might only be a “warm-up.”

“Chris Larsen still holds 2.58B XRP. If $200M was just the warm-up… what’s next?” he cautioned.

He urged investors to stay vigilant, warning: “Don’t get dumped on. Don’t be the exit liquidity. Protect yourself.”

Such language reflects growing fear among the XRP community that retail investors could unknowingly become liquidity providers for large insider exits, particularly at elevated price levels.

XRP Pulls Back After July Surge

XRP was one of the top-performing altcoins this month, helping to lead a sector-wide recovery as Bitcoin began consolidating. Its rally to $3.60 was viewed as a bullish signal by many. However, since Larsen’s token movement, XRP/USD has dropped by 13% and is now trading at around $3.18, according to Cointelegraph Markets Pro and TradingView.

Market participants remain divided on the intent behind the transfers. Some argue that it’s reasonable for a founder to take profits after years of holding, while others view the timing, at or near a major price peak as a red flag.

Broader Market Sees Volatility

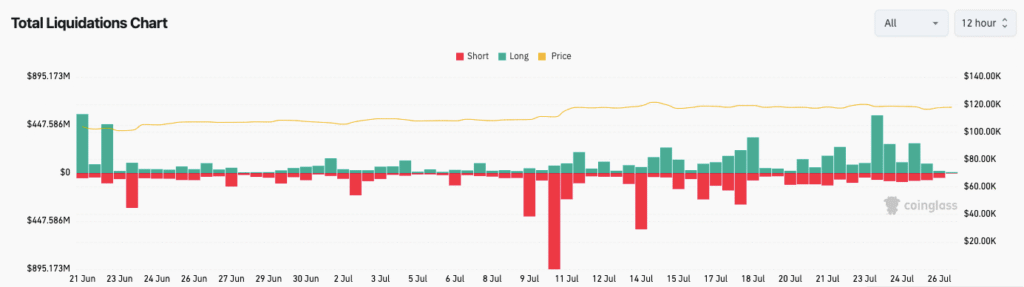

The XRP story unfolds against a backdrop of wider crypto market turbulence. Bitcoin faced its own scare recently after an 80,000 BTC transaction from a Satoshi-era wallet briefly sent prices tumbling to $114,500. This dormant wallet had not moved funds in over 14 years. The transaction, reportedly handled by Galaxy Digital, triggered over $500 million in crypto liquidations, according to CoinGlass.

Despite this, Bitcoin has shown resilience, quickly recovering from the dip. However, events like this combined with large-scale XRP sales, highlight the fragility of market sentiment in the face of whale activity.

XRP Holders Urged to Tread Cautiously

As XRP continues to correct, investor focus is now sharply fixed on any further movements from wallets tied to Ripple’s early leadership. With billions of dollars worth of XRP potentially still in play, the risk of a deeper correction cannot be ruled out.

Until there is greater transparency or reassurances regarding the future of these holdings, traders may remain cautious. While XRP’s long-term fundamentals remain a topic of debate, short-term volatility is almost guaranteed if more tokens hit the market.