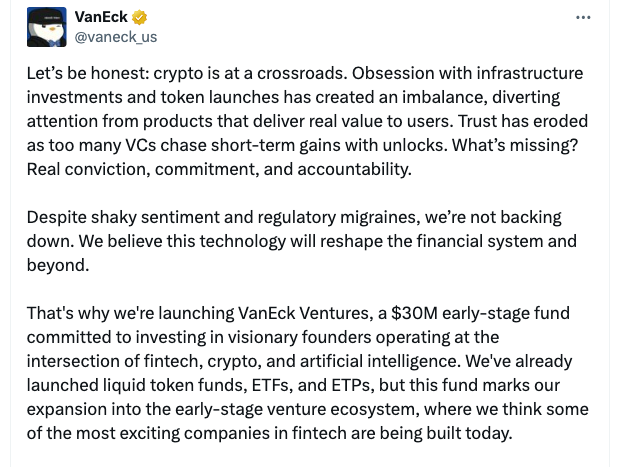

VanEck, a prominent issuer of spot Bitcoin exchange-traded funds (ETFs) in the United States, has announced the launch of VanEck Ventures, a $30 million fund dedicated to investing in early-stage cryptocurrency and artificial intelligence (AI) startups. The initiative aims to support fintech innovations that are shaping the future of payments. The announcement was made on October 9.

Fund Focus and Investment Strategy

VanEck Ventures will focus on pre-seed and seed-stage investments in areas such as tokenized assets, internet-native financial marketplaces, and payments based on stablecoins and tokenized capital markets. This strategy is designed to foster next-generation financial infrastructure and bring innovative solutions to the rapidly evolving fintech space.

The fund’s core themes include the growth of stablecoins as a new form of banking and seamless value transfer across networks. According to Wyatt Lonergan, one of the fund’s leaders, stablecoins will become a crucial “open-source banking layer.” His colleague, Juan Lopez, highlighted that as regulatory clarity grows, the emergence of on-chain utilities offers unprecedented opportunities for innovation.

Leadership and Previous Experience

VanEck Ventures is being spearheaded by Wyatt Lonergan and Juan Lopez, both former executives at Circle Ventures, a venture fund focused on blockchain and digital assets. At Circle Ventures, Lonergan and Lopez collectively invested more than $50 million in early-stage companies across various sectors. Their experience will be key in identifying disruptive technologies in the fintech, crypto, and AI domains.

VanEck believes that their previous success in the crypto and AI investment space gives them a strong foundation to support the next generation of industry leaders.

Fund Expectations and Early Investments

VanEck Ventures plans to make between 25 and 35 investments, with individual contributions ranging from $500,000 to $1 million. The fund has already secured four undisclosed investments. Notably, two-thirds of the fund’s capital has come from external investors, with the remainder contributed internally by VanEck.

VanEck’s CEO, Jan van Eck, expressed excitement about the venture, stating, “This fund extends that vision into the early-stage venture space. We look forward to supporting the founders of what we believe are some of the most disruptive companies in fintech.