Bitcoin’s price has taken a sharp dive, losing over 5% in the last 24 hours, falling to $88,100. The drop comes after US President Donald Trump’s announcement of a Strategic Bitcoin Reserve failed to meet market expectations, leading to increased uncertainty among traders.

Market Reacts to Strategic Bitcoin Reserve

On 7 March, President Trump signed an executive order establishing a Strategic Bitcoin Reserve, a move initially seen as a potential boost for the cryptocurrency. Many market participants expected the government to allocate funds to buy more Bitcoin, driving demand and prices higher. However, Trump’s crypto advisor, David Sacks, clarified that the reserve would only include Bitcoin already seized by the government through criminal and civil asset forfeiture cases.

In a statement on social media platform X, Sacks assured that the initiative “will not cost taxpayers a dime.” While the government plans to acquire more Bitcoin through budget-neutral strategies, the lack of immediate capital inflows disappointed investors, who had hoped for a more aggressive stance.

This cautious approach triggered an 8.7% price drop, from a high of $92,790 on 6 March to an intraday low of $84,700 on 7 March. Analysts pointed out that without fresh buying pressure from the government, Bitcoin lacked a significant bullish catalyst, similar to the market reaction following the approval of spot Bitcoin ETFs in early 2024.

Spot Bitcoin ETFs Witness Major Outflows

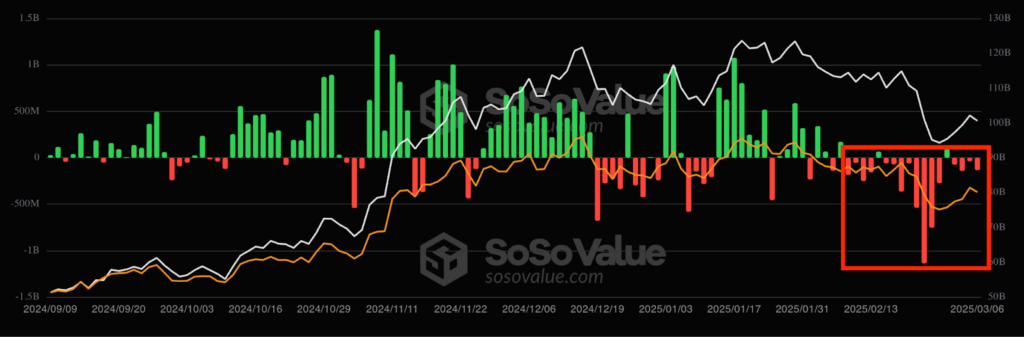

Adding to the bearish sentiment, spot Bitcoin ETFs have seen significant withdrawals in recent weeks. In the last 14 days, these investment products recorded outflows of approximately $3.87 billion. The largest single-day withdrawal occurred on 25 February, with a staggering $1.14 billion leaving the market.

On 6 March alone, Bitcoin ETFs registered $134.3 million in outflows. Crypto insights firm Alva attributed this to investor uncertainty surrounding Trump’s reserve announcement, stating, “Investors are jittery about decentralisation. Major players like Fidelity’s FBTC and ARK’s ARKB are feeling the heat with big withdrawals, signalling market trepidation.”

Key Support Levels to Watch

Bitcoin is now at risk of further decline if it fails to hold above a crucial support level. The 200-day exponential moving average (EMA), currently at $85,550, is seen as a key threshold for Bitcoin’s short-term price action.

If Bitcoin remains above this trendline, analysts believe it could stage a recovery and attempt to break past a significant resistance zone between $92,800 (100-day EMA) and $94,000 (50-day EMA). This could set the stage for a retest of the psychologically important $100,000 level.

However, a daily close below the 200-day EMA could push Bitcoin towards key lower levels. The first area of interest lies between $81,500 (the low recorded on 4 March) and $78,200 (the low from 28 February). If this range fails to hold, further downside pressure could emerge.

As traders look ahead to the upcoming White House Crypto Summit, many will be watching the key resistance and support zones closely. According to crypto analyst Daan Crypto Trades, Bitcoin’s range low at $90,800 and the all-time high of $109,000 are crucial levels in both directions.

Uncertain Outlook for Bitcoin

While Bitcoin has faced a sharp decline following the underwhelming Strategic Bitcoin Reserve announcement, the broader market remains in a wait-and-see mode. Traders and investors are now looking for fresh catalysts, whether in the form of regulatory clarity, institutional adoption, or renewed retail interest.

In the coming days, Bitcoin’s ability to hold above its 200-day EMA will determine whether it can stabilise and attempt a rebound or continue its downward trajectory towards lower support levels. Until then, market sentiment remains cautious amid ongoing volatility.