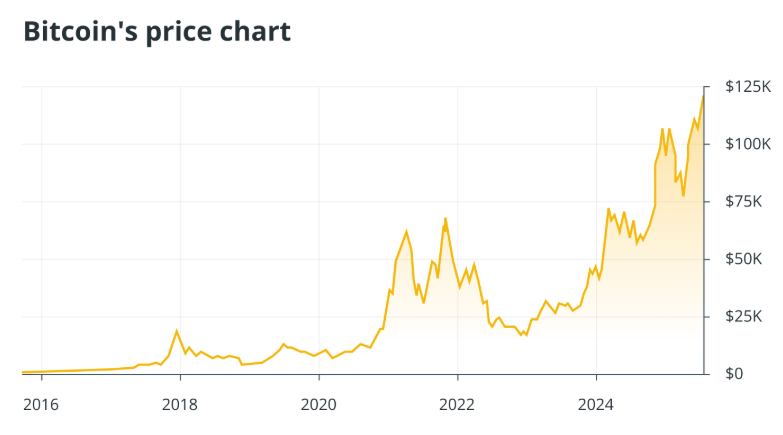

As Bitcoin continues its meteoric rise, industry leaders and financial analysts are increasingly discussing a once-unthinkable scenario: Bitcoin reaching $1 million per coin. With recent developments in 2025 pushing the cryptocurrency to new highs, the debate has become more relevant than ever.

Drivers Behind Bitcoin’s Record-Breaking Surge

Bitcoin’s recent performance has been driven by a combination of policy decisions, institutional investment and growing public interest. One of the biggest catalysts was the launch of spot Bitcoin exchange-traded funds (ETFs) in early 2024, including BlackRock’s iShares Bitcoin Trust ETF. By mid-2025, US Bitcoin ETFs recorded $14.8 billion in net inflows. BlackRock alone raised over $1.3 billion in just two days.

Further legitimising the asset, US President Donald Trump issued an executive order in March 2025 to establish a Strategic Bitcoin Reserve, capitalised with 200,000 BTC. The move was widely seen as an endorsement of Bitcoin at the highest level of government. During July’s Crypto Week in Washington, D.C., Bitcoin hit an all-time high of $123,166, energising investors worldwide.

Is $1 Million Bitcoin Realistic?

Experts suggest that $1 million is a feasible target, albeit with several caveats. Bitcoin’s fixed supply of 21 million coins makes it inherently deflationary. As demand increases, especially among institutions, scarcity continues to drive its value upwards.

Institutional interest is reshaping market dynamics. While most ETF holders are still retail investors, the potential for broader institutional participation remains significant. Meanwhile, crypto ownership globally now stands at around 6.8% of the population, or over 560 million people. A Security.org survey in 2025 revealed that 67% of current crypto holders primarily invest with profit as their key motive, amplifying fear of missing out (FOMO) as prices rise.

Who’s Betting on a $1 Million Bitcoin?

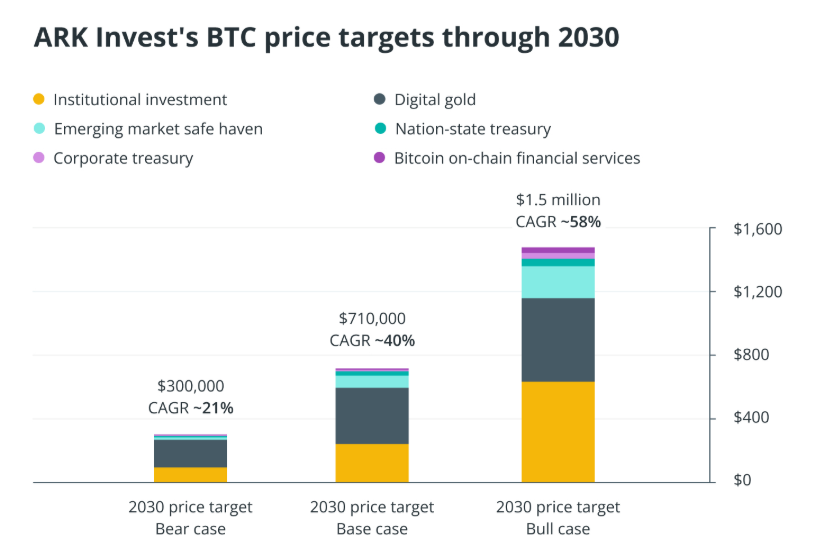

Several high-profile figures have expressed confidence in Bitcoin’s path to $1 million. Cathie Wood of ARK Invest predicts a $1.5 million price by 2030 in her firm’s most optimistic projection. Michael Saylor, founder of Strategy, believes Bitcoin will hit $1 million when Wall Street invests 10% of its reserves into it. Robert Kiyosaki, author of Rich Dad Poor Dad, also foresees the milestone, citing Bitcoin as a hedge against inflation.

What Needs to Happen to Reach $1 Million

For Bitcoin to reach such heights, its market capitalisation would need to exceed $21 trillion, surpassing the total value of gold. This would require significant institutional investment, global adoption and continued technological innovation. Currently, institutional participation in ETFs remains under 5%, a gap that must be addressed.

Analysts estimate that 20 to 40% of the world’s population, between 1.6 and 3.2 billion people, would need to adopt Bitcoin. Improved infrastructure, public education and regulatory clarity are essential. Legislative efforts like the GENIUS Act and the Clarity Act in 2025 have provided helpful frameworks but broader international coordination is still needed.

Technological developments such as the Lightning Network, which enhances transaction speeds and reduces fees, are also vital to scale Bitcoin effectively as a global store of value.

Who Wins and Who Loses in a Million-Dollar Bitcoin World

If Bitcoin reaches $1 million, early adopters stand to benefit enormously. Currently, around 900,000 wallet addresses hold at least 1 BTC. Strategy’s holdings alone would be worth over $600 billion at that valuation. Even more striking is the potential fortune of Bitcoin’s anonymous creator, Satoshi Nakamoto, believed to own 1.1 million BTC, an amount that would be valued at $1.1 trillion.

However, latecomers may not fare as well. Rising entry prices could limit potential returns and increase the risk of significant losses if prices correct. This dynamic may deepen financial inequality, resembling a pyramid-like structure where early participants gain the most as newer investors fuel growth.

Bitcoin’s reliance on market speculation, rather than intrinsic utility, means newer investors essentially fund older ones. If momentum slows or reverses, late entrants could be left with overvalued assets.

The Quantum Threat to Bitcoin’s Future

Beyond market dynamics, Bitcoin faces existential risks from quantum computing. Quantum attacks could break Bitcoin’s elliptic curve cryptography, potentially exposing roughly 4 million BTC stored in addresses with revealed public keys. A successful breach could destabilise the global economy, especially given Bitcoin’s rising prominence.

To mitigate this risk, the National Institute of Standards and Technology is working on post-quantum cryptography. Transitioning the Bitcoin network to these more secure systems could take over two months of coordinated downtime, posing logistical and technical challenges for the decentralised network.

Conclusion: Can Bitcoin Reach $1 Million and Stay There?

While the $1 million mark is no longer outside the realm of possibility, it depends on global adoption, institutional investment and technological evolution, all of which must align. Even if Bitcoin does reach this historic valuation, questions remain about its long-term sustainability and vulnerability to emerging threats like quantum computing.