Bitcoin’s recent rally has been cut short, with its price dropping over 3.7% in the last three days, following a 12-week high of $69,487 on 21st October. Several key indicators suggest that a deeper correction may be on the horizon as the market shows signs of overheating.

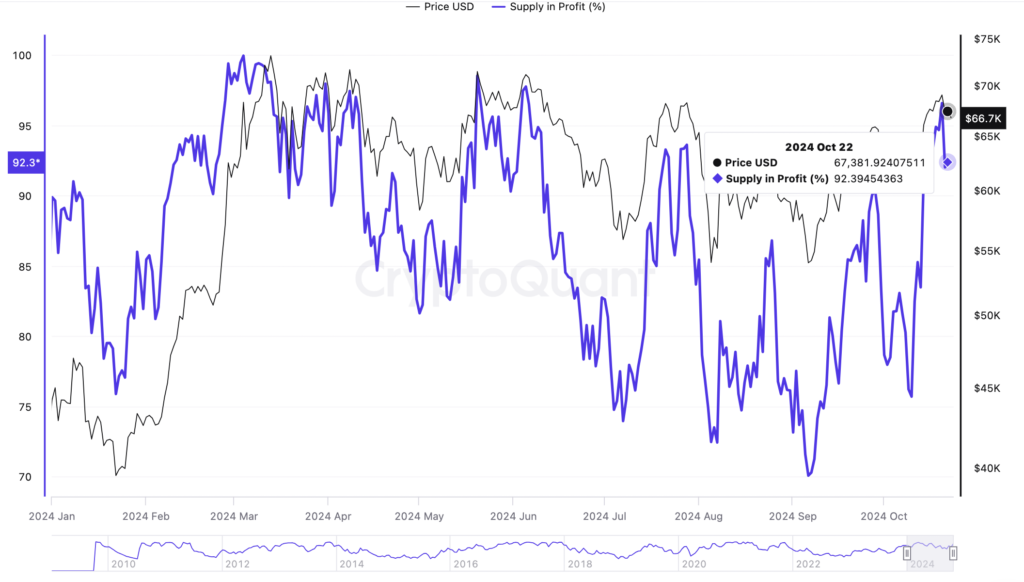

High Percentage of Holders in Profit

Data from CryptoQuant reveals that over 92% of Bitcoin holders are now in profit, with only 7.6% remaining at a loss when Bitcoin’s price was at $67,381 on 23rd October. Independent analyst Axel Adler Jr. pointed out that most coins were purchased around the $55,000 level. A high percentage of holders in profit typically signals an overheated market, which often precedes price corrections, as investors may look to book profits, potentially driving prices lower.

Open Interest Hits Record High

Another key signal of potential volatility is the record-high open interest (OI) on Bitcoin derivatives, which reached $40 billion on the 21st of October. This increase in OI indicates a higher amount of leverage in the market, which could lead to more pronounced price swings. Bitcoin CME futures also hit an all-time high of 179,550 BTC, valued at approximately $12.1 billion, raising concerns of a sharp pullback similar to the one seen in early August, when Bitcoin’s price dropped by nearly 20% in just 48 hours.

Overbought Conditions and Elevated Fear & Greed Index

Bitcoin’s recent climb above $69,000 pushed its daily Relative Strength Index (RSI) into overbought territory at 70, which was followed by a swift drop to $66,000. Additionally, the Crypto Fear & Greed Index has reached 72, signaling “greed” conditions in the market. Historically, such elevated levels have been followed by sharp corrections, as seen in March 2023 and during the 2021 bull run.

With profit-taking, rising open interest, and overbought conditions, Bitcoin’s price may experience further pullbacks in the coming days. Investors are advised to remain cautious as the market faces potential turbulence.