Peter Brandt, a seasoned veteran of the financial market with vast experience dating back to the 1970s, has published a new outlook on the price chart of the most popular cryptocurrency, Bitcoin (BTC). In his latest analysis, Brandt highlights the post-halving behavior of the coin as a key factor.

He notes that great gains typically follow halving cycles, and that the period since March 2024, when the latest all-time high was set, appears to be a brief pause in the ongoing upward trend for BTC. This said, his price target is $135,000 for August or September 2025.

Here is the macro picture of Bitcoin $BTCObservations:-Huge gains come in post-half of halving cycles-Period since Mar 2024 appears as insignificant, brief pause in ongoing trend-My target is $135,000 in Aug/Sep 2025-Close below $48K negates my chart analysis pic.twitter.com/niptj2Umu7

— Peter Brandt (@PeterLBrandt) October 9, 2024

As you can see, the expert does not only rule out the possibility that Bitcoin will reach six figures at once but also that it will increase by 35% over it in the next 365 days. However, Brandt also gives an invalidation point at $48,000 which, if reached, will place these possibilities at zero.

Bitcoin (BTC): Price outlook

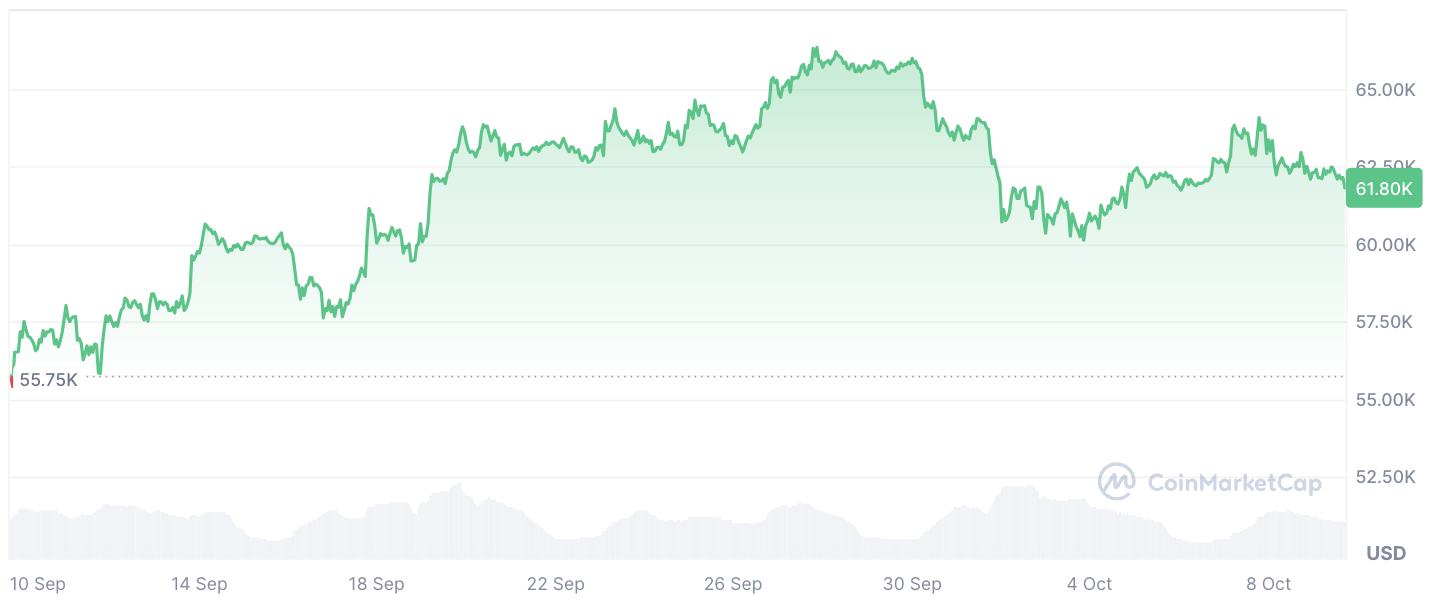

Currently, the price of the major cryptocurrency stands at $61,800 per BTC. After failing to break above the crucial dynamic price resistance at around $65,000 in late September, it then found support at around the $60,000s.

Now, the price of Bitcoin is in a kind of limbo as traders are stuck in a narrow range with no concrete direction. Some may refer to this phase of the market as a “chop.”

Looking ahead, the upcoming release of important macroeconomic data regarding the U.S. economy may be the catalyst needed to revive Bitcoin’s price movement. In particular, traders are anticipating the release of the monthly Consumer Price Index (CPI) data and the Federal Open Market Committee (FOMC) notes over the next two days.