Small-Scale Holders Take Profits as Major Investors Stay Put

Retail Bitcoin investors have offloaded around 6,000 BTC to Binance this month, worth approximately $625 million at current prices. However, large-scale holders, or “whales,” have remained largely inactive, hinting at a divergence in market sentiment.

Retail Investors Rush to Sell

According to on-chain analytics firm CryptoQuant, retail traders appear to believe the bull market is nearing its peak, leading to increased selling activity. Exchange inflows show that smaller BTC holders have been offloading significant amounts of the cryptocurrency throughout January.

Market analyst Darkfost noted that this trend highlights a common behavioural divide between retail investors and whales. “We often hear about a contradiction in the behaviour of investors categorised as whales and retail,” he wrote in a CryptoQuant market update. “This is exactly what is happening now when analysing data from Binance in the short term.”

Whales Show Restraint Amid Price Surge

While smaller investors are taking profits, Bitcoin whales have refrained from making significant moves. Data from Binance suggests that whale inflows for January total around 1,000 BTC—roughly $104 million—indicating only minimal profit-taking.

“This is a perfect example of the contrasting behaviours between whales and retail traders, and it is often considered a better choice to follow whales rather than retail investors,” Darkfost added.

Charts from CryptoQuant reveal a growing trend of retail Bitcoin deposits to Binance, while whale inflows remain subdued. Historically, whales have been seen as the “smart money” in the market, often staying ahead of the broader trend.

Bitcoin Bull Run May Have More Room to Grow

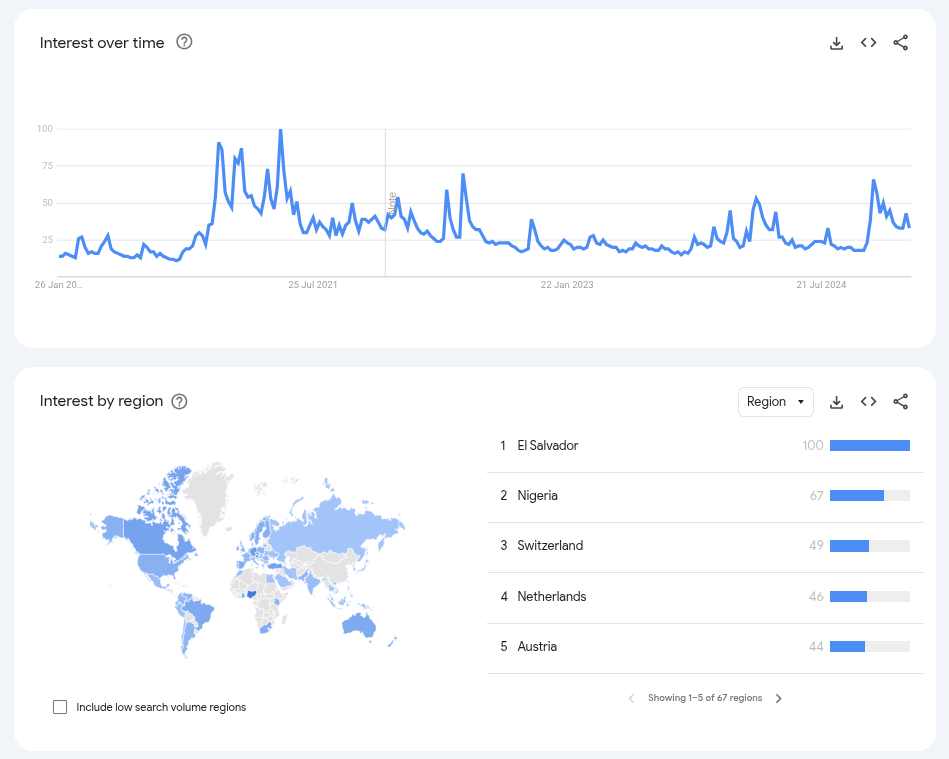

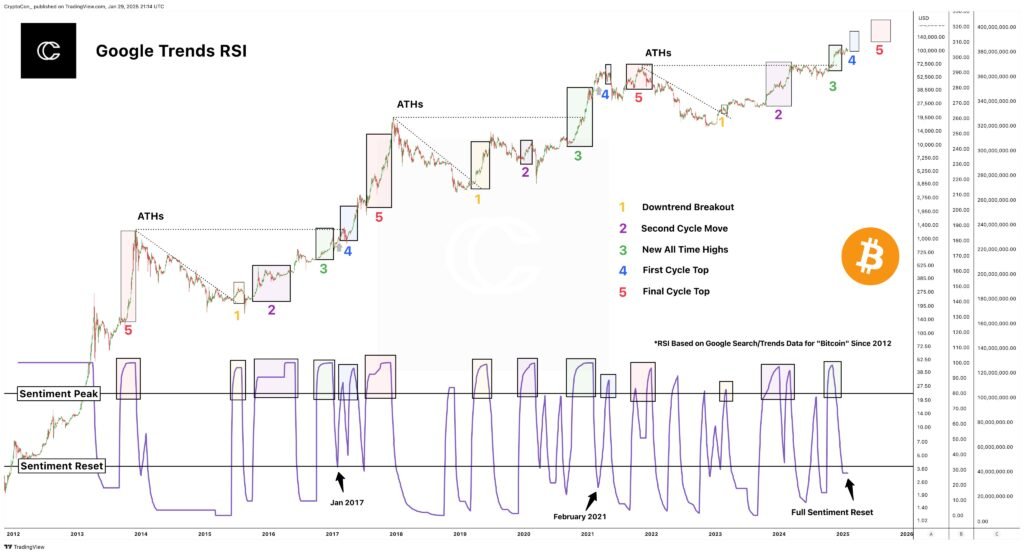

Despite the recent wave of retail selling, analysts suggest that the current Bitcoin rally is far from over. Data from Google Trends, analysed by CryptoCon, indicates that mainstream interest in Bitcoin has reset following an initial surge when BTC/USD surpassed its previous all-time highs.

Using the relative strength index (RSI) volatility indicator on Google search trends, CryptoCon identified five key phases of retail interest in Bitcoin. According to his analysis, the market has just completed Phase 3, where BTC hit a fresh all-time high (ATH).

“We have just completed Phase 3, which is the ATH move. The RSI has made a full reset, which means that the next phase will be underway soon—Phase 4, the First Cycle Top,” CryptoCon explained in a recent post on X (formerly Twitter).

Bitcoin Price Predictions Remain Bullish

If historical patterns hold, Bitcoin’s bull cycle may have considerable room to grow before reaching its final peak. Analysts continue to debate how high BTC could go, with some estimates placing the potential top at $150,000 or more.

While retail traders may be quick to cash out, many experts believe the current cycle is still developing. If whale activity picks up in the coming months, it could signal further price acceleration before the market reaches a true top.