Ethereum (ETH) is leading the cryptocurrency market on 6 February, posting a 4% daily gain to surpass the $2,800 mark. While the total crypto market capitalization has risen by 0.65% to $3.23 trillion, ETH’s outperformance can be attributed to multiple bullish catalysts, including excitement around the upcoming Pectra upgrade, increasing inflows into spot Ethereum exchange-traded funds (ETFs), and technical efforts to reclaim the crucial $3,000 level.

Anticipation Builds Around Pectra Upgrade

One of the key drivers of Ethereum’s price surge is the highly anticipated Pectra upgrade. Slated for March 2025, this upgrade aims to enhance scalability, improve transaction speeds, and reduce gas fees by doubling the blob space in Ethereum blocks. Test runs are scheduled to take place on Ethereum’s test networks, Sepolia and Holesky, throughout February.

Ethereum researcher Justin Drake has highlighted the potential impact of Pectra on ETH’s supply. In a post on X (formerly Twitter) on 5 February, Drake stated, “To become ultrasound again, either issuance has to decrease, or the burn has to increase. I believe both will happen.” Many in the crypto community believe the upgrade could attract more developers to the Ethereum network, boosting demand for ETH and driving prices higher.

Crypto investor Ted Pillows echoed this sentiment, stating, “A lot of bullish things are happening now with Ethereum, including the Pectra upgrade, and none of them have been priced in. Along with that, sentiment is at an all-time low, which is the best signal for reversal. $5K ETH is coming before April 2025.”

Strong ETF Inflows Bolster Ethereum’s Momentum

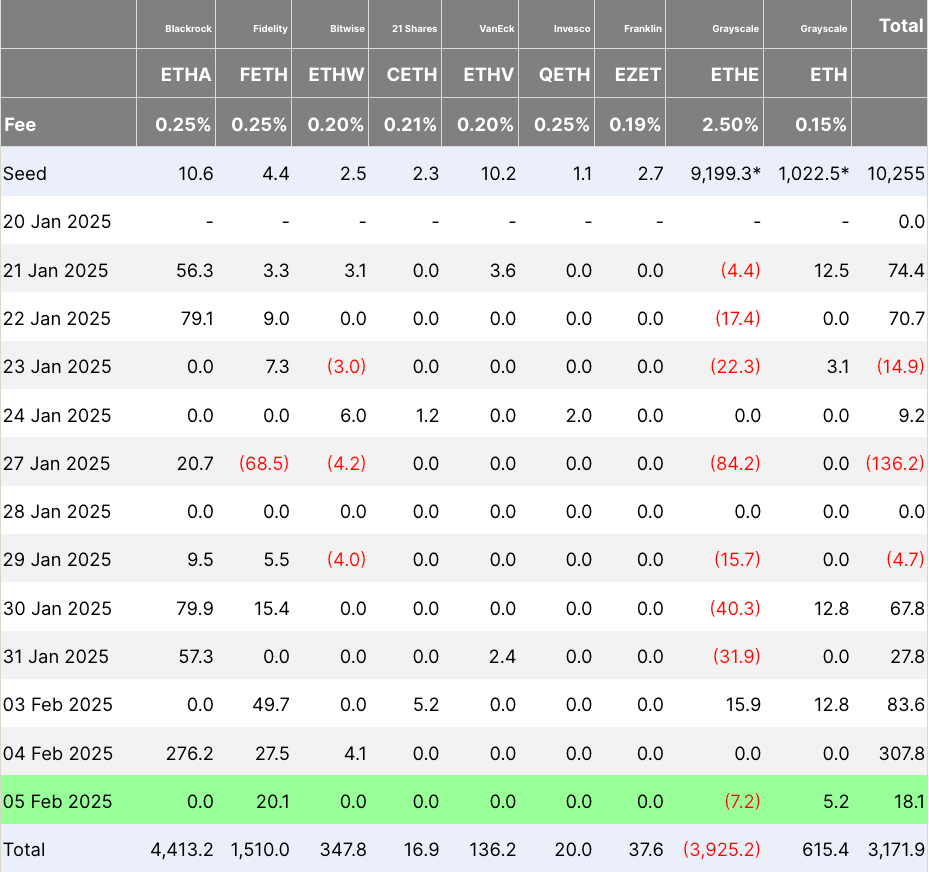

Ethereum’s price rally is also being supported by substantial inflows into US-based spot Ethereum ETFs. Over the past five days, these funds have recorded cumulative inflows of $421.5 million, bringing year-to-date inflows to $1.1 billion and total net inflows to $3.17 billion.

BlackRock’s ETHA fund has emerged as the dominant buyer, accumulating $579 million in inflows between 21 January and 5 February. Market analysts suggest that ETF investments could continue to rise in 2025, particularly if regulatory changes enable Ethereum staking within these funds.

Technical Outlook: Can ETH Reclaim $3,000?

Despite the recent surge, Ethereum’s technical indicators suggest that the market remains slightly biased to the downside. The relative strength index (RSI) is positioned below its neutral level, indicating that bears still hold some control. Additionally, moving averages have formed a bearish cross, which could pave the way for further downside correction.

However, if ETH manages to reclaim the $3,000 level as a support zone, analysts anticipate a strong uptrend. Historically, Ethereum’s price has rallied between 20% and 35% after successfully overcoming and holding above this level.

According to CoinGlass’s liquidation heatmap, the critical support zone to watch for potential rebounds lies just above $2,700. If ETH successfully establishes $3,000 as a support floor, the price could rally towards the December 16 high of $4,100, marking a potential 44% gain from current levels.

As the cryptocurrency market continues to evolve, Ethereum’s upcoming developments and increasing institutional interest could play a crucial role in shaping its price trajectory in the months ahead.