Cryptocurrency investment products have experienced a significant boost, recording their largest inflows since July, amounting to $2.2 billion last week. This surge is largely attributed to growing optimism surrounding a potential Republican victory in the upcoming US elections, as outlined in CoinShares’ latest Digital Asset Fund Flows Weekly Report released on October 21.

US Leads the Charge with $2.3 Billion in Inflows

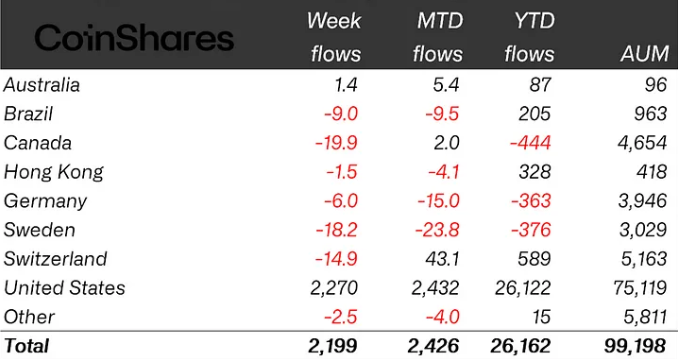

The United States led the way in crypto product investments during the week of October 12-18, with inflows reaching $2.3 billion. In contrast, Canada and Sweden witnessed outflows of $19.9 million and $18.2 million, respectively. Australia was the only other nation to record positive inflows, with $1.4 million.

James Butterfill, CoinShares’ head of research, noted, “We believe this renewed optimism stems from growing expectations of a Republican victory in the upcoming US elections, as they are generally viewed as more supportive of digital assets.” He added that minor outflows in regions like Canada likely resulted from profit-taking amid the bullish market activity driven by the US.

Bitcoin Sees Major Gains

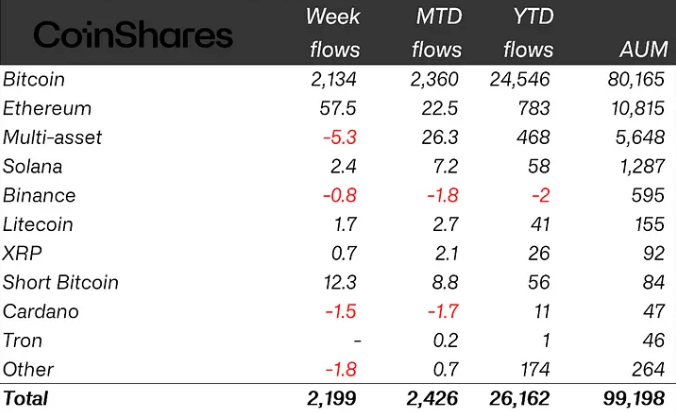

Among various crypto products, Bitcoin was the standout performer, attracting $2.13 billion in inflows. Notably, BlackRock’s iShares Bitcoin exchange-traded fund (ETF) saw $1.19 billion in inflows in just one week. Meanwhile, Ether-based products experienced inflows of $58 million, and short-Bitcoin products recorded $12 million in inflows—the largest since March.

Positive Momentum and Increased Trading Volumes

The recent inflows have contributed to positive price momentum, with trading volumes in investment products surging by 30%. The combined price appreciation and inflows have brought total assets under management close to the $100 billion mark.

Overall, crypto investment products have amassed a total of $2.4 billion in October, aligning with the “Uptober” trend typically seen in the cryptocurrency market during this month.