Market Weakness Signals Possible Retracement

Bitcoin may see a brief pullback to the $72,000 support level as investor sentiment weakens, limiting the chances of an immediate market recovery. The drop in confidence has reached levels last seen in 2022, raising concerns over further downside movement.

The leading cryptocurrency hit a three-month low of $78,197 on 28 February, marking a 28% decline from its record high of over $109,000 on 20 January. Analysts suggest the market is undergoing a repositioning phase, with Bitcoin potentially dipping further into the lower $70,000 range before stabilising.

According to Iliya Kalchev, a dispatch analyst at digital asset investment platform Nexo, a “significant drop below $75,000 seems less likely.” He explained that while the market is filling in gaps left by Bitcoin’s rapid climb, strong support is expected in the $72,000 to $80,000 range.

“This support could provide a foundation for a more sustainable recovery, reducing the likelihood of a deeper retracement,” Kalchev told.

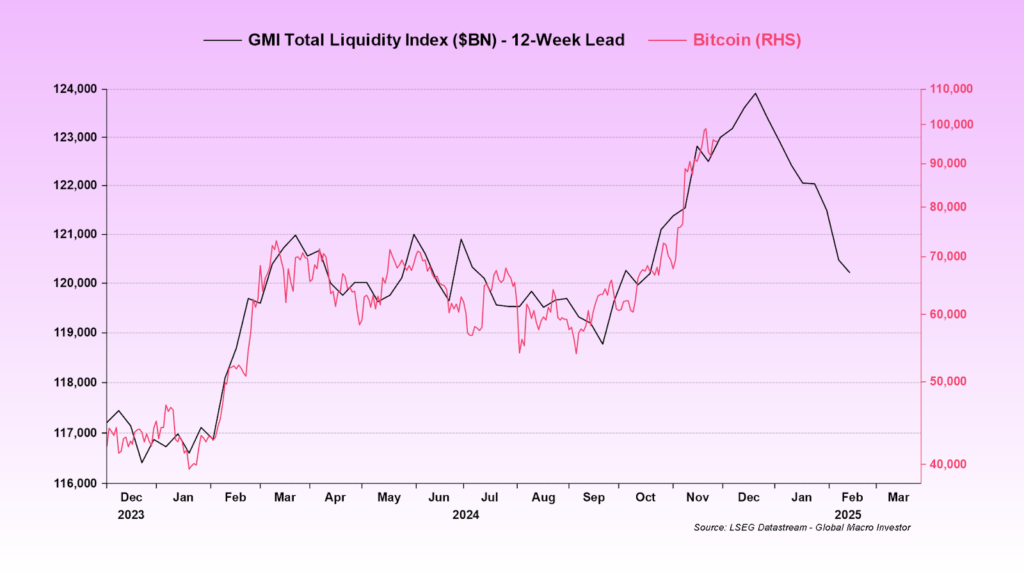

Some market analysts predict that Bitcoin could bottom near $70,000 in early 2025 before the next rally phase begins. Based on its correlation with the global liquidity index, Bitcoin’s right-hand side (RHS) — the lowest bid price traders are willing to sell at — may fall below $70,000 by the end of February, following its peak of $110,000 in January.

Raoul Pal, CEO of Global Macro Investor, first warned of a potential correction to $70,000 in November. At the time, he forecasted a “local top” above $110,000 in January before the current downturn began.

Investor Sentiment Falls to 2022 Lows

Despite expectations of Bitcoin finding a bottom and stabilising in the coming weeks, market sentiment remains at historically low levels.

The Crypto Fear & Greed Index, which measures overall sentiment in the crypto market, recently dropped to 20, a level not seen since July 2022. The last time investor confidence was this low was a month after Bitcoin fell to $17,500 in June 2022, when the cryptocurrency suffered a monthly loss of over 37%.

A combination of external pressures and internal market issues has driven this decline in sentiment. Analysts at Bitfinex highlighted several key factors behind the downturn, including regulatory uncertainty, security breaches, and falling altcoin valuations.

“The combination of a sharp Bitcoin price drop, regulatory uncertainty, security breaches, and declining altcoin valuations has led to extreme fear in the crypto market,” Bitfinex analysts stated.

Additionally, the market has seen increased liquidations, particularly during significant sell-offs on 3 February and between 24-27 February. Long liquidations, where leveraged traders are forced to sell assets at a loss, have hit new highs across multiple downturns.

Bybit Hack Adds to Market Uncertainty

The broader crypto market is still grappling with the fallout from the recent $1.4 billion hack on Bybit, which occurred on 21 February. This attack, now considered the largest security breach in crypto history, has further shaken investor confidence.

Despite the severity of the hack, Bybit has reassured customers by continuing to honour withdrawals and fully replacing the stolen $1.4 billion in Ether by 24 February, just three days after the incident.

While the market remains in a state of uncertainty, analysts suggest that strong support in the $72,000 to $80,000 range could prevent a deeper correction. However, until investor sentiment improves, Bitcoin’s path to recovery may remain challenging.