Bybit CEO Ben Zhou has called for a dynamic risk mechanism that reduces leverage as trading positions increase, following a significant loss suffered by decentralised exchange (DEX) Hyperliquid.

Hyperliquid recently recorded a $4 million loss after an Ether (ETH) whale executed a high-leverage trade. The incident highlights the liquidity challenges faced by both decentralised and centralised exchanges (CEXs).

The $4M Loss: What Happened?

On 12 March, a crypto trader used around 50x leverage to transform a $10 million investment into a $270 million long position on Ethereum. However, the trader found themselves in a dilemma—they were unable to exit the position without causing a sharp price drop that would affect their own holdings.

Instead, they withdrew collateral and strategically offloaded assets, avoiding a self-inflicted price crash. As a result, Hyperliquid’s liquidity pool (HLP) was left to absorb a staggering $4 million loss.

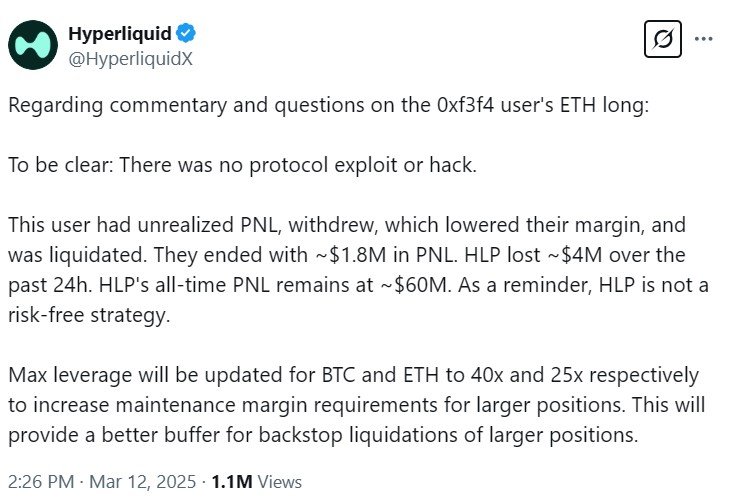

Smart contract auditing firm Three Sigma described the trade as a “brutal game of liquidity mechanics” rather than an exploit or hack. Hyperliquid also confirmed that the loss was not caused by any protocol vulnerability.

Hyperliquid Lowers Leverage on BTC and ETH

In response to the incident, Hyperliquid swiftly reduced leverage trading limits on its platform. The maximum leverage for Bitcoin (BTC) was lowered to 40x, while Ethereum’s cap was cut to 25x. This adjustment increases the maintenance margin requirements for large positions, making it more challenging for traders to take on excessive risk.

“This will provide a better buffer for backstop liquidations of larger positions,” Hyperliquid stated.

Bybit CEO Suggests Alternative Approach

Reacting to the event, Bybit CEO Ben Zhou noted that CEXs also encounter similar liquidity risks when handling whale liquidations. He acknowledged that reducing leverage is an effective way to mitigate risk but warned that it could negatively impact business.

“I see that Hyperliquid has already lowered their overall leverage; that’s one way to do it and probably the most effective one. However, this will hurt business as users would want higher leverage,” Zhou wrote in a post on X.

Instead, he proposed a dynamic risk mechanism where leverage decreases progressively as a position grows. According to Zhou, a whale on a centralised platform would see their leverage automatically reduce to around 1.5x once their position reaches a significant size.

However, he cautioned that traders could still exploit the system by using multiple accounts to bypass restrictions. He also emphasised the need for enhanced surveillance and risk management measures to detect market manipulation.

Hyperliquid Faces $166M Outflow

The fallout from the whale trade has been significant for Hyperliquid, with the DEX experiencing a massive withdrawal of funds.

According to data from Dune Analytics, the protocol saw a net outflow of $166 million on 12 March—the same day as the liquidation event. This suggests that investors may be losing confidence in the platform’s ability to manage risk effectively.

As the debate over leverage limits continues, both decentralised and centralised exchanges face the challenge of balancing user demand for high-risk trades with the need to maintain financial stability.