Ethereum surged to a 12-day high of $2,832 before settling around $2,720, marking a 2% daily increase. This price movement comes despite the broader crypto market experiencing a 2.4% decline. The rise follows months of underperformance, with ETH struggling to keep pace with other major cryptocurrencies.

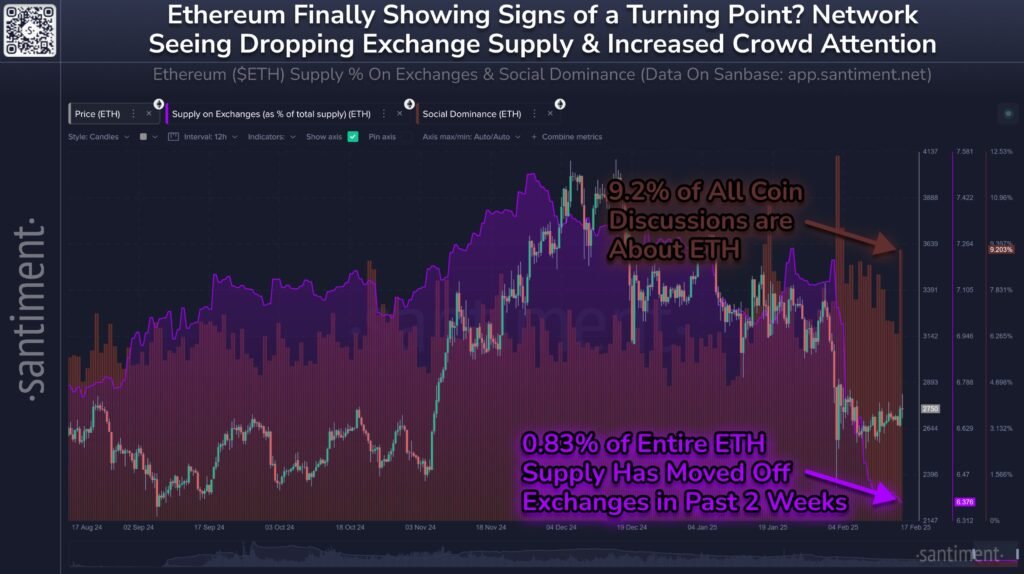

Blockchain analytics firm Santiment reports that Ethereum’s exchange supply has dropped to an all-time low, indicating a strong accumulation trend. Analysts suggest this is not necessarily a breakout but could signal a broader market recovery.

Record-Low Exchange Supply Supports Long-Term Outlook

A major bullish indicator for Ethereum is its shrinking exchange supply. Santiment data shows that only 6.38% of ETH’s total supply remains on centralized exchanges, the lowest since its inception. This suggests investors prefer to hold rather than sell, reducing the risk of sudden sell-offs.

Additionally, ETH withdrawals from derivatives exchanges have surged to their highest level since August 2023, further signaling investor confidence. While these metrics point toward long-term accumulation, analysts caution that they do not guarantee immediate price surges.

ETH/BTC Ratio Struggles Despite Short-Term Gains

Despite the recent price jump, Ethereum continues to struggle against Bitcoin. The ETH/BTC ratio rose by 7% on February 17, reaching 0.029, but remains near its lowest level since December 2020.

Ethereum has underperformed Bitcoin since mid-2022, with BTC maintaining dominance in the market. Investors have increasingly favored Bitcoin, leaving Ethereum searching for stronger catalysts to regain traction. Analysts believe ETH must break key resistance levels before it can gain strength against BTC.

Market Sentiment Remains Uncertain

Market analysts remain divided on Ethereum’s latest rally. While some traders see it as a sign of recovery, others are more cautious. Crypto analyst Lark Davis dismissed the price jump, arguing that ETH often rises slightly before dipping again.

Analysts at Time To Trade noted that Ethereum has not yet broken the $2,710 resistance level. If ETH fails to hold above this mark, it could indicate weak buying pressure, potentially leading to a drop below $2,635 and even $2,500.

Meanwhile, short sellers have increased their bets against ETH. Futures contracts on the Chicago Mercantile Exchange (CME) reached a record high of 11,341, a 40% increase in a week and 500% rise since November. This surge in bearish positions signals skepticism about ETH’s short-term prospects.