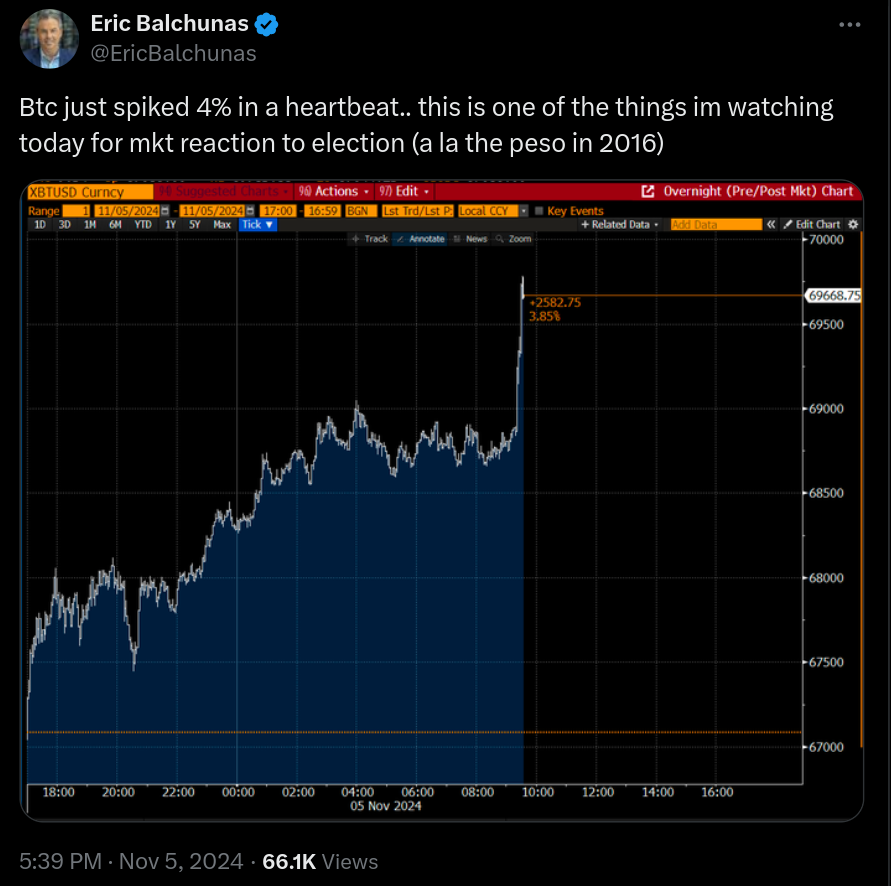

Bitcoin (BTC) experienced a swift price surge of 3.7% on November 5, rising to nearly $70,300 before settling around $69,500, according to data from TradingView. This rapid rise caught short positions off guard, triggering liquidations across the market. Popular trader Exitpump noted “sudden spot buying in unison” on social media, suggesting that the uptick was driven by coordinated demand.

Echoes of Previous Election Years

Market experts are drawing comparisons between this year’s election-driven price movement and previous cycles. Trader Moustache suggested that Bitcoin may have already bottomed, mirroring patterns seen before past US elections. He remarked, “Imagine $BTC bottomed out just before the US election. The majority assumed it would happen afterward,” referencing a similar market landscape in 2020.

Historical data supports this trend: in 2016, Bitcoin rose by 37% from election day to the end of the year, and by 98% in the same period in 2020. Onchain analytics platform CryptoQuant noted that Bitcoin’s 2024 performance closely resembles that of 2016, suggesting the cryptocurrency could be set for another post-election rally.

Market Pricing and Election Risks

According to a bulletin from trading firm QCP Capital, the market is currently anticipating a 3.5% movement in Bitcoin on election night, with some traders potentially underestimating the risks of a prolonged or contested election outcome. QCP noted that the lack of volatility premiums beyond November 8 suggests confidence in a quick resolution, though this could be optimistic.

Analysts Predict Potential Bull Run Continuation

Charles Edwards, founder of Capriole Investments, sees Bitcoin’s bull run as resilient to election-induced volatility, driven by strong inflows into the US spot Bitcoin ETFs. CryptoQuant similarly described Bitcoin as “fairly valued” at its current price level, meaning that a positive post-election catalyst could lead to further gains.

With historical patterns and macroeconomic conditions at play, analysts are watching closely to see if Bitcoin will defy expectations and continue its upward trend post-election.