The cryptocurrency market has witnessed a notable downturn, with the total market capitalisation falling by over 2.5% to approximately $3.15 trillion on 7 February. A combination of liquidations, investor caution ahead of US jobs data, and weakening technical indicators has contributed to the decline.

Market-Wide Sell-Off and Liquidations

The recent downturn follows a correction that began on 31 January, shortly after US President Donald Trump issued an executive order imposing tariffs on imports from Mexico, Canada, and China.

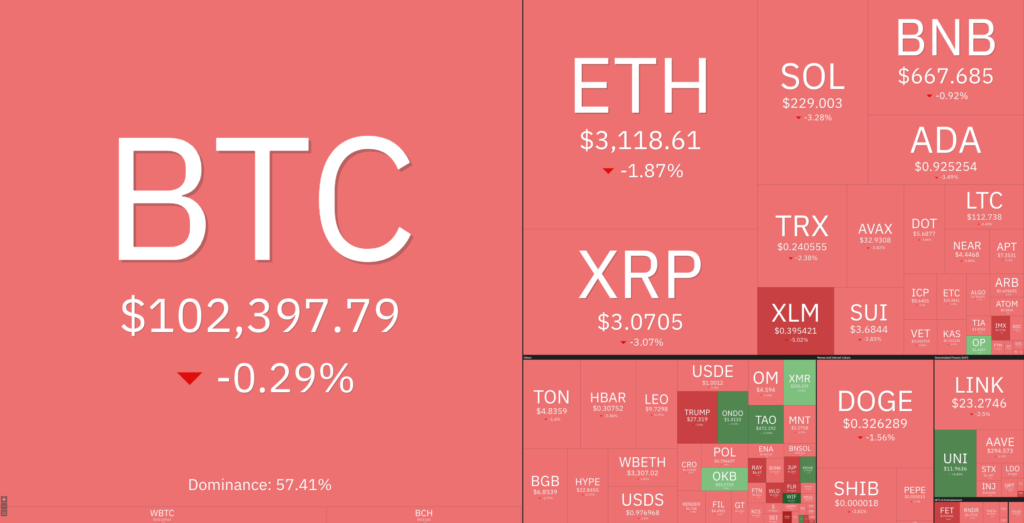

Among the biggest losers in the market downturn, Ethereum (ETH) has fallen by 5% in the past 24 hours, now trading just below $2,700. Bitcoin (BTC) has posted a moderate decline of 1.3%, hovering around $96,800. Other major cryptocurrencies, including Solana (SOL), Dogecoin (DOGE), and Cardano (ADA), have recorded losses of 6.3%, 6.5%, and 6%, respectively.

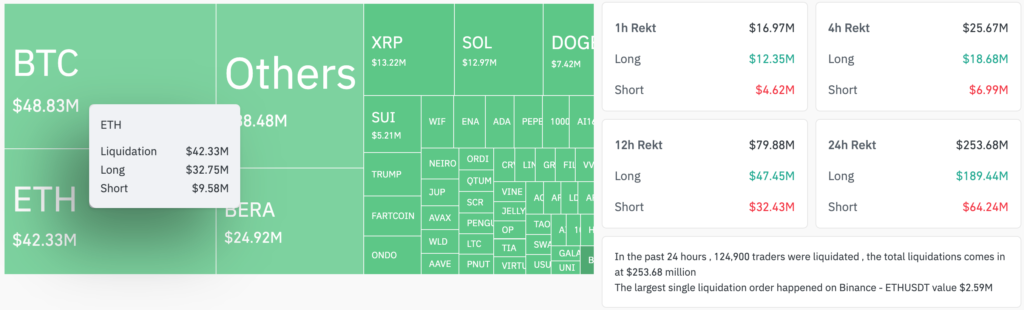

A significant factor in the price drop has been liquidations across the crypto market. Over $250 million in leveraged positions have been liquidated in the past 24 hours, triggering a cascade of sell-offs. Notably, long ETH positions worth $32.75 million were liquidated, slightly exceeding BTC liquidations of $32.2 million.

A total of 124,900 traders faced liquidations, with the largest single loss occurring on Binance involving an ETH/USDT trade worth $2.59 million. The predominance of long liquidations suggests that the market was heavily overleveraged on the bullish side before the sell-off.

Investor Caution Ahead of US Jobs Data

Adding to the volatility, investors are bracing for the release of US jobs data on Friday, 7 February. Market participants are closely watching key labour market indicators, such as job openings, unemployment rates, and wage growth, which could influence the Federal Reserve’s monetary policy stance.

Analysts anticipate a decline in job openings from 256,000 in December to 170,000 in January, with the unemployment rate expected to remain unchanged at 4.1%. Average hourly earnings are projected to rise by 0.3% month-on-month, mirroring December’s increase.

According to The Kobeissi Letter, a capital markets commentator, there is a 28% probability that job additions could exceed 300,000, a figure significantly higher than Wall Street’s median estimate of 170,000. If this occurs, it would be the first instance of such job growth since March 2024.

A weaker-than-expected jobs report could prompt a more dovish stance from the Federal Reserve, potentially leading traders to price in faster interest rate cuts. This scenario would likely boost demand for riskier assets, including stocks and cryptocurrencies. Currently, there is an 85.5% likelihood that the Fed will maintain interest rates at its next meeting on 19 March, with the earliest potential rate cut anticipated in June, carrying a 44.8% probability.

Technical Indicators Signal Further Downside

From a technical perspective, the TOTAL index, which represents the combined market capitalisation of all cryptocurrencies, is testing the support level at $3.11 trillion—the lower boundary of a bullish flag formation.

A breakdown below this key support level could result in a retest of the 50-day simple moving average (SMA) at $2.55 trillion. If this level is also breached, the market could fall further to $2.25 trillion, representing a 27% decline from current prices.

The daily relative strength index (RSI) has dropped sharply from its December high of 78 to its current value of 48, suggesting bearish momentum.

Crypto analyst Crypto Zone noted that the market is in a state of caution, with the Fear and Greed Index currently at 35, firmly within the fear zone. However, they pointed out that such periods of fear have historically provided strategic buying opportunities for savvy investors, as seen in past market recoveries.

While uncertainty looms over the crypto market, traders will be closely watching upcoming economic data and technical levels to gauge the next potential move.