Memecoin Scams Drive Capital Outflows to Ethereum and Arbitrum

Solana has witnessed a sharp decline in user activity, with a 40% drop in active addresses as investor confidence erodes due to rug pulls and insider schemes within the memecoin sector. Capital is flowing out of Solana and into rival blockchains such as Ethereum and Arbitrum, though some analysts believe this downturn could ultimately benefit Solana in the long term.

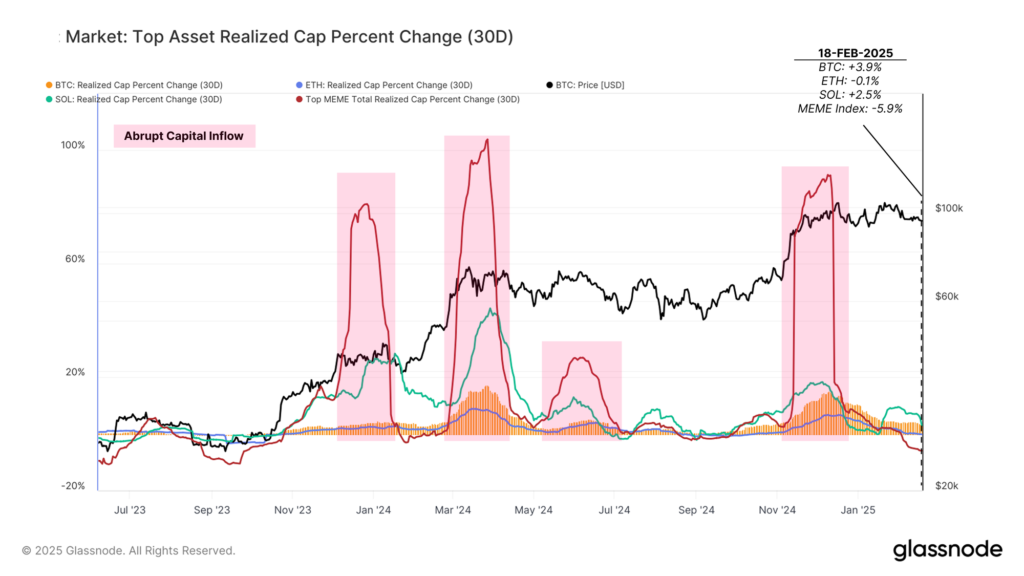

Scams involving Solana-based memecoins have led to significant capital outflows, with the monthly inflow rate turning negative at -5.9%, according to data from Glassnode shared with Cointelegraph. The drop follows December 2024’s peak in investment activity, with much of the decline attributed to a loss of interest in the memecoin sector.

Declining Capital Inflows and Falling Prices

CryptoVizArt, a senior analyst at Glassnode, noted that Solana’s monthly capital inflow has plummeted from December 2024’s highs to just 2.5% per month. The analyst stated:

“The rate of monthly capital inflow into Solana has declined from December 2024 high to 2.5% per month, mostly due to the negative capital flow in the MEME sector. However, Solana still has some positive momentum, but it’s declining faster than Bitcoin.”

Solana’s price has also taken a hit, dropping over 29% in the past month. In comparison, Ether fell by over 15% and Bitcoin declined by 7%, according to data from Cointelegraph Markets Pro.

User Exodus and Reduced Network Activity

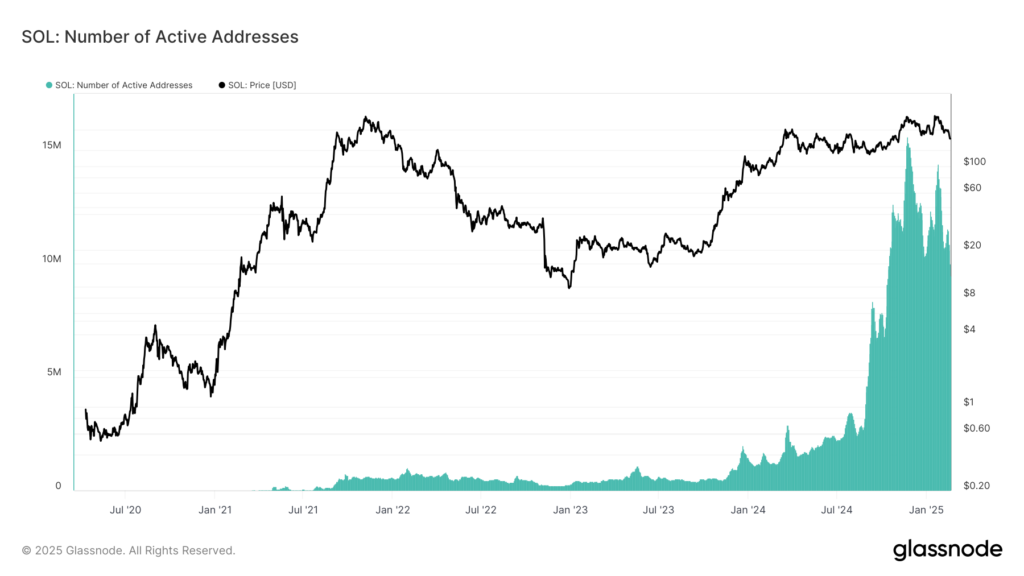

The number of active addresses on the Solana network has decreased significantly, with a weekly average of 9.5 million in February, marking a nearly 40% drop from November 2024’s 15.6 million active addresses. This decline represents a major cooldown for the blockchain, though activity remains higher than pre-bull market levels.

The downturn has been linked to investor disappointment in recent Solana-based memecoin projects, particularly the Libra token, which was endorsed by Argentine President Javier Milei. The project’s insiders allegedly drained over $107 million in liquidity in a rug pull, causing a 94% price collapse within hours and wiping out $4 billion in investor capital.

Potential Long-Term Benefits for Solana

As investor confidence in Solana weakens, millions of dollars worth of cryptocurrency is being transferred to other blockchains. Data from Debridge shows that over $7.7 million has moved from Solana to Arbitrum and over $6.9 million to Ethereum, indicating a capital exodus that may have long-term implications.

Despite these challenges, some analysts suggest that Solana’s current struggles could ultimately lead to a healthier ecosystem. The blockchain’s advanced technology has attracted bad actors, but eliminating fraudulent projects could enhance the network’s credibility in the long run. Blockchain researcher Aylo noted in a February 18 post on X:

“This washout will end up being a very good thing long term. Standards need to go up. Bad actors need to be removed.”

He added that if the Solana price and other Layer-1 token values rely solely on gambling activity, the space will remain small and high valuations will not be justified.

While the immediate future for Solana appears turbulent, these developments could help create a more robust and transparent blockchain ecosystem, fostering long-term growth and investor confidence.