Bitcoin’s price trajectory for February is set to be influenced by a crucial US labour market report, with analysts closely watching its potential impact on investor sentiment and Federal Reserve policy expectations.

Labour Market Data to Shape Bitcoin’s Performance

The US Bureau of Labour Statistics is scheduled to release its latest labour market report on 7 February. The findings could have a significant effect on Bitcoin’s momentum heading into the rest of the month and beyond.

According to Ryan Lee, chief analyst at Bitget Research, the report will serve as a “critical factor” in determining Bitcoin’s near-term movement. Lee explained:

“A strong labour market typically reduces the likelihood of imminent Fed rate cuts, which may result in a dip for Bitcoin prices. If the labour market data shows signs of weakening, it could strengthen the case for rate cuts. Such a shift in policy expectations would likely create a more supportive environment for Bitcoin.”

Bitcoin Faces Resistance Despite January Gains

Bitcoin recorded a 13% increase in January, but its momentum has stalled in recent days. Data indicates that Bitcoin’s price has fallen by nearly 0.5% over the past week.

Some market analysts warn that Bitcoin could drop below the $96,000 mark, citing emerging technical patterns that indicate a possible momentum reversal. To prevent such a correction, Bitcoin must maintain its position above the $101,000 weekly support level in the short term.

Macroeconomic Conditions and Fed Policy in Focus

The upcoming labour market report could act as a key catalyst for Bitcoin’s price movement over the next two months. Analysts suggest that an unemployment rate of around 4.1% may create an ideal scenario for Bitcoin’s continued upward trend.

Benjamin Cowen, founder and CEO of Into the Cryptoverse, highlighted this in a 31 January post on X (formerly Twitter), stating:

“If the unemployment rate is 4.1% or 4.2%, then there is a higher probability that BTC will follow the blueprint from last year and go higher in Feb/Mar. If the unemployment rate is too much higher, then it could make BTC a little bit more unsure.”

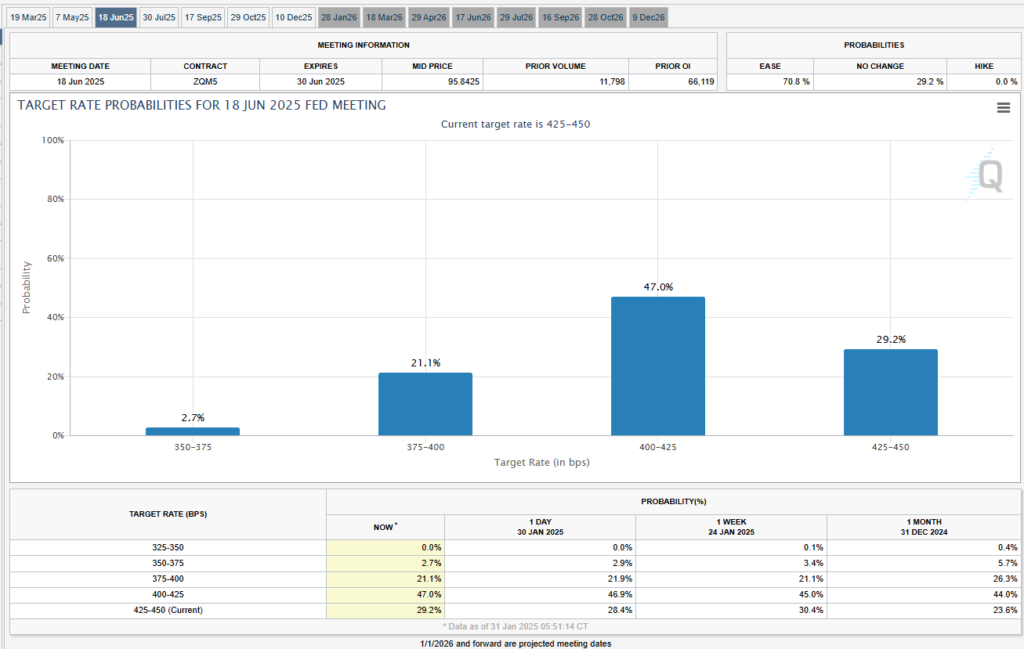

Bitcoin’s price remains highly sensitive to economic developments, particularly in response to the Federal Reserve’s monetary policy. Current market expectations indicate that the next US interest rate cut is likely to occur on 18 June, according to the CME Group’s FedWatch tool.

With macroeconomic conditions continuing to play a crucial role, Bitcoin investors will be watching next week’s labour market data closely to gauge the cryptocurrency’s potential direction in the months ahead.