BTC rallies over 10% in a week amid strong market momentum, with analysts eyeing $120K to $150K and even $1 million long-term targets.

Bitcoin Price Surges to $110,000

Bitcoin has surged past the $110,000 mark for the first time, sparking a wave of bullish predictions from market analysts and institutional investors. The leading cryptocurrency is up over 10% since 5 June, with its price peaking at $110,000 on 11 June, just shy of its all-time high of $111,000. At the time of writing, BTC is trading at approximately $109,400, according to TradingView, having bounced from a low of $108,400 on 10 June.

This rally coincides with a broader market upswing, with the global cryptocurrency market capitalisation exceeding $3.4 trillion for the first time since 29 May.

Analysts Predict Further Gains

As Bitcoin inches closer to its previous peak, analysts anticipate further gains. Popular market analyst Jelle commented on X that Bitcoin’s monthly chart “looks ready for acceleration,” hinting at a continued rally with the potential for a parabolic top.

“If #Bitcoin can turn $108K into support here, I see us entering price discovery next. Initial target: $120K, then $140-150K for a cycle top,” said Jelle.

Michael van de Poppe, founder of MN Capital, also expects BTC to break above its recent high of $110,500 and continue toward new all-time highs. He believes a move past this level could accelerate price action, just as the breakout above $106,500 led to a sharp move to $108,000.

Meanwhile, analyst Mags pointed to a bullish “cup-and-handle” pattern on the weekly chart, forecasting a move to $125,000. Bullish chart patterns like the cup-and-handle and bull flags on the daily timeframe are also targeting the $140,000 level.

Michael Saylor Doubles Down on $1 Million Bitcoin

MicroStrategy chairman Michael Saylor remains one of the most vocal proponents of Bitcoin’s long-term potential. In a recent Bloomberg interview, Saylor declared, “Winter is not coming back. We’re past that phase; if Bitcoin’s not going to zero, it’s going to $1 million.”

Saylor’s confidence stems from the cryptocurrency’s fixed supply and growing institutional demand. His firm, MicroStrategy, began accumulating BTC in 2020 and now holds 582,000 Bitcoin, valued at approximately $63.85 billion.

Institutional Bull Cases Eye Massive Upside

Several major investment firms and financial analysts have issued bullish long-term forecasts for Bitcoin. ARK Invest recently raised its bull-case target for BTC from $1.5 million to $2.4 million by 2030. Anthony Scaramucci of SkyBridge Capital predicts BTC will reach $500,000, attributing the projection to the asset’s limited supply and increasing demand, especially through exchange-traded funds (ETFs).

Bitwise’s head of European research, Andre Dragosch, expects Bitcoin to hit $200,000 in 2025 and potentially $1 million by 2029, citing institutional adoption and Bitcoin’s scarcity as key factors.

$112K Resistance a Key Short-Term Barrier

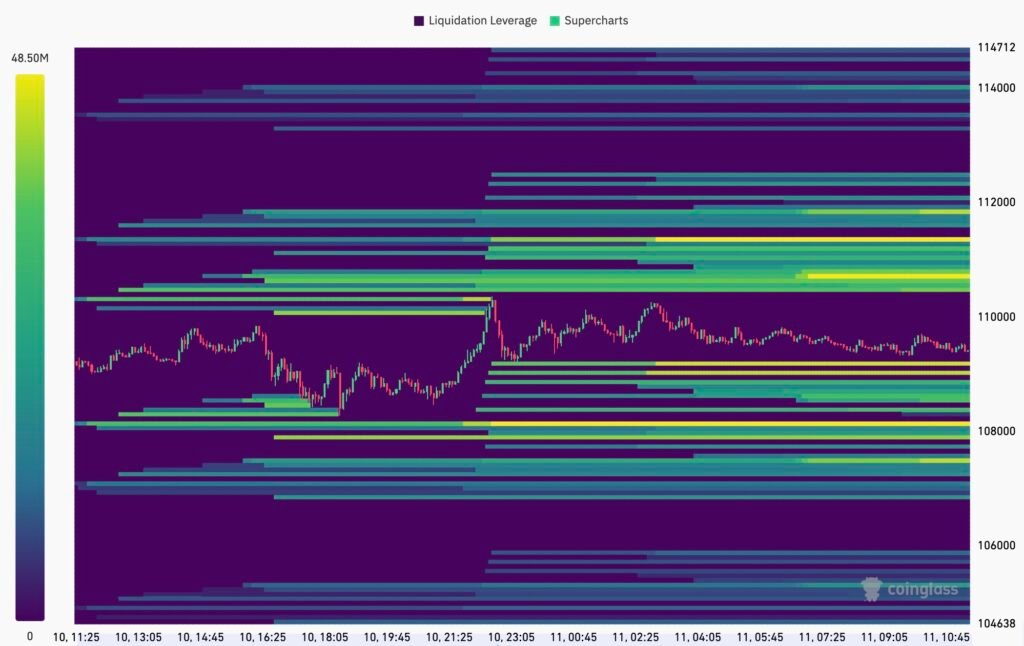

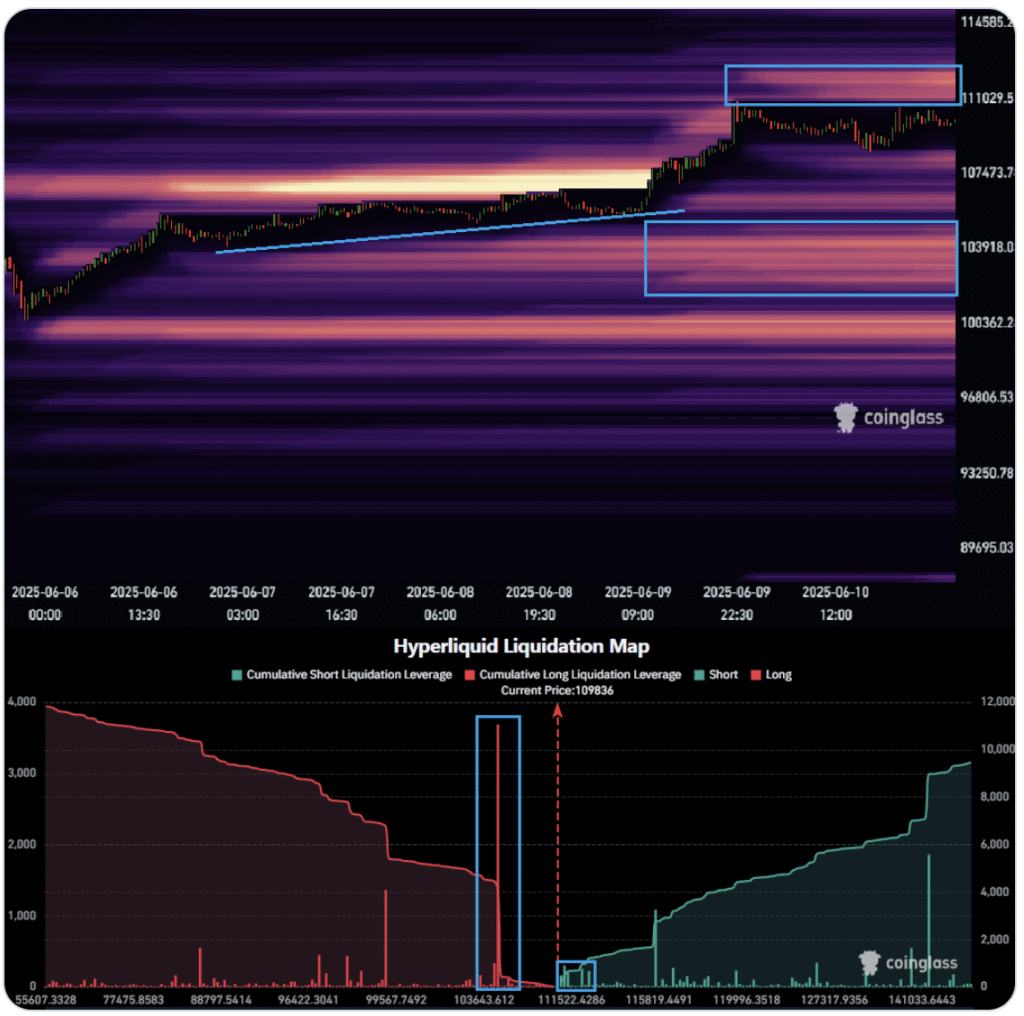

Despite the bullish outlook, Bitcoin faces immediate resistance at $112,000. A large concentration of leveraged positions is visible near this level, according to liquidation data, suggesting it could be a battleground between bulls and bears.

Analyst AlphaBTC noted, “$BTC is struggling to break through that 110K level and may need a longer consolidation before it has the energy to take out the ATH.” If BTC breaks above $112,000, it could trigger a liquidation squeeze, forcing short sellers to exit their positions and pushing the price higher toward the next key level at $114,000.

The Binance BTC/USDT liquidation heatmap supports this view, highlighting $112,000 and $114,000 as short-term liquidity zones where price volatility could intensify.

Conclusion

Bitcoin’s recent rally has reignited investor optimism, with short-term targets ranging from $120K to $150K, while long-term projections extend as high as $1 million. However, traders should remain cautious of near-term resistance levels and broader market risks. Whether Bitcoin can sustain its momentum and enter a new phase of price discovery will depend on how it navigates the current resistance zones in the coming days.