Georgia Representative Mike Collins reveals cryptocurrency purchases, including Ether and altcoins, amid rising scrutiny of lawmakers’ investments.

Cryptocurrency Investments Revealed

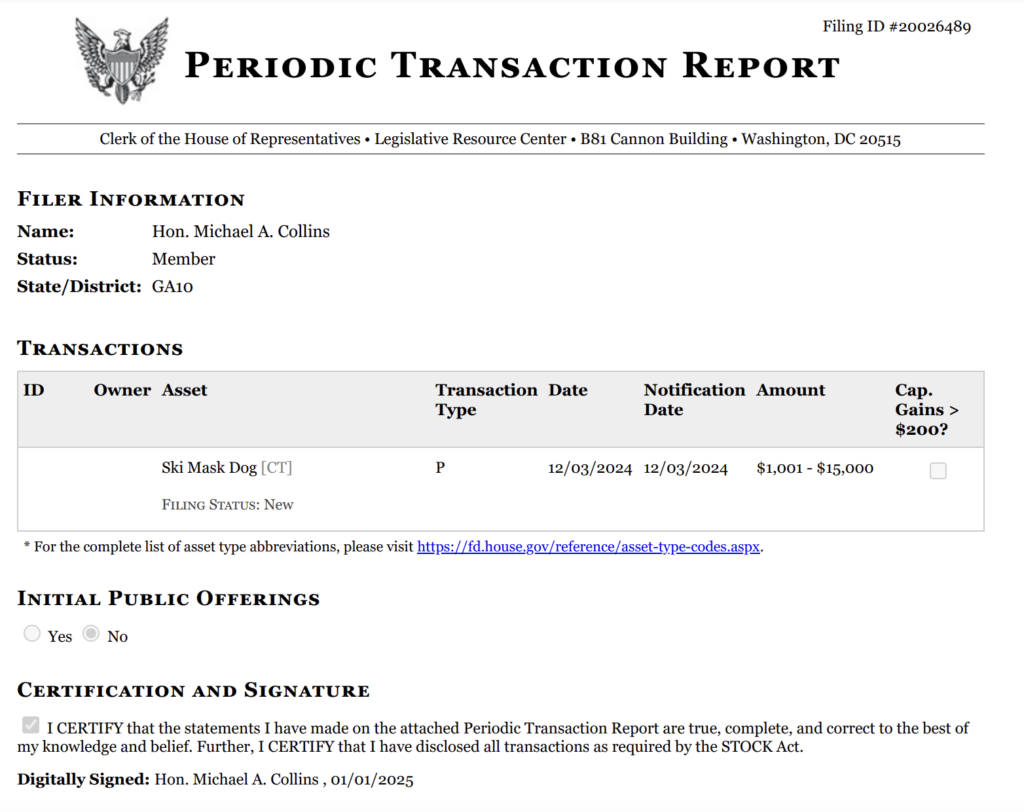

On New Year’s Day, Georgia Representative Mike Collins disclosed his investment in various cryptocurrencies, including the altcoin Ski Mask Dog (SKI). In a financial report filed with the US House of Representatives, Collins revealed he had purchased between $1,001 and $15,000 worth of SKI across three transactions in December 2024. These purchases came roughly a month after the US elections and during a period of surging cryptocurrency prices.

The SKI token, launched in May 2024, traded under $0.01 until the November election but surged to an all-time high of $0.35 in early December before stabilising at approximately $0.25. Collins, a Republican representing Georgia’s 10th congressional district, won reelection in November with more than 63% of the vote.

In addition to SKI, Collins’ financial disclosures indicated investments in other cryptocurrencies, including Ether (ETH), Velodrome (VELO), Aerodrome Finance (AERO), and The Graph (GRT).

Adherence to the STOCK Act

Under the Stop Trading on Congressional Knowledge (STOCK) Act, US lawmakers must disclose stock and cryptocurrency transactions. As of 3 January 2025, Collins appeared to be the first member of Congress to file such a report in the new year.

Despite his investments, Collins has not made cryptocurrency a prominent part of his policy platform. However, he has voted in favour of legislation supported by the crypto industry, such as the Financial Innovation and Technology for the 21st Century (FIT21) Act. He has also expressed intentions to “move fast” on key issues in the 119th session of Congress.

Rising Debate on Lawmakers’ Investments

The disclosure comes amid ongoing scrutiny of lawmakers’ financial activities. Critics argue that trading stocks and digital assets while in office poses potential conflicts of interest. In July, a bipartisan group of senators urged House leaders to amend the STOCK Act to ban members of Congress from trading stocks altogether.

Though some lawmakers, including Texas Senator Ted Cruz and Wyoming Senator Cynthia Lummis, have disclosed cryptocurrency investments in the past, calls to tighten regulations on such activities are growing. It remains unclear whether the 119th Congress will address these concerns or introduce stricter legislation.

Crypto and Politics: An Emerging Trend

As cryptocurrency gains mainstream attention, lawmakers’ involvement in the market is under increasing scrutiny. Collins’ disclosure highlights the intersection of politics and digital assets, raising questions about transparency and accountability.

Whether Collins’ crypto investments will influence his legislative priorities or spark further debate on lawmakers’ financial practices remains to be seen. For now, his disclosures mark a noteworthy start to 2025 in US politics.