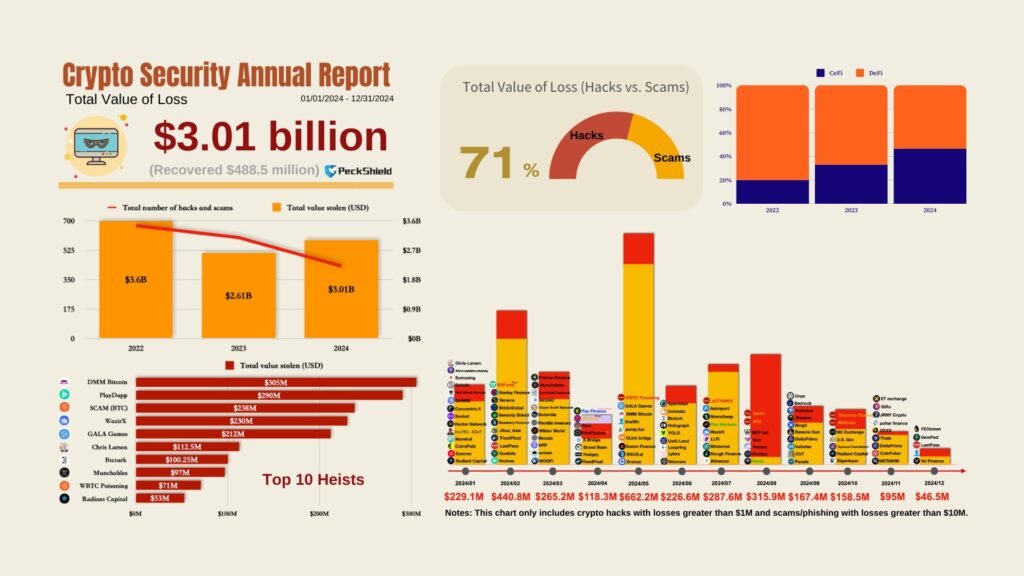

The crypto industry endured a challenging 2024 as Crypto Hacks and Scams capitalized on vulnerabilities, resulting in a staggering $3.01 billion in losses, according to blockchain forensic firm PeckShield. This represents a 15% increase from the $2.61 billion recorded in 2023, further underscoring the persistent security challenges plaguing the digital asset ecosystem.

Decentralized Finance Remains the Primary Target

PeckShield’s analysis reveals that decentralized finance (DeFi) protocols continued to dominate the landscape of losses, contributing the bulk of the total figures. Hackers exploited flaws in smart contracts and other DeFi infrastructure, cementing the sector’s reputation as a high-risk area for investors.

In 2024, hacks accounted for $2.15 billion of the losses, or more than 70% of the total, while scams were responsible for $834.5 million. The remaining 30% of the losses reflected fraudulent schemes, which often preyed on investor naivety or the allure of unrealistic returns.

Major Heists Define the Year

Several high-profile attacks punctuated 2024, with centralized and decentralized platforms alike falling victim to significant breaches.

- DMM Bitcoin: The Japanese exchange suffered the largest attack, losing $305 million in a devastating hack.

- PlayDapp: The gaming platform was next, with losses totalling $290 million.

- WazirX: The Indian crypto exchange faced a $230 million breach, one of the largest in its history.

- BTC Scam: A fraudulent scheme siphoned off $238 million, marking one of the year’s most impactful scams.

Gaming and metaverse platforms also found themselves increasingly targeted as their popularity soared, with Gala Games losing $212 million in another major attack.

Monthly Breakdown: May Takes the Biggest Hit

On a monthly basis, May emerged as the most devastating month of 2024, with losses peaking at $662.2 million. July and August followed as other high-activity periods, each recording losses exceeding $280 million.

Encouragingly, the later months showed a declining trend in losses, with December witnessing the year’s lowest figure at $46.5 million. Analysts attribute this improvement to heightened security awareness and improved protocol upgrades towards the end of the year.

Access Control Vulnerabilities on the Rise

Web3 security firm Hacken reported a sharp rise in attacks exploiting access control vulnerabilities, which accounted for 78% of the total losses in 2024. These weaknesses spanned across DeFi, centralized finance, and gaming/metaverse platforms, highlighting the pressing need for robust access management practices.

While the recovery of $488.5 million in stolen funds offers a glimmer of hope, the $3 billion lost in 2024 underscores the urgent need for enhanced security measures within the crypto industry. Investors and developers must prioritize securing protocols and educating users to build a more resilient digital asset ecosystem.